Key Highlights

| Study Period | 2019 - 2032 |

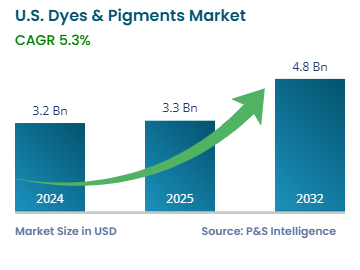

| Market Size in 2024 | USD 3.2 Billion |

| Market Size in 2025 | USD 3.3 Billion |

| Market Size by 2032 | USD 4.8 Billion |

| Projected CAGR | 5.3% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13550

This Report Provides In-Depth Analysis of the U.S. Dyes & Pigments Market Report Prepared by P&S Intelligence, Segmented by Type (Pigments, Dyes), Application (Dyes, Pigments), Distribution Channel (Direct Sales, Distributors & Wholesales, Online Retail, Speciality Chemical Stores), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 3.2 Billion |

| Market Size in 2025 | USD 3.3 Billion |

| Market Size by 2032 | USD 4.8 Billion |

| Projected CAGR | 5.3% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. dyes & pigments market is valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 5.3% from 2025 to 2032. The market is growing as a result of the increasing usage in industrial applications and greater focus on sustainability, specifically the transition toward organic and bio-based dyes and pigments. Regulations regarding hazardous chemicals and waste force manufacturers to develop more-environment- friendly dyes and pigments. In particular, producers of textiles and personal care are choosing non-toxic, sustainable raw materials.

The primary driver for the market is the expansion of various end-use industries, including packaging, textiles, plastics, automotive, medical devices, consumer goods, food and beverages, and construction.

New processing techniques have resulted in improved color stability, resistance to fading, and better compatibility with manufacturing processes, including 3D printing. Another factor contributing to rising demand for colorants is the increasing use of specialty colorants for digital printing on packaging and textiles.

The inorganic bifurcation dominates the pigment market with 50% revenue share as these products have been available for a longer time and are cheap and simple to produce. Moreover, the wide availability of petroleum reserves and the high refining capacity of the U.S. enable the production of synthetic dyes and pigments in huge volumes.

The organic bifurcation has the higher CAGR, of 5.4%, because of the growing concerns for the environment, natural resources, and human health. With time, several conventional chemicals have been banned by the EPA and FDA for use in the dyes and pigments meant for a range of products. Moreover, products labeled as organic allow companies to seek higher prices for them, which drives their profitability.

Reactive dyes are the largest and fastest-growing category, with 55% share in 2024 and 5.5% CAGR over the forecast period. This is because they form strong covalent bonds with fibers based on cellulose, which leads to color stability with repetitive washing. These chemicals also create a huge range of bright colors, are easy to apply, and disperse uniformly on textiles. Further, a larger chunk of these dyes bond to the textile fibers, which leads to less dye wastage.

Types studied in the report:

Textiles dominate the dyes market with 60% revenue, and they will witness the highest CAGR, of 6%, over the forecast period. The country produces a range of general-purpose, functional, and high-performance textiles for individuals, military, automotive, construction, industrial, and other applications. Reactive dyes are primarily favored for cotton, disperse dyes for polyester and other synthetic materials, and acid dyes for wool and nylon. This industry is witnessing a burgeoning trend of digital printing, waterless dyes, and organic, eco-friendly raw materials due to the shifting consumer preferences and strict government regulations.

Paints & coatings lead the market for pigments with 40% share in 2024, and they are also the fastest-growing category, with 5.8% CAGR. This is because paints & coatings have wide-ranging applications, including automobiles, consumer goods, construction, plastics, industrial machinery, and packaging.

Applications analyzed in the report:

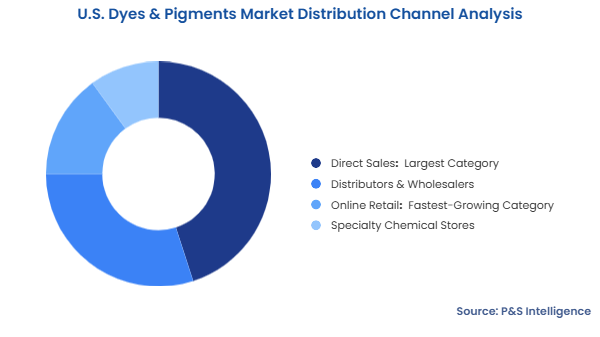

Direct sales are the largest category, with 45% share in 2024. Major producers primarily sell to end users in bulk as this enables them to exercise greater control over price, brand, and customer relationships. Additionally, most users are proper industries, such as construction materials, paints & coatings, textiles, automotive, plastics, and packaging, which have long-term supply contracts with producers.

Distribution channels studied:

Drive strategic growth with comprehensive market analysis

South is the dominant region with 40% revenue share in 2024. This is due to the high concentration of textile plants in this region, especially in North Carolina, Georgia, and South Carolina. The textile sector uses dyes in huge volumes in making a variety of colored fabrics and garments. In addition, the productive construction industry in the South leads to a high-volume pigment demand in paints and coatings.

Regions covered during the study:

The market is quite fragmented, as it includes a mix of large, multinational corporations, as well as many mid-sized and small, niche competitors. The fragmentation is mainly due to the wide product diversity and the varied requirements of end-use sectors. Many of these applications are highly specialized, and many players in the market cannot fulfill the wide range of performance specifications for every. With the emerging customization demands and concern for the environment, industries require eco-friendly durable, and stable dyes and pigments. This encourages smaller and emerging players to focus on bio-based and sustainable formulations.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages