Market Statistics

| Study Period | 2019 - 2032 |

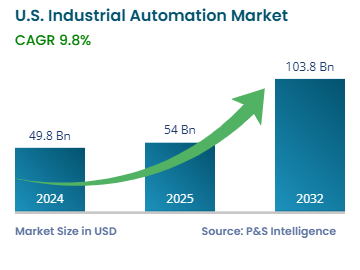

| 2024 Market Size | USD 49.8 Billion |

| 2025 Market Size | USD 54 Billion |

| 2032 Forecast | USD 103.8 Billion |

| Growth Rate(CAGR) | 9.8% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Nature of the Market | Consolidated |

Report Code: 13446

This Report Provides In-Depth Analysis of the U.S. Industrial Automation Market Report Prepared by P&S Intelligence, Segmented by Component (Hardware, Software, Service), Technology (PLC, SCADA, DCS, MES, PLM, ERP, HMI, Industrial Robotics), Application (Oil & Gas, Automotive, Healthcare, Food & Beverages, Chemicals, Energy & Power, Metals & Mining, Aerospace & Defense), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 49.8 Billion |

| 2025 Market Size | USD 54 Billion |

| 2032 Forecast | USD 103.8 Billion |

| Growth Rate(CAGR) | 9.8% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Nature of the Market | Consolidated |

|

Explore the market potential with our data-driven report

The U.S. industrial automation market valued USD 49.8 billion in 2024, and it is expected to reach USD 103.8 billion by 2032, growing at a CAGR of 9.8% from 2025-2032.

The market is primarily growing due to the rapid integration of robots into operations across the manufacturing, logistics, and healthcare facilities. Industrial robots now perform physically challenging or hazardous operations, such as part assembly, plasma welding, material packaging, and substance management.

This transition does not aim to eliminate human employees from the workforce but instead, it modifies the types of available employment positions. Modern companies seek workers who have specialized skills to deploy, program service, and fix automated systems. Robotics and automation create new employment prospects that demand from workers the acquisition of technological competencies to replace obsolete occupational requirements.

The manufacturing sector of the U.S. is witnessing an increasing adoption of cobots. They differ from standalone industrial robots because they operate as human assistants who perform tasks, instead of performing robotic functions independently. These robots feature sensors and AI functions, which ensure higher productivity and efficiency in multiple sectors, including healthcare, manufacturing, and retail businesses. In factories, robots secure heavy parts, while the human workers take care of the final installation, to reduce strain and injuries. The integration of human–robot teamwork in industries has become more prevalent because it helps businesses maintain worker engagement through non-hazardous, meaningful tasks and improve operational efficiency.

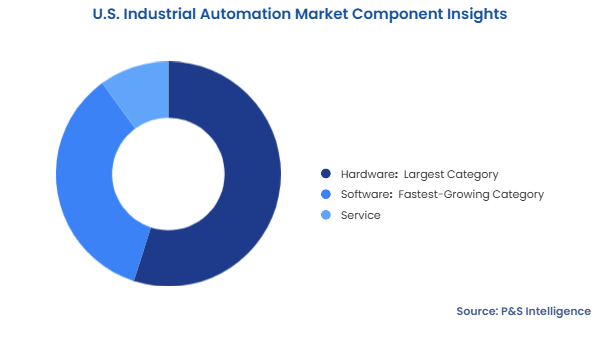

Hardware is the largest category with a market share of 55%, in 2024 as robots, sensors, and controllers are necessary for every factory. The demand for them is increasing as businesses are using robots to increase efficiency, lower labor costs, and augment precision.

Software is the fastest-growing category, with 10% CAGR, as more companies are adopting digital automation. The more sophisticated a factory, the more modern software it uses to control its machines, mine data, and refine production. Tools such as SCADA and MES help businesses monitor their operations and improve performance, using tools such as AI, ML, cloud-based systems.

Here are the components studied in the report:

Industrial robotics is the largest category with a market share of 35%, in 2024. Automated production in the manufacturing, automotive, and logistics industries requires industrial robots to handle repetitive tasks, cut labor costs, and improve precision. The increasing adoption of collaborative and mobile collaborative robots with AI and ML functionalities drives this category.

MES is the fastest-growing technology, with 10.5% CAGR. As factories get smarter, they will require better software to manage real-time production. MES links machines to their performance and their workflows as the implementation of digital transformation and AI-driven automation is rising.

Here are the following technologies studied in the report:

The automotive industry is the largest category with a market share of 30% in 2024 as it has been reliant on robots for welding, painting, and assembly for decades. With the rise of EVs and the need for faster, more-efficient production, automation continues to be a key focus area for OEMs. The automotive category also dominates due to the usage of AI and robotics to increase precision, cut costs, and speed up production.

Healthcare is the fastest-growing category, with 11% CAGR because of the growing need for precision, efficiency, and faster production of medical goods. Surgery, lab work, and drug production are assisted by robots, while diagnostics and care for patients are enhanced by AI.

The following applications are studied in the report:

Drive strategic growth with comprehensive market analysis

The region is the largest market for industrial automation with a market share of 45%, in 2024 because it relies on automation to increase production in states like Michigan, Ohio, and Indiana. The major sectors here include automotive, machinery, and equipment manufacturing, which robustly implement automation.

South is the fastest-growing region, with 11.5% CAGR. A modern manufacturing powerhouse is developing in the South with lower costs, tax incentives, and growing presence of industrial entities. Texas, Georgia, and Tennessee are witnessing a robust trend of smart factories and robotics.

Here are the regions covered in this report:

A few dominating firms control the U.S. industrial automation market space which operates under a consolidated structure. The industrial automation market contains significant influence from major companies including Rockwell Automation, Siemens, ABB, and Honeywell who deliver comprehensive automation solutions including robotics and AI together with industrial software. Major contracts alongside continuous innovation are possible because these companies possess resources and technology together with global capabilities. Smaller businesses and startup operations enter the market by releasing unique automation technologies that focus on artificial intelligence machine learning and robotics systems. The innovative approaches of these newcomers face challenges to match established giants thus leading to market dominance by selecting major companies.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages