Key Highlights

| Study Period | 2019 - 2032 |

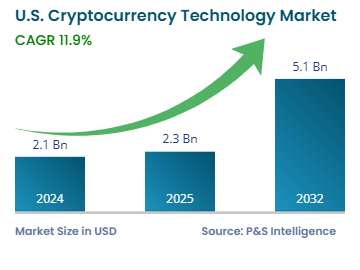

| Market Size in 2024 | USD 2.1 Billion |

| Market Size in 2025 | USD 2.3 Billion |

| Market Size by 2032 | USD 5.1 Billion |

| Projected CAGR | 11.9% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

Report Code: 13535

This Report Provides In-Depth Analysis of the U.S. Cryptocurrency Technology Market Report Prepared by P&S Intelligence, Segmented by Component (Hardware, Software), Type (Bitcoin, Ethereum, Litecoin, Ripple, Binance Coin), Process (Mining, Transaction), End User (Retail & Individual Users, Enterprises & Institutions, Government & Public Sector), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 2.1 Billion |

| Market Size in 2025 | USD 2.3 Billion |

| Market Size by 2032 | USD 5.1 Billion |

| Projected CAGR | 11.9% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. cryptocurrency technology market size was USD 2.1 billion in 2024, which is expected to reach USD 5.1 billion by 2030, growing at a CAGR of 11.9% during the forecast period 2025–2032. This is because more mainstream entities are adopting blockchain infrastructure and digital assets, and Major financial institutions and tech companies are using crypto solutions to upgrade their platforms. This increasing interest of financial institutions and investors in cryptocurrency creates a high demand for crypto tools and shows their increasing confidence in it.

The situation is improving because regulators have provided clarity about digital assets. The regulatory environment for cryptocurrency and digital assets in the U.S. is evolving positively with a focus on security and innovation, supported by the rising capital investment. The recent advancements include Scalable blockchain, DeFi platforms, and Web3 applications.

Companies now understand the legal parameters that drive the development of blockchain, crypto startups, and related services. The market is also driven by the government activities that investigate central bank digital currencies (CBDCs).

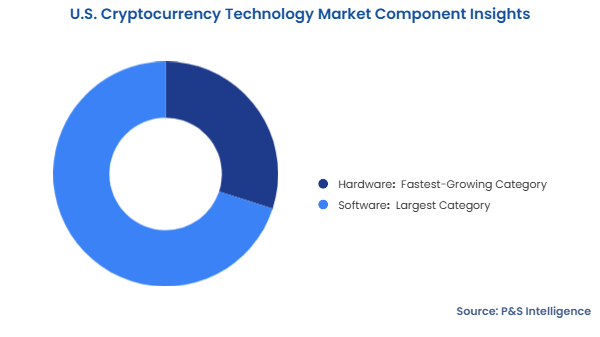

Software is the larger category, with a market share of 70% in 2024, due to the wide use of crypto wallets, blockchain platforms, DeFi applications, smart contract tools, and exchange software. The rise in the number of businesses and consumers interacting with digital assets drives the requirement for secure, scalable, and easy-to-use software.

Hardware is the faster-growing category, with 12.5% CAGR, because of the rising demand for secure and efficient crypto mines, hardware wallets, and blockchain nodes. With the declining energy costs and simplification of regulations, the demand for high-performance ASIC miners and GPUs is surging. Further, due to the rise of exchange hacks, sales of wallets, such as Ledger and Trezor, are rising with a focus on self-custody and digital security.

Here are the components studied in the report:

Bitcoin is the largest category, with a market share of 60% in 2024 because it was the first and is the most-prominent cryptocurrency. It receives strong support from institutional entities, funds regulatory acceptance, and is traded globally. Bitcoin accounts for a 40% capitalization in the market for this reason. The influential branding, 21-million-coin supply maximum, increasing utilization in corporate reserve holdings, and supportive government programs drive this category’s dominance.

Ethereum is the fastest-growing category, with 13% CAGR. This is due to its blockchain platform capabilities with dApps, Web3 tools, smart contracts, rising number of tokenization projects, and complete support for DeFi and NFT ecosystems. Ethereum also provides developers with a programming platform, whereas Bitcoin mainly acts as a value store. The upgrades in Ethereum 2.0 enhance its capacity for sustained operations and reduce the power consumption of the associated hardware.

Here are the types of this segment:

Transaction is the larger category, with a market share of 55% in 2024. The rising volume of cryptocurrency transactions, such as conducting payments, investing, and executing smart contracts, creates a requirement for fast, secure, and scalable systems. The U.S. witnesses billions of dollars’ worth of cryptocurrency transactions each day, while Coinbase, Binance. US, and several decentralized exchanges function as trading platforms.

Mining is the fastest-growing category, with 12.9% CAGR, because Bitcoin and other such currencies operate under proof-of-work validation systems. After China banned crypto in 2021, the U.S. took it up. Texas and Wyoming have favorable regulatory frameworks and low energy prices, attracting miners to set up operations. The security benefits and reward acquisition of mining attract corporate and individual participants.

Here are the categories of this segment:

Retail & individual users are the largest category, with a market share of 50% in 2024. Almost 50 million people in the U.S. use cryptocurrency for investment, trading, and transactions. Acquiring digital assets and trading in them is simple with user-friendly digital asset management platforms, such as Coinbase, Robinhood, and Cash App.

Enterprises & institutions are the fastest-growing category, with 13.5% CAGR. Financial organizations now provide crypto investment options, while the finance, logistics, and healthcare sectors are integrating the blockchain technology for secure data operations. The category is also driven by Bitcoin ETF approvals, emergence of smarter contracts, and adoption of Hyperledger and Ethereum enterprise blockchain platforms. For instance, JPMorgan Chase & Co. offers crypto-linked services, while Tesla Inc. and MicroStrategy Incorporated hold Bitcoin assets.

The following end users are studied in this report:

Drive strategic growth with comprehensive market analysis

The West is the largest region, with a market share of 45% in 2024. Silicon Valley is home to multiple startups, technology giants, and venture capital organizations working on cryptocurrency projects. These key companies headquartered in the west include Coinbase and Ripple, along with several Web3 startups. A strong technology ecosystem, investor enthusiasm, and favorable rules that drive innovation encourage blockchain research and software development in this region.

The South is the fastest-growing region, with 13% CAGR. The states of Texas and Florida are witnessing an increase in cryptocurrency-related activities because of the affordable energy and supportive government regulations. Texas’s inexpensive energy supply has encouraged major firms, such as Riot Platforms and Marathon Digital, to set up large-scale operations. Miami sponsors blockchain conventions and establishes municipality-based innovation programs for blockchain.

Here are the categories of this segment:

The market is fragmented, primarily due to the wide range of players operating across different segments of the ecosystem. Large and small technology companies operate independently of each other, without anyone dominating the market. Every segment of the blockchain ecosystem, including mining, software, wallets, exchanges, and blockchain infrastructure, possesses multiple competitors active in innovation. The open-source blockchain technology, low development hurdles, and continuous development of new platforms drive the market fragmentation.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages