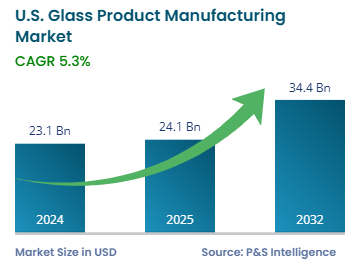

Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 23.1 billion |

| 2025 Market Size | USD 24.1 billion |

| 2032 Forecast | USD 34.4 billion |

| Growth Rate(CAGR) | 5.3% |

| Largest Region | Midwest |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13482

This Report Provides In-Depth Analysis of the U.S. Glass Product Manufacturing Market Report Prepared by P&S Intelligence, Segmented by Product Type (Flat Glass, Container Glass, Specialty Glass, Fiberglass, Automotive Glass), Manufacturing Process (Float Glass Process, Blown Glass, Pressed Glass, Tempered & Laminated Glass), Distribution Channel (Direct Sales, Retail, Online Platforms), End User (Construction, Automotive & Transportation, Consumer Goods, Electronics, Healthcare & Pharmaceuticals), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 23.1 billion |

| 2025 Market Size | USD 24.1 billion |

| 2032 Forecast | USD 34.4 billion |

| Growth Rate(CAGR) | 5.3% |

| Largest Region | Midwest |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. glass product manufacturing market size was USD 23.1 billion in 2024, and it will grow by 5.3% during 2025–2032, reaching USD 34.4 billion by 2032.

The market is expanding due to the growing investments in infrastructure and the booming trend of green buildings. Many industries are switching to glass products due to their appeal, thermal efficiency, and better durability. Smart glass products are becoming popular in commercial and residential buildings as they adjust their transparency based on outside and inside light.

The automotive industry depends on advanced glass for sunroofs, windshields, and displays for electric and autonomous vehicles. Moreover, consumers prefer sustainable and recyclable glass as it is environment-friendly and a good alternative to plastics. Moreover, from touchscreen interface to optical fiber components, glass has become a vital part of advanced electronics and the 5G infrastructure.

The flat glass category held the largest market share, of 40%, in 2024, because it is widely used in windows, doors, and interior partitions. The growth of the construction sector drives the consumption of flat glass across the country. It is also used in automotive windshields, furniture, solar panels, and appliances.

The specialty glass category will grow at the highest CAGR, of 5.5%, during the forecast period. This is due to the rising demand of high-tech industries, such as semiconductors and smartphones, for anti-glare and conductive glass. Moreover, specialty glass usage is expanding in emerging fields, such as renewable energy.

The product types analyzed here are:

The float glass category held the largest market share, of 55%, in 2024. This is because it is used for a number of common-use products, such as windows, mirrors, and panels. Its versatility makes it ideal for the construction and automotive sectors.

The tempered & laminated glass category will grow at a higher CAGR, of 5.9%, during the forecast period. This is because of its expanding use in soundproofing, hurricane-resistant windows, and security installation. They are high in demand for green buildings and modern vehicles.

The manufacturing processes analyzed here are:

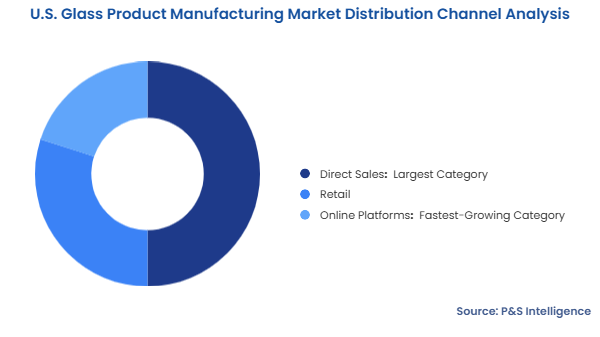

The direct sales category held the largest market share, of 50%, in 2024 because most people and businesses buy glass products directly from the manufacturer. Various glass products require tailored dimensions, which is why manufacturers closely work with clients to understand their technical requirements. Moreover, the automotive, construction, pharmaceutical, semiconductor & electronics, and renewable energy sectors procure glass products in bulk under long-term contracts with suppliers.

The online platforms category will grow at the highest CAGR, of 5.8%, during the forecast period. Businesses, as well as customers, are shifting to online platforms due to their convenience and accessibility. Decorative glassware, mirrors, and other general-use products are sold in high volumes on Amazon, Wayfair, and other retailers. The shift in buyer behavior was as much a result of the pandemic as a desire for faster deliveries.

The distribution channels analyzed here are:

The construction category held the largest market share, of 45%, in 2024, because of the high-volume demand for flat and tampered glass for windows, doors, and interiors. Residential and commercial builders prefer glass for its aesthetic and practical appeal. Metro areas require energy-efficient glass, such as double-glazed and low-E glass, to reduce emissions. As per the Census Bureau, construction spending in the U.S. stood at USD 2,196.1 billion in March 2025.

The electronics category will grow at the highest CAGR, of 6.2%, during the forecast period. This is because of the use of ultra-thin and flexible glass in screens and sensors, especially for OLED and foldable displays. With the rise of AI, 5G, and supercomputing, the demand for high-precision glass materials in the electronics sector is burgeoning.

The end users analyzed here are:

Drive strategic growth with comprehensive market analysis

The Midwest region held the largest market share, of 35%, in 2024, due to the large industrial base of Ohio, Michigan, and Illinois. These states have factories and infrastructure that support glass production, as well as easy access to raw materials, such as silica sand and soda ash. This further reduces transportation costs and supports large-scale production.

The market in the Western region will grow at the highest CAGR, of 6%, during the forecast period. This is because of the rising preference for smart architecture and interiors for buildings. Los Angeles, San Francisco, and Seattle are witnessing an increasing demand for modern construction materials due to their high rates of urbanization and real estate growth. Moreover, glass is used in solar panels and related renewable energy infrastructure, which is expanding in the region.

The regions analyzed in this report are:

The market is fragmented because a large number of producers cater to the construction, automotive, electronics, and solar energy sectors. Moreover, the presence of basic commodity and energy-efficient solar glass creates opportunities for multiple players. Glass blowing is an ancient art, which is why a large number of companies are able to practice it on a large scale.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages