Key Highlights

| Study Period | 2019 - 2032 |

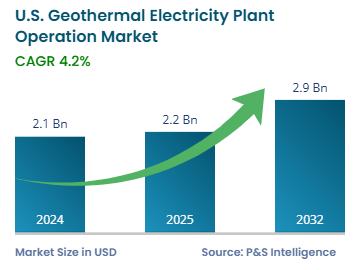

| Market Size in 2024 | USD 2.1 billion |

| Market Size in 2025 | USD 2.2 billion |

| Market Size by 2032 | USD 2.9 billion |

| Projected CAGR | 4.2% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

Report Code: 13554

This Report Provides In-Depth Analysis of the U.S. Geothermal Electricity Plant Operation Market Report Prepared by P&S Intelligence, Segmented by Technology (Binary Cycle Plants, Flash Steam Plants, Dry Steam Plants, Hybrid Systems), Power Plant Size (Small-scale Plants (<5 MW), Medium-scale Plants (5-20 MW), Large-scale Plants (>20 MW)), Application (Residential, Commercial, Industrial), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 2.1 billion |

| Market Size in 2025 | USD 2.2 billion |

| Market Size by 2032 | USD 2.9 billion |

| Projected CAGR | 4.2% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. geothermal electricity plant operation market size in 2024 was USD 2.1 billion, and it will reach USD 2.9 billion by 2032 at a CAGR of 4.2% during 2025–2032. The market is primarily driven by the growing focus of the country on renewable energy, rising emission concerns, availability of ample government support in the form of incentives and funding, and substantial geothermal energy reserves. This technology has the advantage of creating electricity all day round, unlike the conventional sources of renewable energy, including wind and solar. This is because while wind speeds and the amount of solar radiation vary throughout the day, the heat under the earth’s crust is constant.

The flash steam category led the market in 2024 with a share of around 60% because of their effectiveness in tapping high-temperature geothermal reservoirs. These plants are mainly located in California and Nevada, which have ample geothermal resources with high enthalpy. Due to the efficiency of converting high-pressure steam to a high power output, flash-steam plants are common.

The binary cycle category has the highest CAGR. The binary cycle technology works at relatively low temperatures and, therefore, is suitable for moderate-intensity geothermal areas, which are abundant in the U.S. This versatility, combined with higher heat exchanger efficiency and the incorporation of the organic Rankine cycle, pushes its utilization in previously untapped regions.

The technologies analyzed here are:

Large-scale plants dominate the market as large-scale utilities operate most geothermal electricity plants in the country. Most of these plants are in California and Nevada, the most prominent being The Geysers complex. These plants provide economies of scale and energy support, which is important amidst a rising focus on clean electricity.

The medium-scale category has the highest CAGR as these plants satisfy the median utility demand selectively and at considerably lower costs than large-scale power plants. They also entail minimal exploitation of resources, which receives advantages from the progress in the technologies of drilling and reservoir management These advances enable operators to access the formerly non-recoverable resources, thus strengthening energy security for the country. Medium-scale plants are also being set up in regions with limited grid connectivity and less resource availability for large-scale generation.

The power plant sizes analyzed here are:

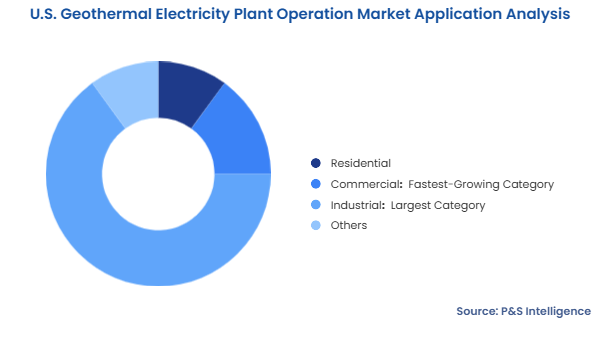

The industrial category dominates the market with about 65% market share in 2024. Since it demands a reliable and continuous energy supply for the extensive factory operations. The manufacturing, mining, and agriculture industries depend intensively on geothermal power for delivering electricity and performing process heating operations. Geothermal power ensures operational stability, which leads industrial users to select it, particularly in California and Nevada, which have abundant geothermal resources.

The commercial category is growing the fastest because businesses are strongly focused on sustainability and energy performance improvements. Hotels, retail centers, and office buildings are choosing geothermal technology to cover their electrical requirements and power their heating and cooling operations in regions that already have mature geothermal systems.

The applications analyzed here are:

Drive strategic growth with comprehensive market analysis

The western region has the largest share of approx. 75%, since it consists of extensive geothermal resources and suitable geological features for their extraction. The region benefits from its substantial high-temperature geothermal reservoirs and supportive policies, including California's Renewable Portfolio Standards, which require renewable energy usage.

The South has the highest CAGR because of the rising adoption of the EGS technology. The enhancements in operational technology enable operators to extract geothermal power from areas that would previously have unfavorable natural conditions, thus expanding geothermal potential in the southern region. The states of Texas and Louisiana are using their experience in oil & gas exploration to leverage geothermal energy opportunities. The expansion of renewable energy systems and the prioritization of grid stability also propel this growth.

The regions analyzed here are:

The market is fragmented as it consists of diverse participants, including established firms and evolving industry players focused on innovation. Large-scale plant ownership by industry giants, such as Calpine Corporation and Ormat Technologies, is prominent in the market. On the other hand, mid-sized entities and startup companies are launching specialized geothermal technologies, such as EGS and hybrid renewable power solutions. The innovation efforts of these smaller companies focus mostly on lower-temperature geothermal resource areas, which are untapped by the larger players, who focus on profitability.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages