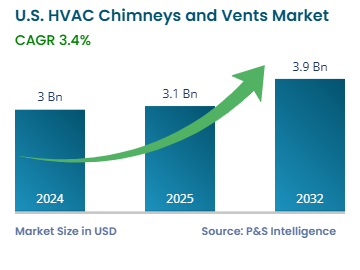

Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 3 billion |

| 2025 Market Size | USD 3.1 billion |

| 2032 Forecast | USD 3.9 billion |

| Growth Rate(CAGR) | 3.4% |

| Largest Region | South |

| Fastest Growing Region | west |

| Nature of the Market | Fragmented |

Report Code: 13476

This Report Provides In-Depth Analysis of the U.S. HVAC Chimneys and Vents Market Report Prepared by P&S Intelligence, Segmented by Product Type (Ductless Chimneys, Island Chimneys, Metal Chimneys, Masonry Chimneys, Ridge Vents, Soffit Vents, Gable Vents, Louver Vents), Material Type (Stainless Steel, Aluminum, Composites, Galvanized Steel, PVC/Plastic), Application (Residential, Commercial, Industrial), Installation Type (New Installation, Retrofit), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 3 billion |

| 2025 Market Size | USD 3.1 billion |

| 2032 Forecast | USD 3.9 billion |

| Growth Rate(CAGR) | 3.4% |

| Largest Region | South |

| Fastest Growing Region | west |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. HVAC chimneys and vents market revenue was USD 3 billion in 2024, and it is expected to witness a CAGR of 3.4% from 2025 to 2032, reaching USD 3.9 billion in 2032.

This is due to the rise in the adoption of modern chimneys and vents with advanced technologies, such as IoT-connected system smart ventilation systems, air purifiers, and chimneys. These variants meet the U.S. government’s regulations for energy efficiency and sustainability.

Additionally, climate change and extreme weather events in the in U.S., which are visible in hotter summers and colder winters, create a requirement for efficient HVAC systems, chimneys, and vents. Furthermore, the urbanization and residential and commercial infrastructure development in the U.S. HVAC propels the demand for chimneys and vents for HVAC systems. Moreover, the rising focus on indoor air quality with the rising remote working trend drives the demand for proper ventilation, filtration, and air purification systems.

Metallic chimneys are the largest category, with 55% market share in 2024. This dominance can be attributed to their durability and ease of installation, as these chimneys are made from corrosion-resistant materials, such as stainless steel and galvanized sheets.

Island chimneys will grow at the highest CAGR, of 4%, during the forecast period. This growth can be attributed to the technological advancements, such as a higher suction power, energy-efficient LED lighting, and smart connectivity for remote control.

Based on product type, the market has the following categories:

The stainless steel category held the largest market share, of 30%, in 2024. Stainless steel is more durable, versatile, and cost-effective in comparison to the other materials used for the manufacturing of chimneys and vents.

Composites will grow at the highest CAGR, of 3.8%, during the forecast period. This can be attributed to the rising need among industries for chimneys and vents made of high-temperature-resistance materials. Furthermore, the overall transportation and installation costs are reduced for chimneys and vents made from composites as these materials are lightweight.

Based on material type, the market has the following categories:

The residential category held the largest market share, of 48%, in 2024. This is due to the rising demand for higher home comfort, a better indoor air quality, and efficient ventilation. Additionally, homeowners in the U.S. are focusing on renovations and retrofitting, which is raising the demand for HVAC chimneys and vents. The awareness of a better indoor air quality in the U.S. has risen manifold since the COVID-19 pandemic.

The industrial category will grow at the highest CAGR, of 5.5%, during the forecast period. The increasing focus of the industrial sector on compliance with the EPA and OSHA’s regulations drives the demand for chimneys and vents that use advanced technology and follow the emission standards. The major end users here include industries that subject workers to highly polluted indoor air or those that require immaculately clean spaces, such as metals and mining, thermal power generation, oil & gas, automotive & transportation, and pharmaceuticals.

Based on application, the market has the following categories:

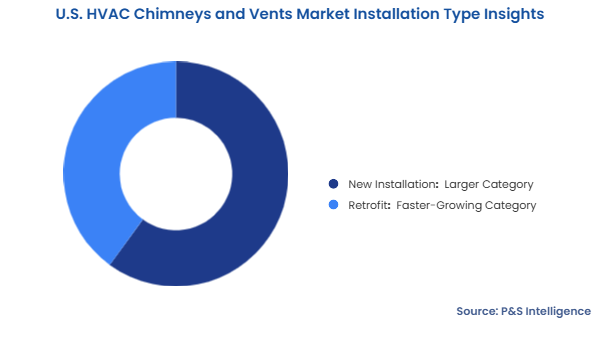

The new installation category held the larger market share, of 60% in 2024, The demand for new chimneys and vents is driven by the rapid urbanization in the U.S., with the boom in residential, industrial, and commercial construction. As per the U.S. Census Bureau, construction spending in the country stood at USD 2,179.9 billion in January 2025, and it rose to USD 2,195.8 billion the next month.

The retrofit category will grow at the higher CAGR, of 4.5%, during the forecast period. This growth can be attributed to the rising retrofit activities and replacement of aging and faulty parts. The replacement of chimneys and vents is becoming an important part of retrofitting buildings in the U.S. to meet modern air quality standards and energy efficiency expectations.

Based on installation type, the market has the following categories:

Drive strategic growth with comprehensive market analysis

The southern region of the U.S. is the largest market, with a market share of 35% in 2024. This is because of a rapid increase in construction activities due to urbanization. The warm climate of the region further drives the demand for high-capacity cooling appliances for large buildings, which, in turn, creates the requirement for extensive networks of chimneys and vents.

The western region of the U.S. will grow at the highest CAGR, of 5%, during the forecast period. The region is home to California, Nevada, and Washington, which are mandating green building technologies and construction practices. This is raising the demand for advanced HVAC chimneys and vents, especially for heating appliances, owing to the colder climate here.

The market has been categorized into the following regions:

The nature of the market is fragmented due to the presence of a number of global and regional players providing diverse product ranges. The production of standard chimneys does not require advanced technologies, which makes the market entry for SMEs easy and the market more fragmented. Additionally, there are various regional players that are focusing on providing customized and locally tailored solutions, which also contributes to the market fragmentation.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages