Key Highlights

| Study Period | 2019 - 2032 |

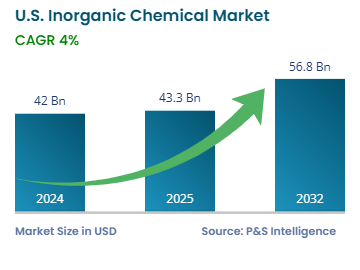

| Market Size in 2024 | USD 42.0 Billion |

| Market Size in 2025 | USD 43.3 Billion |

| Market Size by 2032 | USD 56.8 Billion |

| Projected CAGR | 4% |

| Largest Region | Midwest |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13531

This Report Provides In-Depth Analysis of the U.S. Inorganic Chemical Market Report Prepared by P&S Intelligence, Segmented by Product Type (Acids, Alkalis, Salts, Metal Oxides), Application (Construction, Agriculture (Largest Category), Healthcare & Pharmaceuticals, Semiconductor & Electronics (Fastest-Growing Category), Automotive, Food & Beverages, Power & Energy, Textiles & Apparel), Purity Grade (Reagent Grade, Industrial Grade, Electronic Grade, Pharmaceutical Grade), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 42.0 Billion |

| Market Size in 2025 | USD 43.3 Billion |

| Market Size by 2032 | USD 56.8 Billion |

| Projected CAGR | 4% |

| Largest Region | Midwest |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. inorganic chemical market valued USD 42.0 billion in 2024, and this number is expected to increase to USD 56.8 billion by 2032, advancing at a CAGR of 4.0% during 2025–2032.

The market is primarily driven by the expansion of end-use industries due to the rising population, rising disposable income, changing life preferences, and increasing exports. Inorganic chemicals are essential base materials for construction, automotive, electronics, healthcare, and agricultural products. The production of fertilizers, pharmaceuticals, construction materials, and industrial catalysts depends entirely on acids, bases, salts, and oxides. The ongoing research and investments aim to develop more-effective and sustainable inorganic chemicals.

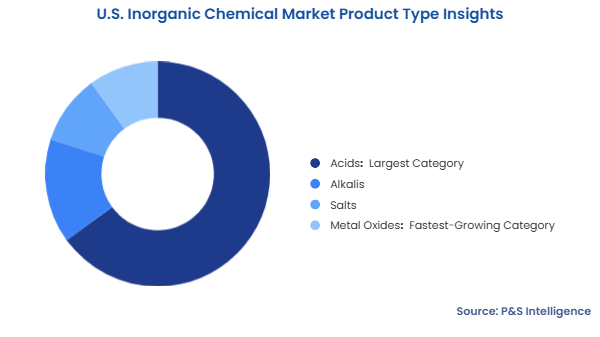

Acids are the largest category with 65% share because a wide range of industries, including chemicals, pharmaceuticals, water treatment, and metallurgy, extensively utilize them. For instance, sulfuric acid serves numerous critical functions during fertilizer production, petroleum refining, and battery operation. Similarly, hydrofluoric acid is an integral raw material for the semiconductor industry.

Metal oxides have the highest CAGR, on account of their rising usage in batteries for energy storage systems, solar cells, electronic components, magnetic materials, and catalysis reactions. In environmental sciences, they are used in sensors to detect pollution in gases and for wastewater treatment. These compounds also find application in the healthcare sector, specifically MRIs and targeted drug delivery.

The product types covered in this report are:

Agriculture is the largest category with 60% share since farmers need essential nutrients, such as nitrogen, phosphorus, and potassium. Soil fertility and crop yield depend heavily on ammonium nitrate, potassium chloride, and phosphate compounds. Moreover, the high-volume usage of insecticides, weedicides, and pesticides boosts this category’s advance.

This is itself because of the rising worldwide food requirement and increasing need to augment farm productivity. As per the Bureau of Economic Analysis, agriculture and allied sectors contributed USD 1.537 trillion to the GDP of the U.S. in 2023. Moreover, in 2024, the value of agricultural exports from the country rose by USD 1.8 billion from 2023.

Major applications covered in this report are:

Industrial is the largest category with 70% share because they serve numerous industries, including construction, manufacturing, water treatment, and agriculture, being of a general nature. Large quantities of sulfuric acid, sodium hydroxide, and calcium carbonate are used for metal refining, textile processing, and fertilizer production. The demand for high-performance, cost-effective chemicals by all industries drives this category.

Electronic is the fastest-growing category because this is among the costliest grades of inorganic chemicals. With the growing semiconductor production to meet the rising domestic and international demand for digitization, the sale of these chemicals is rising. HNO3, H2SO4, HCl, and HF are widely used during wafer production for etching, cleaning, and contaminant removal. Similarly, compounds of boron and arsenic, as well as phosphoric acid, is used during doping to alter the chip’s electrical characteristics.

The purity grades covered in this report are:

Drive strategic growth with comprehensive market analysis

The Midwest is the prime revenue contributor with 40% share because this region contains an expansive industrial base and huge farms. Significant chemical facilities operate in Ohio, Illinois, and Michigan. Fertilizer consumption in the Midwest is driven by its expanding farm productivity. Industrial-grade inorganic chemical demand is also rising in automotive plants, steel facilities, and food processing units.

These regions are analyzed:

The market is fragmented because it offers different products for different industries. Several specialized manufacturers offer products for agricultural fields, construction sites, electronic production, and medical applications. Large multinational companies compete with several local and mid-size firms. The market fragments further due to the different purities of products and industry-specific formulations. Moreover, companies do not generally produce all kinds of inorganic chemicals because this area is so vast.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages