Key Highlights

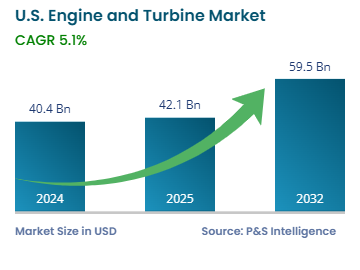

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 40.4 Billion |

| Market Size in 2025 | USD 42.1 Billion |

| Market Size by 2032 | USD 59.5 Billion |

| Projected CAGR | 5.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13517

This Report Provides In-Depth Analysis of the U.S. Engine and Turbine Market Report Prepared by P&S Intelligence, Segmented by Product Type (Engines, Turbines), Fuel Type (Gasoline, Diesel, Natural Gas, Hydrogen, Biofuels, Geothermal, Wind, Hydro Energy), Application (Automotive & Transportation, Industrial Machinery, Power Generation, Oil & Gas Industry, Aerospace & Defense, Marine), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 40.4 Billion |

| Market Size in 2025 | USD 42.1 Billion |

| Market Size by 2032 | USD 59.5 Billion |

| Projected CAGR | 5.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. engines and turbines market valued USD 40.4 billion in 2024, and it is expected to grow at a CAGR of 5.1% from 2024 to 2032, reaching USD 59.5 billion in 2032. The market is growing because of the expanding energy requirement, technological advancements, and invention of environment-friendly power production techniques.

The energy requirement in the country continues to grow because of the expanding population and rampant urbanization and industrialization. Engines and turbines are the basis to producing mechanical power in the absence of electricity. Therefore, they have wide-ranging applications from thermal power plants (conventional and clean) and gensets to automobiles, ships, aircraft, and rockets. These air-breathing machines can be used for both propulsion and producing electricity, which makes them a fundamental part of human life.

Energy-efficient engines and turbines and those capable of using more than one fuel, including low-emission ones, are a major trend in the country. With over 4.8 billion tonnes, the U.S. was the second-largest GHG emitter in the world in 2022, only behind the People’s Republic. As agreed in the United Nations Framework Convention on Climate Change, the U.S. intends to reduce its emissions by over 60% compared to the levels recorded in 2005 by 2035.

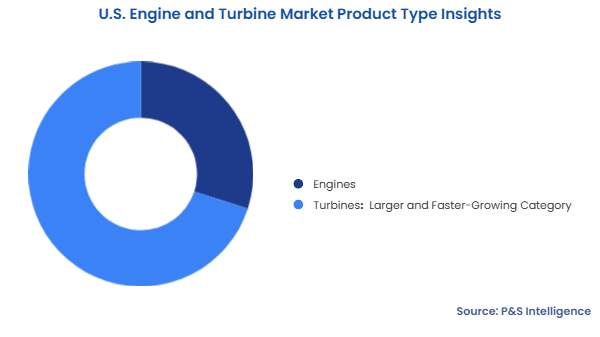

Turbines are the larger and faster-growing category with 70% share in 2024 over the forecast period, respectively. This is because they are widely used for power generation services, industrial applications, and supporting renewable energy development. Natural gas turbines drive most power plants in the U.S., but wind and hydro capacity is also increasing. The aerospace and space exploration sectors also majorly use turbine engines for their higher power and thrust, despite being less fuel-efficient than conventional piston engines. The latter are now mostly confined to the automotive and marine industries; however, the rising popularity of EVs is driving down ICE usage.

Product types studied in the report:

Hydrogen is the fastest-growing category, with a 60% share during the forecast years. This is because of the decarbonization initiatives, clean energy investments, and net-zero emission goals of the U.S. Innovations in green hydrogen production and an increase in hydrogen-fueled gas turbine installations drive its usage. In October 2023, Duke Energy announced plans to build an integrated facility in Florida that will produce, store, and burn green hydrogen in a turbine to produce electricity.

Fuel types considered:

Power generation dominates the market with 65% share as most of the electricity in the country is produced via methods to which turbines are integral. This includes crude oil, coal, natural gas, biomass, wind, geothermal, and even nuclear energy. As per the EIA, utilities in the country produced 4,178 billion kilowatt-hours of electricity in 2023. The increasing usage of CHP and combined-cycle plants is another factor that drives this category. While CHP systems use a turbine to produce both electricity and heat, combined-cycle plants are designed to maximize fuel efficiency. This is done by first burning gas to drive a gas turbine, and then, using the waste heat to produce steam for a steam turbine.

The aerospace & defense category has the highest CAGR. This is due to the increasing orders for civilian and military aircraft from around the world. All major aerospace companies, including Boeing, Airbus, Bombardier, Embraer, Textron Aviation, Lockheed Martin, Raytheon Technologies, Northrop Grumman, and General Dynamics, are based in the U.S, as are two major engine manufacturers: GE Aerospace and Pratt & Whitney. Moreover, the other two major firms offering aerospace engines—Safran and Rolls-Royce—also have plants in the country.

Applications analyzed:

Drive strategic growth with comprehensive market analysis

South is the dominant region, with largest share of 40% due to the large manufacturing base, high energy production, and extensive oil & gas operations. The power demand is high in Texas, Louisiana, and Florida, where numerous thermal power plants, refineries, and offshore drilling locations operate. As per the EIA, Texas, West Virginia, Louisiana, and Oklahoma were among the top 10 states in 2022 in terms of total energy production in the country. Engine and turbine demand in this region is also driven by the constant presence of the military, a large aviation hub, and commercial sectors.

Regions covered:

The market is fragmented because a huge variety of engines and turbines are needed for different applications. Further, not every manufacturer offers both turbines and engines, and those that do, do so for specific applications. For instance, companies that make engines for cars do not generally make turbines for aircraft as well. Moreover, the huge variations in the power output and fuels enable different companies to carve different niches. The emergence of multi-fuel engines and turbines has enabled new, innovation-driven companies to thrive amidst the intense competition and emission reduction efforts.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages