Market Statistics

| Study Period | 2019 - 2032 |

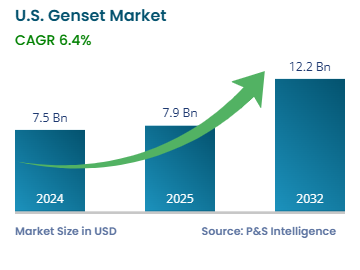

| 2024 Market Size | USD 7.5 billion |

| 2025 Market Size | USD 7.9 billion |

| 2032 Forecast | USD 12.2 billion |

| Growth Rate(CAGR) | 6.4% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13475

This Report Provides In-Depth Analysis of the U.S. Genset Market Report Prepared by P&S Intelligence, Segmented by Fuel Type (Diesel, Gas, Gasoline), Power Rating (5-75 kVA, 76-375 kVA, 376-750 kVA, Above 750 kVA), Application (Commercial, Industrial, Residential), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 7.5 billion |

| 2025 Market Size | USD 7.9 billion |

| 2032 Forecast | USD 12.2 billion |

| Growth Rate(CAGR) | 6.4% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. genset market revenue was USD 7.5 billion in 2024, and it is expected to witness a CAGR of 6.4% from 2025 to 2032, reaching USD 12.2 billion in 2032.

This is due to the increasing incidence of power outages and grid stability issues, which create a high demand for backup power supply options. Additionally, with the expansion of manufacturing plants, data centers, and commercial buildings, the demand for reliable power backup solutions is increasing. Furthermore, rising construction activities in the residential and commercial sectors drive the demand for gensets as a temporary power source.

Moreover, the strict emission regulations imposed by the EPA and state authorities are forcing industries to shift to low-emission gensets for backup power. In April 2023, after determining the harmful effects of the carbon monoxide generated from portable generators, the U.S. Consumer Product Safety Commission proposed the Consumer Product Safety Act (CPSA) to limit these emissions.

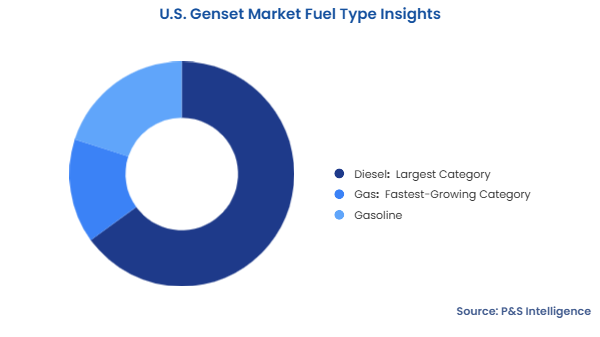

Diesel held the largest share, of 65%, in 2024 due to their widespread adoption across various industries due to its high efficiency. Additionally, these machines are used in heavy-duty applications, such as manufacturing plants, data centers, hospitals, and emergency backup systems. These systems, as well as diesel itself, are cost-effective, easily available, well-understood, and efficient.

The gas category will grow at the higher CAGR of 6.8%, during the forecast period. This growth is due to the widespread adoption of the natural gas genset for their lower emissions and environment-friendliness. Additionally, natural gas generators can integrate with renewable energy sources, such as solar and wind energy storge systems, which enhances the overall sustainability.

Based on fuel type, the market has the following categories:

The 76–375 kVA category held the largest share, of 40%, in 2024. These types of generators are used in the most commercial establishments, SMEs, and small industrial facilities. These mid-capacity gensets are popular at individual retail stores, supermarkets, large residential estates, and office buildings.

The above 750 kVA category will grow at the highest CAGR. of 7%, during the forecast period. This is due to the rising demand for backup power solutions from heavy-duty industries, such as data centers and healthcare facilities, which require power without any disruptions to their operations.

Based on power rating, the market has the following categories:

The commercial category held the largest market share, of 50%, in 2024. The healthcare, data center, retail, and hospitality sectors require an uninterrupted power supply for continuous operations and maximum client/customer comfort. While power cuts can be deadly for patients on life support at hospitals, data centers must maintain operations as per their tier rating. All tiers mandate an uptime of over 99%, which makes gensets vital at data centers.

The residential category will grow at the highest CAGR, of 6.5%, during the forecast period. This is due to the increasing dependence on electronic items in the daily life, which has increased the demand for a continuous supply of power at homes. The boom in residential construction due to the burgeoning population and urbanization also drive the market in this category.

Based on application, the market has the following categories:

Drive strategic growth with comprehensive market analysis

The Southern region is the largest market, with 45% share in 2024. This is because the region witnesses frequent hurricanes and severe storms, which lead to power outages. This, along with the large population of the region, whose accommodation needs are driving construction on a massive scale, propels the demand for gensets as both a primary and backup electricity source.

The Western region of the U.S. will grow at the highest CAGR, of 7.5%, during the forecast period. This is due to the expansion of data centers, which require an uninterrupted power supply. Other reasons for the market growth in the region is an expanding hospitality industry, presence of large hospitals and office zones, and the changing lifestyles of people, apparent in the rising adoption of smart devices for just about everything.

The market has been categorized into the following regions:

The market for gensets in the U.S. is consolidated due to the presence of several key players, such as Generac Holdings Inc., Caterpillar Inc., Cummins Inc., Kohler Co., and Briggs & Stratton Corporation. The main reason for the market consolidation among them is the initial high investment for the manufacturing of generators and the extensive distribution channel requirements, which make entry of new market players very difficult. The major players are investing in new technologies and developing gensets that are easily integrated with renewable energy sources.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages