Market Statistics

| Study Period | 2019 - 2032 |

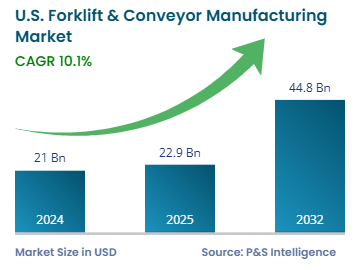

| 2024 Market Size | USD 21 billion |

| 2025 Market Size | USD 22.9 billion |

| 2032 Forecast | USD 44.8 billion |

| Growth Rate(CAGR) | 10.1% |

| Largest Region | Midwest |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13483

This Report Provides In-Depth Analysis of the U.S. Forklift & Conveyor Manufacturing Market Report Prepared by P&S Intelligence, Segmented by Product Type (Forklifts, Conveyors), Power Source (Internal Combustion, Electric), Load Capacity (Below 5 Ton, 5-15 Ton, Above 16 Ton), Automation Level (Manual, Semi-Automated, Fully Automated), End-Use (Manufacturing, Retail & E-commerce, Food & Beverage, Construction & Heavy Industry, Pharmaceutical & Healthcare, Agriculture), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 21 billion |

| 2025 Market Size | USD 22.9 billion |

| 2032 Forecast | USD 44.8 billion |

| Growth Rate(CAGR) | 10.1% |

| Largest Region | Midwest |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. forklift & conveyor market size was USD 21 billion in 2024, and it will grow by 10.1% during 2025–2032, reaching USD 44.8 billion by 2032.

The market is growing with the upgrade in the logistics and distribution infrastructure that is used in the retail, manufacturing, chemicals, food & beverages, and other industries. With the integration of robotic forklifts, automated guided vehicles, and smart conveyor systems, warehouses are moving toward fully automated functioning. This is resulting from the rising demand for error-free order fulfillment. Technological advancements and the integration of IoT allow businesses to monitor warehousing operations in real time and improve productivity.

With the numerous workplace-related injuries and deaths each year, safety has become an area of concern and a key driver for the adoption of superior safety features and reduction of the dependence on humans. As per the Bureau of Labor Statistics, 2.6 million non-fatal injuries and 5,283 deaths were reported among employees in the country in 2023.

The forklifts category held the larger market share, of 65%, in 2024. This is because they are the most-commonly used material handling vehicles in factories, warehouses, distribution centers, and even construction sites. They are easy to operate for moving heavy stuff that cannot go on a conveyor or handled by a human. A lot of stuff is moved around and stored on pallets, which forklifts are especially designed to pick up and move.

The conveyor category will grow at the higher CAGR, during the forecast period, because more companies now prefer automated systems to move products without people. Conveyors move items non-stop, which makes packaging and sorting easier and quicker. Belt, roller, and overhead conveyors can be designed to fit any layout or workflow.

The product types analyzed here are:

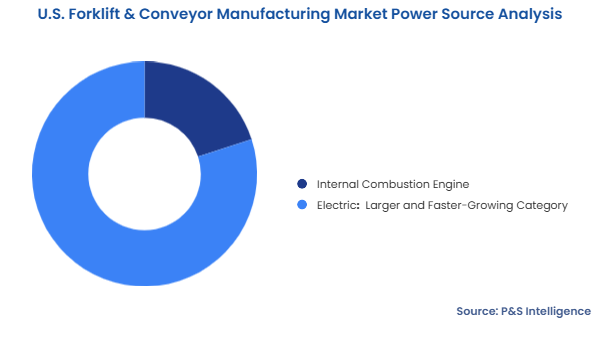

The electric category held the larger market share, of 80%, in 2024, and it will grow at the higher CAGR, during the forecast period. This is because they do not release harmful gases and cost less to operate and maintain than those running on gasoline and diesel. Additionally, new lithium-ion batteries last longer and charge faster. Moreover, the government offers incentives and tax breaks for using electric vehicles. They cost more initially, but save money later on. Furthermore, companies want to be more eco-friendly now amidst the rising emission concerns and stringent control regulations.

The power sources analyzed here are:

The 5–15 tons category held the largest market share, of 70%, in 2024, because these forklifts are used by warehouses, factories, and shipping companies. They are good for everyday tasks, such as moving boxes and pallets. They are neither too small nor too big, which allows them to fit inside smaller spaces yet lift heavy items.

The above 16 tons category will grow at the highest CAGR, during the forecast period. This is because of the growth of industries such as construction, mining, and energy, which require higher-capacity machines to carry heavy loads. Bigger forklifts help reduce the accidents because they are built to carry heavy loads safely.

The load capacities analyzed here are:

The manual category held the largest market share, of 55%, in 2024. This is because they are cheap and thus, used by small businesses to move stuff around. Moreover, older factories that have not upgraded their infrastructure for autonomous operations still use manual systems.

The fully automated category will grow at a higher CAGR, of during the forecast period. This is because robots and machines can work at all times with better accuracy. They are great for online shopping companies, which are handling more orders every day and must provide timely and correct deliveries.

The automation levels analyzed here are:

The manufacturing category held the largest market share, of 40%, in 2024. This is because the automotive, consumer goods, and machinery sectors require heavy-duty material handling equipment. Factories working 24/7 have a high need for equipment that can handle heavy payloads over long stretches. Moreover, the strong industrial base in the Midwest and South and Trump’s policies for reviving domestic manufacturing drive the market in this category.

The agriculture category will grow at the highest CAGR, during the forecast period. This is because farms and food companies use cold storage and fast-moving systems to keep the food fresh and deliver it faster. Smart warehouses with automation, electric forklifts, and tracking systems are fast emerging in the agricultural sector to store and move hay, sacks, pallets, pails, drums, and other stuff.

The end uses analyzed here are:

Drive strategic growth with comprehensive market analysis

The Midwest region held the largest market share, of 75%, in 2024 because of the presence a large number of factories in the states of Michigan, Ohio, and Illinois. The continuous urbanization and industrialization in this region drive the demand for advanced forklifts, conveyors, and other pieces of material handling equipment for efficient storage, delivery, and warehousing.

The market in the western region will grow at the highest CAGR, during the forecast period. This is because of the booming e-commerce sector, which impels companies to build massive warehouses with automated conveyors and forklifts. Moreover, the West is known for its advanced technologies, which allows users to switch to electric and automated systems. The huge ports in Los Angeles and Long Beach handle tons of imported goods, requiring a large number of forklifts and conveyors.

The regions analyzed in this report are:

The market is fragmented because conveyors and forklifts are used in many different settings, such as warehouses, construction sites, factories, and retail stores. This creates space for small and local companies as well, apart from the big brands. Moreover, basic forklifts and simple conveyors do not need a lot of money to manufacture, which makes it easy for newer companies to enter. Furthermore, even when large companies buy smaller ones, they still let the smaller ones operate under their own business names.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages