Key Highlights

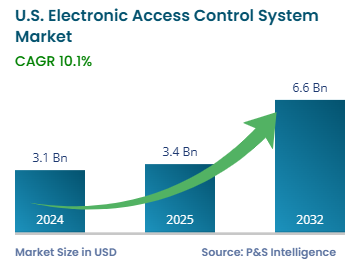

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 3.1 Billion |

| Market Size in 2025 | USD 3.4 Billion |

| Market Size by 2032 | USD 6.6 Billion |

| Projected CAGR | 10.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13603

This Report Provides In-Depth Analysis of the U.S. Electronic Access Control System Market Report Prepared by P&S Intelligence, Segmented by Component (Software, Hardware), Type (Biometric, Card-Based, Keypad/PIN, Bluetooth & NFC, Proximity-Based), Application (Physical, Logical), Deployment Type (On-Premises, Cloud-Based), End Use (Government & Public Sector, Commercial, Industrial & Manufacturing, Educational Institutions, Healthcare, Residential Buildings), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 3.1 Billion |

| Market Size in 2025 | USD 3.4 Billion |

| Market Size by 2032 | USD 6.6 Billion |

| Projected CAGR | 10.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. electronic access control system market was valued at USD 3.1 billion in 2024, and this number is expected to increase to USD 6.6 billion by 2032, advancing at a CAGR of 10.1% during 2025-2032.

This is because of the rising security concerns, quick adoption of sophisticated technologies, and expanding commercial, healthcare, government, and residential sectors. Security solutions are enhancing with technological advancements, which include biometric authentication, cloud-based access management, and AI for real-time monitoring.

The demand for advanced electronic access control systems is increasing because of the rise in the number of smart buildings and adoption of IoT-connected environments, which make technology integration with current infrastructure easy. The expansion of the e-commerce sector also drives the need for secure and scalable access solutions. The market growth will be further stimulated by government initiatives and regulatory standards for strengthening infrastructure security. Mobile-based access control, energy-efficient systems, and targeted efforts to protect against cybersecurity threats would make security even stronger.

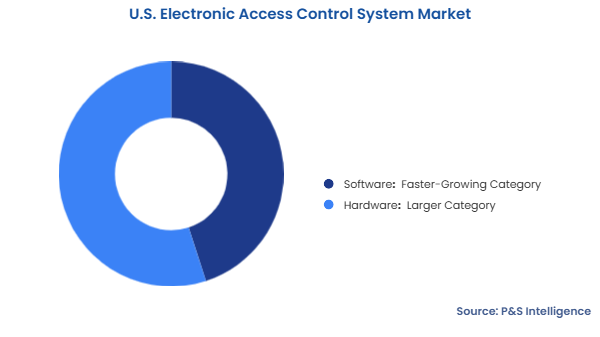

The hardware category dominates the market with a revenue share of 55% in 2024, because it serves as the crucial element for security protection and access control operations. Any access control system requires essential devices, including card readers, biometric scanners, electronic locks, keypads, and access control panels. Secure, controlled entrance to restricted areas occurs through advanced verification mechanisms, including fingerprint recognition, smart cards, and PIN codes. Biometric authentication devices have gained popularity because they provide enhanced security and reliability.

Components covered in the report are:

The card-based category accounted for the largest revenue share, of around 25%, in 2024, and this category is further expected to maintain its position during the forecast period. Secured areas often grant access through physical cards, such as magnetic stripe cards, smart cards, and RFID cards. Such access control systems simple to use, cost-effective, and compatible with the existing infrastructure. Such electronic access control systems are common in commercial workplaces, government buildings, educational buildings, and healthcare centers for door entry management. Organizations favor card-based security solutions because they easily connect with the present infrastructure and give control over multiple user access points, which provides scalability.

Here are the types covered in the report:

The physical access control category dominates the market with a revenue share of 60% in 2024. This is because it is a fundamental security element for building and room entry points and restricted site areas. Generic security components within this category include card-based systems, keypads, and biometric scanners with RFID technology, which are widely implemented to control building site access. Physical access control systems are popular in offices, educational institutions, healthcare facilities, and government premises because they are dependable.

The following are the applications studied in the report:

The on-premises deployment category accounted for the larger revenue share, of around 85%, in 2024, and this category is further expected to maintain its position during the forecast period. This is because the majority of the organizations prefer to maintain control of their access control systems, by hosting them across their internal infrastructure. On-premises systems provide superior security control, which is why they are popular in the government, healthcare, and education sectors.

Deployment type categories covered in the report are:

The commercial category accounted for the largest revenue share, of around 25%, in 2024, and this category is further expected to maintain its position during the forecast period. This dominance is because access control plays an important part in safeguarding property, confidential materials, and protecting employees in office buildings, retail spaces, and corporate facilities. Advanced security systems have gained popularity in commercial establishments because companies need efficient management for their large workforce and secure area access requirements.

Here are the end users covered in the report:

Drive strategic growth with comprehensive market analysis

The Southern region had the largest revenue share, of around 35% in 2024, and it is additionally expected to maintain its place in the market during the forecast period. This is because of its dense commercial and industrial establishments, strong infrastructure investments, and widespread adoption of security solutions. The cities of Atlanta, Houston, and Dallas are home to numerous businesses, government buildings, educational institutions, and healthcare facilities. These places require advanced security measures to protect their assets and people. The market growth is because of the rising need for stronger security measures in cities due to the surging safety concerns and the implementation of regulatory standards for infrastructure protection.

The regions analyzed in this report are:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages