Key Highlights

| Study Period | 2019 - 2032 |

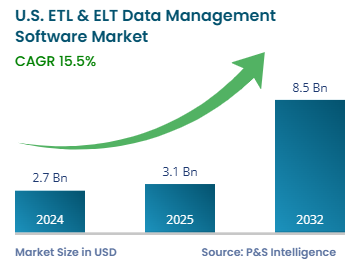

| Market Size in 2024 | USD 2.7 billion |

| Market Size in 2025 | USD 3.1 billion |

| Market Size by 2032 | USD 8.5 billion |

| Projected CAGR | 15.5% |

| Largest Region | West |

| Fastest Growing Region | Northeast |

| Market Structure | Fragmented |

Report Code: 13539

This Report Provides In-Depth Analysis of the U.S. ETL & ELT Data Management Software Market Report Prepared by P&S Intelligence, Segmented by Deployment (Cloud, On-premise, Application), Business Function (Real-Time Analytics, Customer 360 and Customer Relationship Management, Predictive Maintenance, Customer Experience Management, Data Migration, Data Traffic Management), Organization Size (Large Enterprise, Small & Medium Enterprises), Vertical (BFSI, IT and Telecommunications, Government and Defense, Retail and E-Commerce, Healthcare and Life Sciences, Energy and Utilities, Manufacturing, Transportation and Logistics), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 2.7 billion |

| Market Size in 2025 | USD 3.1 billion |

| Market Size by 2032 | USD 8.5 billion |

| Projected CAGR | 15.5% |

| Largest Region | West |

| Fastest Growing Region | Northeast |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. ETL & ELT data management software market was valued at USD 2.7 billion in 2024, and it is projected to grow at a CAGR of 15.5% during 2025–2032, to reach USD 8.5 billion in 2032. This rapid growth is due to the vast amount of data generated from digital platforms, which businesses are looking to manage, integrate, and transform via specialized tools, to derive actionable insights from it. These tools make the process of extracting, transforming, and loading data easier and faster, which helps businesses streamline data processing and improve decision-making.

This market is driven by the rising popularity of cloud computing, the growing adoption of big data analytics, and the increasing demand for data-driven decision-making. The growing complexity of organizing diverse large datasets from multiple sources drives companies to invest in improved solutions for ETL and ELT processes. Corporate investments in these software solutions target data accessibility improvement, alongside scalability and enhanced security needs. The adoption of automated data processing systems, which use AI and ML, is the major trend.

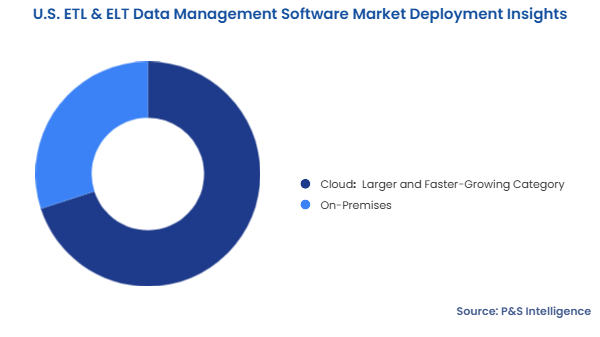

The cloud category is the larger, holds the market share of approx. 70% in 2024 because of its scalability, cost efficiency, and integration convenience. Through cloud solutions, enterprises obtain flexibility in data processing needs with scalable capabilities, which minimizes the upfront expenditure. Additionally, the availability of pay-per-use payment methods minimizes operational costs. Cloud solutions work effortlessly alongside other services, enhancing data workflow efficiency. Cloud solutions offer remote accessibility, which helps teams work together more efficiently, maintain fast implementation cycles, and get rapid software updates for fresh features and advanced security protocols.

Deployment types studied in the report:

The real-time analytics category dominates this segment with market share of around 35% in 2024. The rising business necessity for promptly made data-driven choices drives real-time analysis activities, particularly among e-commerce, finance, and healthcare businesses. The increase in IoT, social media, and mobile data usage stimulates the need for tools that analyze data immediately after generation. The combination of real-time insights and the flexibility of cloud platforms offers companies a competitive edge in their respective industries.

Applications studied in the report:

The large organizations dominate the market, generated around USD 1.9 billion in revenue in 2024 because they generate and utilize extensive data volumes, thus showcasing complex data processing requirements. Advanced solutions are essential for managing diverse, real-time, unstructured datasets across large organizations efficiently. Organizations across critical sectors heavily invest in advanced technologies, such as analytics, AI, and ML, which fuels the demand for ETL & ELT tools. MNCs prefer secure data management systems with compliance management and business scalability.

Organization Sizes that were taken under study:

The BFSI vertical is the largest category in 2024. The BFSI sector generates large data volumes during transactions and interactions with customers, which it is mandated to protect. Financial service organizations require advanced ETL & ELT data management infrastructure to properly process these large volumes of data and meet regulatory requirements. The BFSI sector needs increasingly sophisticated ETL & ELT software solutions because of its requirement to handle real-time data analysis for fraud detection and risk management.

Verticals covered in the report:

Drive strategic growth with comprehensive market analysis

The West is the largest region with a market share of 35% in 2024. Leading technology firms as well as startup organizations maintain their headquarters or major operational centers in Silicon Valley and Seattle. The requirement for data management software is expanding because major technology firms execute extensive data operations using both cloud computing and big data analytics. Major cloud service providers operating within this area, such as Google Cloud, Amazon Web Services (AWS), and Microsoft Azure, offer ETL & ELT solutions.

Regions covered in the report:

The market is fragmented as a huge number of U.S.-based, European, and Asian IT vendors offer ELT/ETL data management tools. Because this approach is based on software, development expenses are relatively low, allowing new companies to easily gain ground. While there are major IT vendors who cater to critical sectors, the smaller companies are usually approached by SMEs and niche end users. The diversity of applications across industries creates a large potential for software customization, thus opening opportunities for startups. The rapid evolution of AI, ML, IoT, and big data analytics fragments the market further, by enabling innovation-focused startups to make a mark.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages