Key Highlights

| Study Period | 2019 - 2032 |

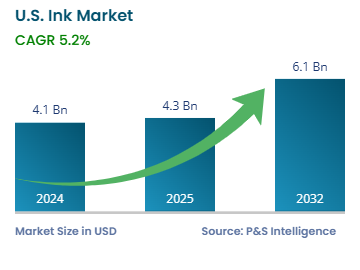

| Market Size in 2024 | USD 4.1 Billion |

| Market Size in 2025 | USD 4.3 Billion |

| Market Size by 2032 | USD 6.1 Billion |

| Projected CAGR | 5.2% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

Report Code: 13521

This Report Provides In-Depth Analysis of the U.S. Ink Market Report Prepared by P&S Intelligence, Segmented by Product Type (Printing Inks, Industrial Inks), Application (Packaging, Commercial Printing, Textile, Industrial Manufacturing, Electronics, Automotive, Aerospace, Healthcare), Formulation (Water-Based Inks, Solvent-Based Inks, UV-Curable Inks, Oil-Based Inks, Latex Inks), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 4.1 Billion |

| Market Size in 2025 | USD 4.3 Billion |

| Market Size by 2032 | USD 6.1 Billion |

| Projected CAGR | 5.2% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. ink market was valued at USD 4.1 billion in 2024, and this number is expected to increase to USD 6.1 billion by 2032, advancing at a CAGR of 5.2% during 2025–2032.

The market is driven by the developments in technology, sustainability efforts, and escalating industrial requirements. The rising adoption of digital printing is making packaging, labeling, and textile production more advanced, efficient, quicker, and sustainable. The growth of the e-commerce sector directly drives the consumption of inks for carton and package printing and labeling,

Bio-based, water-based, and UV-curable inks are rising in demand because of the stringent VOC regulations. The 3D printing technology creates new business opportunities, mainly in the manufacturing and healthcare sectors.

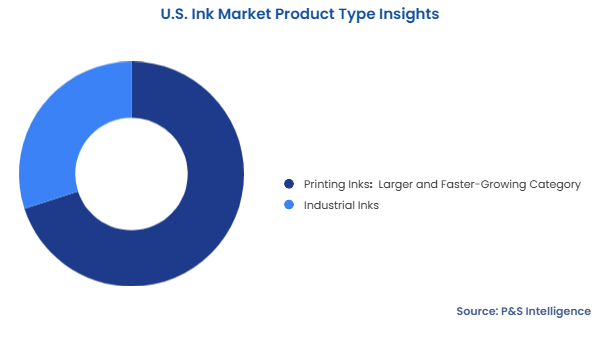

Printing inks are the larger and faster-growing category, with 70% share in 2024 during the forecast period, respectively. This is because of the expansion of the packaging, commercial printing, and e-commerce sectors. Since 3D printing is a new approach, most of the industrial printing currently is also done with conventional, high-performance printing inks. These chemicals are available in a wide range to print on textiles, plastics, ceramics, metals, wood, and even concrete.

The product types covered in this report are:

Packaging is the largest category in the market with 65% share because of e-commerce growth, consumer product production expansion, and customer preference shift toward better-quality and eye-catching packaging. The strong focus on brand promotion creates a high demand for superior printed inks for flexible packaging, cartons, and labels. Environmental regulations that promote food-safe and eco-friendly labeling, as well as the adoption of digital and UV-curable inks, drive the market.

From food & beverages to consumer goods, everything requires effective and attractive packaging made of plastics, paperboard, metals, and other materials. As per studies, ultra-processed food makes up over 50% of the daily energy intake of adults and youths in the U.S. From diced fruits and packaged meats to sauces and ready-to-eat meals, a huge variety of processed food is available in the country. Moreover, men in the U.S. spend up to USD 730 and women over USD 1,000 on personal care and cosmetic products each year.

The electronics sector will witness the highest CAGR on account of the rapid digitization of individuals’ lives, commercial workflows, and industrial operations. All this is reflected in an increasing demand for smartphones, computers, tablets, and intelligent personal assistants. These gadgets contain complex circuit boards with hundreds of individual ICs, processors, and other components. Conductive inks containing copper, carbon, and silver are widely used to print on these circuit boards. Similarly, dielectric inks are used between layers of conductive materials to provide insulation. Further, resistive inks are used on transistors, display elements, and sensors.

Major applications covered in this report are:

Solvent-based is the largest category with 60% share because they fulfill packaging, outdoor signage, and industrial printing requirements. These inks deliver outstanding sticking power, durability, and environmental resistance, which enables long-lasting prints and labels. They also provide economic advantages and work well with different materials.

The formulations covered in this report are:

Drive strategic growth with comprehensive market analysis

The western region is the prime revenue contributor with 40% share because this region contains major technology centers and printing companies, thus expanding digital and industrial printing requirements. California witnesses a high-volume demand for inks for packaging, labeling, and functional printing in the electronics and consumer goods industries. The area leads the way in sustainable printing, implementing more UV-curable and water-based inks to satisfy rigorous environmental directives. The growing e-commerce activities and rising adoption of 3D printing drive the market region as well.

These regions are analyzed:

The market is fragmented because it contains a variety of companies, including local and specialized suppliers and global manufacturers. The market fragmentation stems from various end-use applications, which need different formulations. The continuous innovation of eco-friendly and high-performance inks has triggered intense market competition by bringing in new entrants and specialized producers.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages