Key Highlights

| Study Period | 2019 - 2032 |

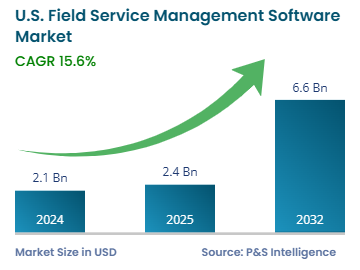

| Market Size in 2024 | USD 2.1 Billion |

| Market Size in 2025 | USD 2.4 Billion |

| Market Size by 2032 | USD 6.6 Billion |

| Projected CAGR | 15.6% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

Report Code: 13560

This Report Provides In-Depth Analysis of the U.S. Field Service Management Software Market Report Prepared by P&S Intelligence, Segmented by Deployment (On-premise, Cloud), Enterprise Size (Large Enterprises, Small and Medium Enterprises), Offerings (Work Order Management, Scheduling, Dispatch, and Route Optimization, Inventory Management, Customer Management, Sevice Contract Management, Reporting & Analytics, Consulting, Integration & Implementation, Training & Support), Industry (Telecom, Manufacturing, Healthcare & Life Sciences, Energy & Utilities, Construction & Real Estate, Transportation & Logistics, Retail & Wholesale, Banking, Financial Services and Insurance, Oil & Gas), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 2.1 Billion |

| Market Size in 2025 | USD 2.4 Billion |

| Market Size by 2032 | USD 6.6 Billion |

| Projected CAGR | 15.6% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. field service management software market size was USD 2.1 billion in 2024, which is expected to reach USD 6.6 billion by 2032, growing at a CAGR of 15.6% during the forecast period of 2025–2032.

The key market drivers are the rising demand for higher efficiency of field-based employees, growing usage of mobile devices and cloud-based platforms, rising expectations of customers for faster and personalized service, increasing adoption of real-time data analytics, IoT, remote troubleshooting, and strengthening focus on cost-efficiency, predictive maintenance, real-time scheduling, and asset management.

Companies utilize technicians to solve equipment problems across multiple locations. The absence of real-time solutions forces them to operate with outdated schedules and manuals, which results in service delays, communication breakdowns, and unhappy customers. Real-time solutions provide managers with exact information about team locations, ongoing tasks, and deadline progress, enabling operations to run efficiently with this high level of visibility.

A technician can access real-time information about changing work schedules, critical reassignment updates, and local part inventory information. The time savings and minimized travel allow field workers to execute additional tasks. The GPS routing system helps field workers determine which route will provide the fastest path or that with the least traffic. This enhances operational productivity and reduces expenses by minimizing fuel usage and equipment downtime.

Real-time updates help customers know about technician arrival times as well as get notifications about potential delays. Through applications connecting to the FSM software, customers receive immediate status updates and can provide real-time feedback.

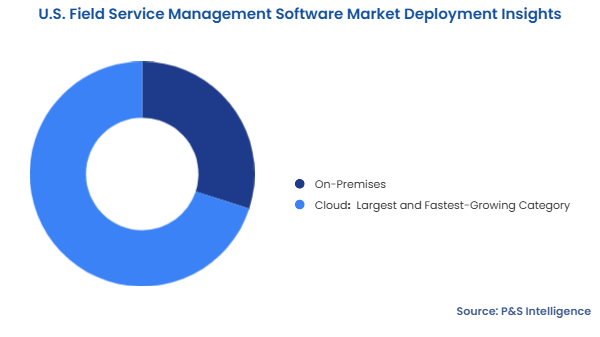

Cloud is the larger category with a market share of about 70% and the fastest growing because it provides flexible solutions, real-time access, scalability, and cost-effectiveness. The software operates without physical servers, performs automatic data backup, and provides AI predictive analysis.

Here are the deployment studies in the report:

Large enterprises dominate the market because they require sophisticated tools to manage their complex operations and employee teams. They have a large on-field staff working on extensive assets. FSM software offers cost and time advantages to such companies by automating many of the tasks related to the management of field-based teams.

The fastest-growing category is SMEs in 2024. These organizations find cloud-based solutions both affordable and scalable enough to enhance operational efficiency, while reducing expenses. Hence, since these companies do not have as strong a financial capability, these cost-effective solutions help them stay afloat in the sea of established and well-financed MNCs.

Here are the categories of this report:

The software category will have a larger share in 2024, approx. 65%, because a wide range of software is available for numerous tasks associated with managing employees in the field. For instance, work order management tools enable task organization, job tracking, and completion monitoring, which drives productivity and customer satisfaction. Similarly, the combination of real-time data processing with artificial intelligence in scheduling, dispatching, and route optimization software minimizes travel duration, optimizes scheduling, and ensures proper work assignments to technicians.

Services are the faster-growing category because companies looking to use FSM software to the best of its ability require a range of services. This includes training & consulting, deployment & system integration, operations & maintenance, upgrades, cybersecurity, and data backup & recovery.

Here are the offerings Studied in this report:

Telecom is the largest category as telecom companies deploy FSM software to control their diverse network infrastructure, which includes both cell towers and cables. This enables telcos to provide dependable maintenance services to their customers as well as keep the connection up.

Healthcare and life sciences are the fastest-growing category in 2024. The criticality of medical equipment and the need for it to be completely safe and precise drive the adoption of FSM software. This enables effective service and compliance management, both of which are necessary to protect patient safety and minimize downtime.

Here are the industries studied in this report:

Drive strategic growth with comprehensive market analysis

West is the largest region with a market share of around 35% in 2024, because California is home to one of the largest hubs for technology on earth: California. FSM software usage remains high across the telecom and healthcare industries in this region on account of the efficient IT infrastructure and easy availability of 4G/LTE and 5G connectivity.

The South region is the fastest growing, with Texas, Florida, and Georgia leading in implementation. The accelerating requirement for effective field operations in the expansive energy, utilities, and construction sectors drives this market expansion in the region.

Here are the regions analyzed:

The market is severely fragmented as diverse FSM solutions are used by companies, which span startups to established corporate entities. The market consists of numerous players that target different sectors and implement exclusive features to meet specific business requirements. Big players exist, yet smaller companies are expanding their operations through specialized service offerings or by concentrating on specific market segments. Developing software is not that hard, which offers opportunities to new companies.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages