Market Statistics

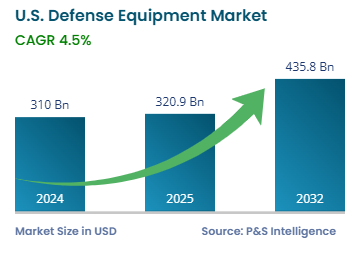

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 310 billion |

| 2025 Market Size | USD 320.9 billion |

| 2032 Forecast | USD 435.8 billion |

| Growth Rate(CAGR) | 4.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Consolidated |

Report Code: 13470

This Report Provides In-Depth Analysis of the U.S. Defense Equipment Market Report Prepared by P&S Intelligence, Segmented by By Armed Forces (Army, Navy, Air Force, Space Force), By Operation (Manual Defense Equipment, Autonomous Defense Equipment), By Propulsion (ICE, Electric, Hybrid), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 310 billion |

| 2025 Market Size | USD 320.9 billion |

| 2032 Forecast | USD 435.8 billion |

| Growth Rate(CAGR) | 4.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Consolidated |

|

Explore the market potential with our data-driven report

The U.S. defense equipment market size stood at USD 310 billion in 2024, and it is expected to grow at a CAGR of 4.5% during 2025–2032, to reach USD 435.8 billion by 2032.

The market is driven by increasing defense spending, technological advancements, geopolitical tensions, need for supply chain resilience, and export policy reforms. As per the Stockholm International Peace Research Institute, the defense spending of the U.S. rose by 5% in 2024 from 2023, reaching USD 997 billion. The U.S. not only spends to secure its borders and people but also other nationalities. It has been a prominent supporter of Ukraine, Israel, and Saudi Arabia, and in recent times, India and Pakistan as well. The key areas of focus for the Department of Defense include air superiority, nuclear missiles and bombs, naval might, and cyber defense and space warfare.

Navy held the largest market share, over 40%, in 2024, in terms of value, because the U.S. has been investing heavily in its naval force of late to support global maritime defense and protect its interests across the world. The U.S. maintains the world’s largest and most-potent fleet of aircraft carriers, submarines, and destroyers, which need substantial funds for operations, modernization, and technological modernization. The rising tension in the Indo-Pacific and Arctic regions compels the country to maintain naval dominance. Hence, the U.S. is increasing its funding for warships, developing new missile systems, and researching advanced technologies.

Space force will have the highest CAGR during the forecast period. Satellite communication systems, space surveillance tools, space-based tools, and systems that protect computer networks get substantial federal funding. As per government sources, the President’s Budget for the U.S. Cyber Command rose from USD 1.6 billion in 2024 to USD 1.7 billion in 2025, while the NDAA has allocated an additional USD 30 billion. Moreover, the congress has allocated USD 28.7 billion more to the U.S. Space Force for FY 2025.

These armed forces were analyzed:

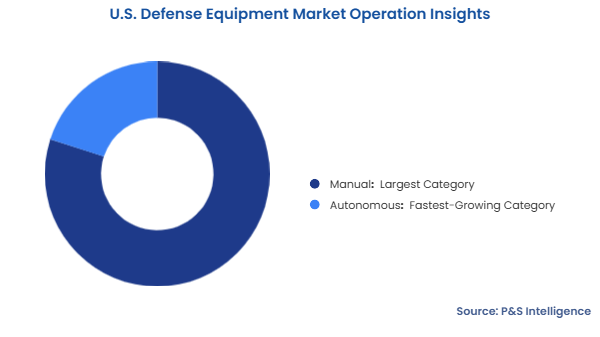

The manual bifurcation held the larger market share, of 80%, in 2024 due to the long-standing involvement of traditional defense systems, such as fighter jets, warships, and tanks, in wars and counter-terrorist operation.

The autonomous category will have the higher CAGR during the forecast period due to the advancements in AI, shift toward automation, and adoption of unmanned technologies. The idea is to improve efficiency, reduce the risk of human deaths, and support better decision making in serious situations.

These operations were analyzed:

The ICE category held the largest market share, of 85%, in 2024. The defense sector relies on ICE-based terrestrial vehicles, aircraft, and ships for long missions because military operations require strong and reliable systems that can work efficiently under harsh conditions. Moreover, diesel can be easily carried in barrels and tanks, which makes ICE propulsion more convenient and ready for anything. Moreover, manned aircraft majorly rely on ATF-driven turbine engines for maximum power, range, service ceiling, and payload delivery.

The electric category will have the highest CAGR during the forecast period. The improving battery technology, increasing demand for stealth capability, and growing importance of the U.S. military on sustainability drive the usage of electric propulsion systems. Electrically driven military vehicles are quiet, less detectable, eco-friendly, and ideal for modern unmanned missions. The aircraft carriers and submarines of the U.S. Navy already operate on nuclear-powered electric propulsions, giving them practically unlimited range, except for other supplies.

These propulsions were analyzed:

Drive strategic growth with comprehensive market analysis

The South held the largest market share, of 45%, in 2024. North Texas, Florida, and Alabama form the largest defense markets as they host vital defense contractors, aircraft manufacturing facilities, and major shipyards. Moreover, the tense U.S.–Mexico border necessitates the deployment of an adequate number of security personnel with the appropriate equipment to detect and apprehend illegal intruders.

The West will have the highest CAGR during the forecast period due to the fast progress in aerospace and defense technology. California is home to several key defense technology companies, space exploration ventures, and research institutions, which are focused on such next-generation military technologies as artificial intelligence defense systems and autonomous warfare. Moreover, due to its long coastline, the West has a strong presence of the navy and coast guard.

The regions analyzed for this report include:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages