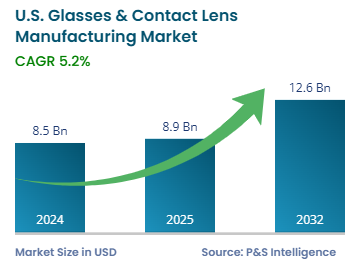

Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 8.5 billion |

| 2025 Market Size | USD 8.9 billion |

| 2032 Forecast | USD 12.6 billion |

| Growth Rate(CAGR) | 5.2% |

| Largest Region | Northeast |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13471

This Report Provides In-Depth Analysis of the U.S. Glasses & Contact Lens Manufacturing Market Report Prepared by P&S Intelligence, Segmented by Product Type (Prescription Glasses, Sunglasses, Contact Lenses, Smart Glasses & AR Glasses), Material (Plastic Lenses, Glass Lenses, Silicone Hydrogel, Hybrid Lens Material), Application (Vision Correction, Fashion & Lifestyle, Medical & Therapeutic Use, Sports & Outdoor Activities, Digital Eye Strain Reduction), Distribution Channel (Retail Stores, E-Commerce Platforms, Direct-to-Consumer Brands, Hospitals & Eye Clinics), End User (Adults, Children & Teens, Elderly Population, Industrial & Safety Use), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 8.5 billion |

| 2025 Market Size | USD 8.9 billion |

| 2032 Forecast | USD 12.6 billion |

| Growth Rate(CAGR) | 5.2% |

| Largest Region | Northeast |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. glasses & contact lens market size was USD 8.5 billion in 2024, and it will grow by 5.2% during 2025–2032, reaching USD 12.6 billion by 2032.

The market is driven by the increasing incidence of eye diseases and changing fashion behavior. Glasses remain a more-popular choice over lenses due to their longer life and ease of use. They also protect the eyes from harmful rays and can be paired with different outfits tailored to the occasion.

Contact lenses, on the other hand, are favored by young people for aesthetic preference and different colors. About 40.9 million adults in the U.S. wear contact lenses, which is around 17% of all adults. Most of them, about 93% use soft contact lenses made from flexible plastics. They are preferred for the overall seamless look they give to the face and the comfort they offer with their breathable material.

Another big trend is blue-light glasses to protect the eyes from the radiation from TV and PC screens and smart lenses that could work with digital devices in the future. These devices are also now available online, making it easier for buyers to try them out virtually.

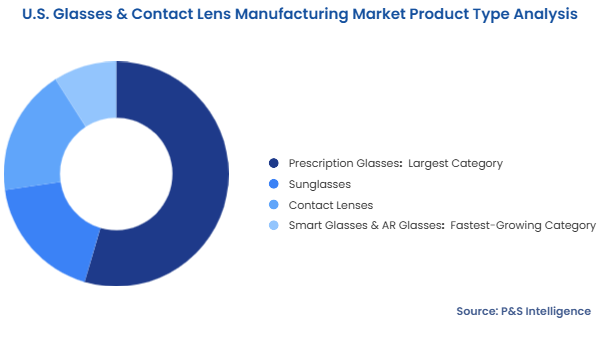

The prescription glasses category held the largest market share, of 60%, in 2024, because it addresses issues such as nearsighted, farsighted, and astigmatism. They are available from basic frames to luxury designer eyewear, suiting one’s style. Moreover, they are easier to maintain than lenses because of their strong frame and carrying boxes. About 63.7% of the adult population in the U.S. wears prescription glasses, paying between USD 100 and USD 150.

The smart glasses & AR glasses category will grow at a higher CAGR, during the forecast period. This is because of the appeal it offers such as audio, notifications, and virtual displays that attract the tech enthusiast. They are further increasing in logistics and beyond the consumer markets. AppleMeta is heavily investing in this technology.

The product types analyzed here are:

The plastic lenses category held the largest market share, of 55%, in 2024, because they are lighter than glass and much more comfortable for everyday use. They are cost-friendly, scratch-resistant, and provide UV protection while being adaptable which makes them widely used.

The silicone hydrogel category will grow at a higher CAGR, during the forecast period, due to its ability to allow more oxygen which helps provide comfort to the eye. They are easy to use daily and overnight without any discomfort. Approximately 260,144 daily wear soft contact lenses resulting in ongoing expansion of lens designs. Furthermore, their improved moisture retention and reduced eye dryness are recommended for professionals.

The materials analyzed in this report are:

The vision correction category held the largest market share, of 65%, in 2024. The primary reason people buy glasses and contact lenses is common ophthalmic conditions, such as myopia, hyperopia, and presbyopia. Moreover, glasses are suitable for people of all age groups requiring continuous use and updates.

The digital eye strain reduction category will grow at the highest CAGR, during the forecast period. This is because of the increasing hours on digital devices, which leads to dry eyes, blurred vision, and headaches. The blue-light lens is popular with or without prescription due to the rising preference for online education and WFH.

The applications analyzed here are:

The retail stores category held the largest market share, of 70%, in 2024. This is because Visionworks and a huge number of private optometrists provide on-the-spot frame fitting, lens testing, and expert advice then and there. Retail outlets work with insurance providers, making it convenient for customers to use vision enhancements, which further drives store audiences.

The e-commerce platforms category will grow at the highest CAGR, during the forecast period, because it allows customers to shop from anywhere. There are various discounts and coupons available, making it more accessible to the broader audience. Virtual try-on features attract more customer because of their convenience and innovation.

The distribution channels analyzed here are:

The adults category held the largest market share, of 75%, in 2024 as vision enhancement needs become prominent in adulthood. These people widely use prescription glasses or advanced contract lenses and upgrade their eyewear regularly. About 197.6 million adults in the U.S. wear correction lenses.

The children & teens category will grow at the highest CAGR, during the forecast period. This is owing to the increasing screen time at a tender age, leading parents to be proactive in eye health and vision checks for their kids. Furthermore, teenagers active in sports are turning to contact lenses for appearance and easy handling. As per the American Community Service, 625,000 children under the age of 18 in the U.S. have weak eyesight.

The end users analyzed here are:

Drive strategic growth with comprehensive market analysis

The northeast region held the largest market share, of 40%, in 2024. This is due to the presence of densely populated cities, such as New York and Boston, which are characterized by high education levels and changing fashion trends. The region offers appreciable access to healthcare and a higher rate of vision correction product purchases. Furthermore, with a high income and better insurance, consumers spend more on premium glasses, designer frames, and advanced contact lenses.

The market in the southern region will grow at the highest CAGR, during the forecast period. This is owing to the expanding rate of urbanization and establishment of new clinics and shopping centers, increasing access to eyesight correction products. States such as Texas and Florida are experiencing a faster population because of job opportunities, which is further fueling the demand for vision care. The tech-savvy demographic here is also increasingly demanding corrective eyewear and blue light lenses. Moreover, this region is improving in both private and public healthcare efforts, leading to better awareness and treatment of vision issues.

The regions analyzed in this report are:

The market is fragmented because of the diverse consumer needs and a variety of options to choose from. Numerous brands offer different types of eyewear, including prescription and fashion-forward glasses. The market includes both global and small local players, with people choosing their products based on budget and necessity. The quality varies by the cost and it ranges differently for many different players. Moreover, making lenses and glass frames is not difficult as these products have been around for a long time.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages