Key Highlights

| Study Period | 2019 - 2032 |

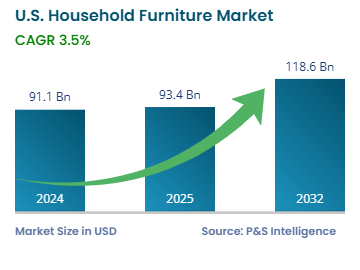

| Market Size in 2024 | USD 91.1 Billion |

| Market Size in 2025 | USD 93.4 Billion |

| Market Size by 2032 | USD 118.6 Billion |

| Projected CAGR | 3.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13567

This Report Provides In-Depth Analysis of the U.S. Household Furniture Market Report Prepared by P&S Intelligence, Segmented by Product Type (Living Room Furniture, Bedroom Furniture, Dining Room Furniture, Kitchen Furniture, Home Office Furniture, Outdoor & Patio Furniture), Material Type (Wood, Metal, Plastic, Glass, Leather & Fabric), Distribution Channel (Online Retailers, Brick and Mortar Stores, Specialty Stores, Mass Merchandisers, Home Improvement Stores), Price Range (Low End, Mid Range, Luxury & Premium), End User (Residential, Commercial), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 91.1 Billion |

| Market Size in 2025 | USD 93.4 Billion |

| Market Size by 2032 | USD 118.6 Billion |

| Projected CAGR | 3.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. household furniture market was valued at USD 91.1 billion in 2024, and this number is expected to increase to USD 118.6 billion by 2032, advancing at a CAGR of 3.5% during 2025–2032.

The market is driven by the growing population, its increasing purchasing power, its move to cities, expanding construction activities, and elevating spending on renovations. The emergence of e-commerce platforms improves consumer convenience and accessibility.

AI-driven customization, focus on practical design and introduction of environment-friendly and multipurpose products are the key trends. People living in upland areas and cities are increasingly selecting modular furniture to maximize their space.

Living room furniture is the largest category, with 35% share. This is because consumers allocate substantial funds to sofas & recliners, accent coffee tables, and entertainment centers. Residents both buy and rent living room furniture because this area is the essential space for relaxation and social interaction. This category is driven by the increasing spending on renovations and customized interior spaces. E-commerce platforms enable consumers to view furniture in their living rooms virtually.

The product types covered in this report are:

Wood is the largest category in the market, with 40% share, because of its long life, attractive appearance, and its wide usage potential. People particularly value oak, maple, and walnut hardwoods, as well as engineered wood products, due to their reasonable costs. Moreover, the U.S. has abundant forests and expansive groves of trees planted just for furniture, leading to the easy availability of wood.

The material types covered in this report are:

Brick-and-mortar stores are the largest category with 60% share because customers value visual product inspections, comfort checks, and tactile finish assessments prior to making purchases. Showrooms and furniture retailers are popular for their individualized customer service, financing options, and delivery services.

The distribution channels covered in this report are:

Mid-range is the largest category with 50% revenue because it meets the needs of middle-class consumers for high quality and reasonable costs. A range of brands offer durable and alluring furniture to homeowners and residential tenants at reasonable costs.

The price ranges covered in this report are:

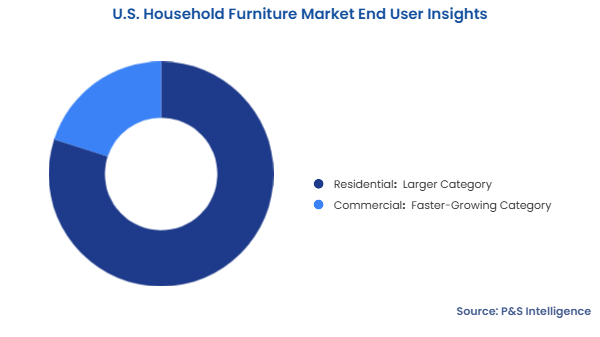

Residential is the larger category in the market with 80% share because of the rising house ownership rates, evolving interior styles, and rising spending on home aesthetics. The number of home-based workers (22 million in 2023) multiplies the demand for office furniture. As per the Census Bureau, USD 937.7 billion was spent on residential construction in the U.S. in March 2025.

Major end users covered in this report are:

Drive strategic growth with comprehensive market analysis

The southern region is the prime revenue contributor with 30% share because this region has a large population, rapidly developing urban areas, and an active housing construction industry in Texas, Florida, and Georgia. Major furniture manufacturing centers are located in the South, benefitting from lower production expenses and nearness to raw material resources. Most states with over 50% forest cover are located in the South. New residents and retirees continue to migrate to the region due to a milder climate, lower living costs, easy healthcare access for the elderly, rich culture, and abundance of beaches and forested area. An expanding middle class and a robust retail sector in the region also drive furniture sales in the South.

These regions are analyzed:

The market displays a fragmented structure because it features diverse competitors, ranging from big multinational brands to small and medium-sized manufacturers. Regional manufacturers, makers of specialty furniture, and individuals who offer custom design the products fragment the market. Consumer accessibility through e-commerce to direct-to-consumer brands has intensified market competition. The changing consumer preferences for sustainable, customized, and technology-integrated furniture open market opportunities for specialized manufacturers. Additionally, not every manufacturer offers everything, as furniture is itself so vast and diverse. The availability of different kinds of wood in different regions of the U.S. also means that no one company has a major share.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages