Key Highlights

| Study Period | 2019 - 2032 |

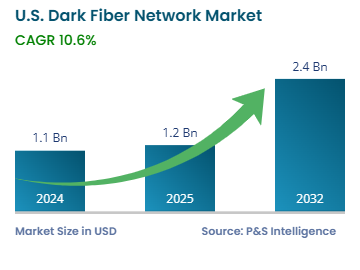

| Market Size in 2024 | USD 1.1 billion |

| Market Size in 2025 | USD 1.2 billion |

| Market Size by 2032 | USD 2.4 billion |

| Projected CAGR | 10.6% |

| Largest Region | West |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13565

This Report Provides In-Depth Analysis of the U.S. Dark Fiber Network Market Report Prepared by P&S Intelligence, Segmented by Fiber Type (Single-mode Fibre, Multimode Fiber), Material (Glass, Plastic), Network Type (Metro, Long Haul), Technology (DWDM, Mobile Backhaul), Application (IT & Telecom, BFSI, Industrial Automation & Control, Aerospace & Defense, Data Centers, Healthcare Industry, Railway Industry), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 1.1 billion |

| Market Size in 2025 | USD 1.2 billion |

| Market Size by 2032 | USD 2.4 billion |

| Projected CAGR | 10.6% |

| Largest Region | West |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. dark fiber network market size was USD 1.1 billion in 2024, and it will grow by 10.6% during 2025–2032, to reach USD 2.4 billion by 2032. It has come out as a viable solution for various organizations that have been planning on improved communication and network solutions. The rising penetration of internet services is creating a demand for higher bandwidth.

Dark fiber refers to the vast network of extra optical fibers that was installed underground when the internet first emerged but is not in use currently. Now that the demand for bandwidth is again increasing in the country, network service providers are renting these idle fiber-optic cables. This is because lit fibers, which are the data transmission line in use currently, have become over-saturated and unable to accommodate the growing internet user base

Businesses across the country now use applications that require high-speed and scalable connectivity such as AI, cloud computing, IoT, and real-time data analysis.

Dark fiber networks are unused or unlit optical fiber cables that provide businesses a chance to create their own network with almost limitless capacities. This is highly important in today’s business environment as companies are experiencing increasing traffic volumes in their networks. This impels companies to look for telecom infrastructure that can support high-bandwidth operations. Optical fibers deliver high-bandwidth and low-latency connectivity for all key organizational processes, such as work-from-home/remote access, online meetings, and cloud services.

The biggest driver for the market is the expansion of 5G networks and the rising number of people connected to one. As per Ericsson, more than 300 million people live in areas with 5G low-band networks, while between 210 and 300 million people also live get 5G mid-band connectivity. Additionally, 60% of the cell phone subscriptions in the country are already 5G.

5G connections work at substantially higher frequencies in comparison to the previous generations, to achieve non-situationally higher data rates and uniquely connect billions of devices at once. However, these higher frequencies have a short range and operate efficiently only when supported by small cells, base stations, and high data center densities.

Dark fiber networks offer the bandwidth and scalability to accommodate the tremendous volumes of data that 5G applications work with. Additionally, the utilization of 5G networks depends greatly on fiber optical cables for backhaul and fronthaul transport. Dark fiber networks are perfect for such purposes as they provide the ultra-high-rate and secure data transmission necessary for the efficient running of 5G systems.

The fibers analyzed in this report are:

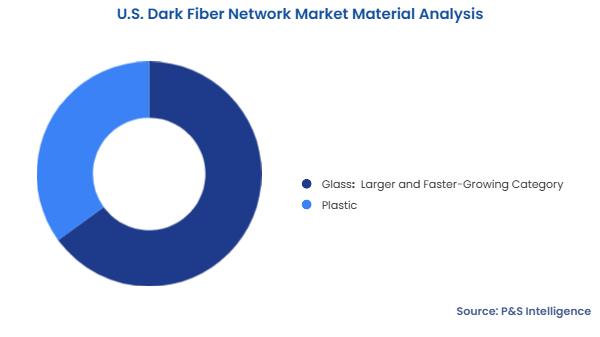

The materials analyzed in this report are:

The network types analyzed in this report are:

The technologies analyzed in this report are:

The applications analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The geographical breakdown of the market is as follows:

The market is fragmented because there are several telecommunications companies, internet providers, and specialized companies that offer dark fiber on rent. This fragmentation stems from the large number of telecommunications providers in many regions and at the local level who provide dark fibers differing in price, quality, and availability.

However, some major internet service providers exist in urban areas, including internet giants, such as AT&T, Verizon, and Comcast. Small local ones are also strengthening their infrastructure and capacities to target more consumers.

In April 2024, Uniti Group Inc. announced plans to expand its lit and dark fiber network in Huntsville, AL, to 190 miles.

In June 2022, NEC Corporation announced that Neutral Networks has energized its NEXT optical fiber network between the U.S. and Mexico. Neutral Networks utilized the ICE6 800G coherent technology of Infinera Corporation (now a subsidiary of Nokia Corporation), developed in partnership with NEC Corporation.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages