Key Highlights

| Study Period | 2019 - 2032 |

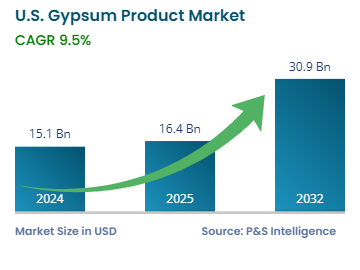

| Market Size in 2024 | USD 15.1 Billion |

| Market Size in 2025 | USD 16.4 Billion |

| Market Size by 2032 | USD 30.9 Billion |

| Projected CAGR | 9.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Consolidated |

Report Code: 13587

This Report Provides In-Depth Analysis of the U.S. Gypsum Product Market Report Prepared by P&S Intelligence, Segmented by Type (Gypsum Wallboard/Drywall, Plaster Products, Gypsum Ceiling Tiles, Gypsum Flooring Underlayment, Gypsum Blocks, Agricultural Gypsum), Distribution Channel (Building Material Distributors, Home Improvement Retailers, Specialty Retailers, Direct Sales to Contractors), Manufacturing Process (Natural Gypsum based products, Synthetic Gypsum based products), End User (Residential Construction, Commercial Construction, Industrial Applications, Agricultural Applications), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 15.1 Billion |

| Market Size in 2025 | USD 16.4 Billion |

| Market Size by 2032 | USD 30.9 Billion |

| Projected CAGR | 9.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Consolidated |

|

Explore the market potential with our data-driven report

The U.S. gypsum product market valued USD 15.1 billion in 2024, and this number is expected to increase to USD 30.9 billion by 2032, advancing at a CAGR of 9.5% during 2025–2032. This expansion is driven by the growth in the construction industry, increase in the demand for sustainable building materials, and advancements in high-performance gypsum boards.

Gypsum products provide sustainability through recycling possibilities and less environmental damage. Technological enhancements have brought about improved boards, which are lightweight, highly durable, and mold-resistant. The demand for specialized gypsum products that provide energy-efficiency and fire resistance is increasing as well.

The wallboard/drywall category dominates the market with a revenue share of 60% in 2024. This is because of their essential role in residential and commercial construction, where drywall is the primary material for interior walls and ceilings. The product is cost-efficient to produce, user-friendly to install, resistant to fire, and pleasing to look at.

The types covered in the report are:

The building material distributors category accounted for the largest revenue share, of around 65%, in 2024, and this category is further expected to maintain its position during the forecast period. They supply gypsum products in bulk to contractors, developers, and retailers across the construction industry in the U.S. They offer a wide range of products, such as wallboards, ceiling tiles, and plaster.

The home improvement retailers category is the fastest-growing because consumers are opting for do-it-yourself (DIY) home renovation. In response, retailers expand their product ranges to serve individual consumers, who display a huge variation in their choices. Residential renovation projects require easily installed gypsum wallboards, ceiling tiles, and plaster products because homeowners prioritize cost-efficient options.

Here are the distribution channels studied in the report:

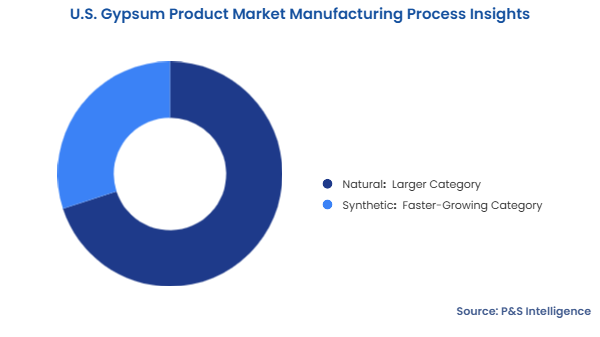

The natural category leads the market with a revenue share of 70% in 2024, due to their cost-effectiveness and widespread availability. Building applications utilize these products across wallboards, ceiling tiles, and plaster because of their long-established position and their natural origins. The existing infrastructure for natural gypsum mining and processing will continue to drive the market in this category.

Synthetic products are a faster-growing category because of the growing adoption of eco-friendly and sustainable building materials. Synthetic gypsum is produced as a byproduct of industrial processes, such as flue gas desulfurization, which reduces the strain on natural reserves.

The following are the manufacturing processes studied in the report:

The residential construction category leads the market with a revenue share of 75% in 2024 because of the widespread use of gypsum wallboards, ceiling tiles, and plaster products during housing construction and renovation. Due to urbanization, the U.S. is witnessing a growing demand for affordable housing, thereby driving gypsum consumption owing to its cost-effectiveness, fire resistance, and soundproof attributes.

Commercial construction represents the fastest-growing category, because of the increasing demand for office spaces, retail stores, hotels, and institutional buildings. The high priority of fire security, sound reduction, and energy saving impels commercial real estate developers to use gypsum products.

The following are the end users studied in the report:

Drive strategic growth with comprehensive market analysis

The Southern region is the largest revenue generator, with around 40% share, in 2024, and it is expected to maintain its place in the market during the forecast period. This is due to its large construction sector and rising population. The region consists of major gypsum manufacturers, which enhances supply chain efficiency and ensures widespread availability. The increase in the number of new housing and renovation projects propels gypsum product consumption, particularly for wallboards and ceiling tiles.

The Western region is expanding due to the expanding population and surging focus on sustainable building methods. Modern infrastructure construction and green building programs in California promote innovative gypsum product utilization.

These regions are covered:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages