Market Statistics

| Study Period | 2019 - 2032 |

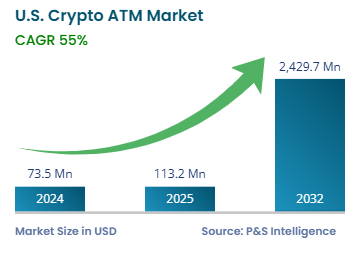

| 2024 Market Size | USD 73.5 Million |

| 2025 Market Size | USD 113.2 Million |

| 2032 Forecast | USD 2429.7 Million |

| Growth Rate(CAGR) | 55% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13450

This Report Provides In-Depth Analysis of the U.S. Crypto ATM Market Report Prepared by P&S Intelligence, Segmented by Type (One Way, Two Way), Offering (Hardware, Software), Currency (Bitcoin, Litecoin, Ethereum, Dogecoin, Bitcoin Cash, Dash, Tether), Application (Commercial Spaces, Restaurants & Other Hospitality Spaces, Transportation Hubs, Standalone Units), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 73.5 Million |

| 2025 Market Size | USD 113.2 Million |

| 2032 Forecast | USD 2429.7 Million |

| Growth Rate(CAGR) | 55% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. crypto ATM market valued at USD 73.5 million in 2024, and this number is expected to increase to USD 2429.7 million by 2032, advancing at a CAGR of 55% during 2025–2032.

The biggest drivers of the growth of the market are the rising cryptocurrency usage, such as of Bitcoin and Altcoin; regulatory progress, advancing financial technology, and expanding business acceptance of cryptocurrencies. The strict compliance measures being designed and implemented to tackle fraud and illicit activity will create better trust through enhanced KYC and AML policies.

Technology advancements, for example, multi-currency support, improved security features, and integration with decentralized finance applications, will enhance the user experience. Partnerships between crypto providers and financial institutions for digital assets and traditional banking might also strengthen with such technological and regulatory progress.

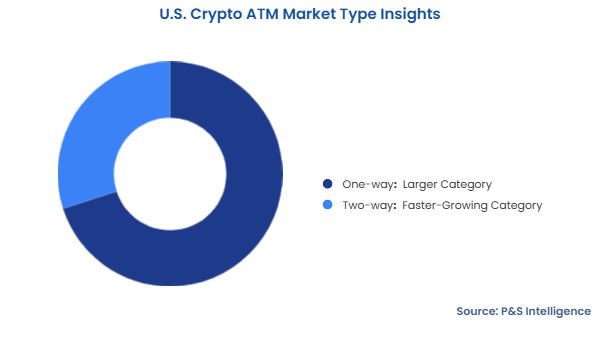

The one-way category is larger with 70% share as such machines enable users to acquire cryptocurrencies by depositing cash or cards. The popularity of one-way crypto ATMs is primarily due to the low costs of their installation and maintenance. The straightforward regulatory standards on these machines make them accessible for new cryptocurrency users.

The following are the types covered in this report:

Hardware stands as the larger category, with 75% share as every crypto ATM depends on displays, QR scanners, and printers to work correctly. The essential hardware components enable user engagement, transaction procedures, and security protocol testing. Installing every machine requires substantial hardware investment, which is a key reason it generates higher revenue than software. The growing number of machines installed in retail and public areas propels the demand for durable and high-performance components.

The main offerings covered in this report are:

Bitcoin stands as the largest category with 35% share because nearly all machines enable BTC purchase and sale operations. Bitcoin is the most popular among all cryptocurrencies because of its powerful brand image, universal usage, and high market liquidity, which appeals to novices and skilled investors. Bitcoin has also found integration with major financial platforms and widespread institutional acceptance.

The currencies covered in this report are:

Commercial spaces dominate the market with 45% revenue because shopping malls, retail stores, gas stations, and convenience stores witness high foot traffic. Crypto ATM operators install machines in commercial spaces to achieve maximum visibility and usage. The infrastructure, power supply, and security elements available in commercial spaces enable the proper operations of ATMs.

Major application areas covered in this report are:

Drive strategic growth with comprehensive market analysis

The West region is the prime revenue contributor with 40% share. Cryptocurrency adoption in California, Nevada, and Arizona is high because of their population’s technological prowess and the presence of major technology centers, primarily Silicon Valley. The large number of cryptocurrency startups, investors, and users in California have established a supportive environment for ATMs that helps people sell and buy cryptocurrencies. Due to the high density of residents and well-developed digital infrastructure, crypto ATMs are common in retail stores, convenience shops, and various other public spaces.

Here are the regions analyzed in this report:

The market is fragmented because it includes numerous major companies and operators in the small-to-medium category. Bitcoin Depot, CoinFlip, and CoinCloud hold sway, but numerous regional and independent operators give them stiff competition. The low barriers to entry and increasing fascination with cryptocurrencies drive the entry of new companies in the market. The differing state rules and compliance standards create obstacles for companies to gain complete control of the market across the country.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages