Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 190 billion |

| 2025 Market Size | USD 206.2 billion |

| 2032 Forecast | USD 388.4 billion |

| Growth Rate(CAGR) | 9.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Consolidated |

Report Code: 13485

This Report Provides In-Depth Analysis of the U.S. Credit Card Market Report Prepared by P&S Intelligence, Segmented by Credit Type (General Purpose Credit Cards, Specialty & Other Credit Cards), Technology (Contactless Cards, Digital Wallet-Integrated Cards, App-Enabled Cards, Traditional Cards), Application (Food and Groceries, Health and Pharmacy, Restaurants and Bars, Travel and Tourism), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 190 billion |

| 2025 Market Size | USD 206.2 billion |

| 2032 Forecast | USD 388.4 billion |

| Growth Rate(CAGR) | 9.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Consolidated |

|

Explore the market potential with our data-driven report

The U.S. credit card market size stood at USD 190 billion in 2024, and it is expected to grow at a CAGR of 9.5% during 2025–2032, to reach USD 388.4 billion by 2032.

The market is driven by the rise in consumer spending, technological advancements, popularity of credit card rewards & offers, high demand for credit access, need for improved credit risk management, and expansion of fintech companies and digital banks.

There are over 1 billion active credit cards in the U.S., which are used for millions of transactions every day, becoming an essential part of the daily life for spending, borrowing, and managing money.

Moreover, people do not like carrying as much cash around due to the fear of getting mugged on the street. Additionally, ATMs have a limit on cash withdrawal, which promotes the usage of credit cards and other electronic payment technologies for high-value transactions. Most banks permit withdrawals of USD 1,500 per day, which might not be enough for expensive items, such as electronics, home appliances, or automobiles.

The general-purpose category holds the larger market share, of 75%, and it will also witness a higher CAGR over the forecast period. This is due to their wide acceptance, flexible, and increasing usage for daily purchases. These cards are issued by major networks, such as Visa, Mastercard, and American Express, which are well known and accepted around the country. Financial institutions constantly improve their offerings with rewards, cashbacks, and travel incentives, to attract more users.

The Rising living costs, high inflation, and surging interest rates are leading many people to rely on credit cards for everyday expenses, to maximize benefits. In addition, digital payment technologies, such as mobile wallets and contactless transactions, have made credit cards more convenient and secure, speeding up their adoption.

These credit types were analyzed:

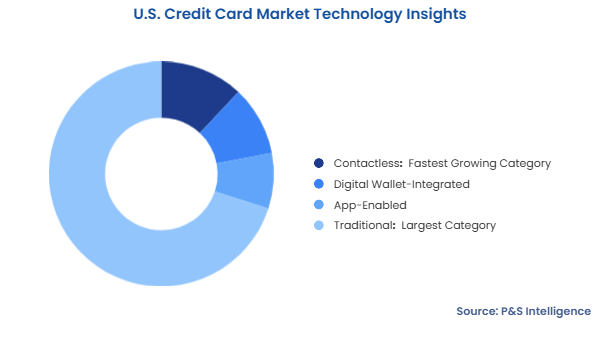

Traditional cards held the largest market share, over 70%, in 2024. This is because these cards have been around for more than 50 years due to their wide acceptance, present infrastructure, and the trust of older customers. Despite the emergence of new technologies, most credit card transactions in the U.S. are done using traditional cards, because not every merchant or consumer has switched to advanced systems.

Contactless cards will have the highest CAGR during the forecast period. This is because tapping cards using NFC has become immensely popular in recent years. Contactless technology is promoted by major card networks, such as Visa, Mastercard, and American Express, and most merchants now have terminals that support it. Moreover, most of the new cards being issued presently are enabled with smart features, and they will eventually replace the traditional ones completely.

These technologies were analyzed:

Food & groceries have the largest market share, over 55%, in 2024. This is because of the regularity of grocery shopping, for which people widely use credit cards to avail of cashback and discounts and spend flexibly. Supermarkets and grocery stores have high transactional volumes, and the rising popularity of online grocery shopping and food ordering further drives this category.

Travel & tourism will have the highest CAGR, during the forecast period. With the rising international and domestic travel, airlines, hotels, and travel agencies now offer attractive credit card rewards and loyalty programs. Additionally, the buy now, pay later option is extensively capitalized on by people. Since these transactions are of a high value, people normally pay via credit cards.

These applications were analyzed:

Drive strategic growth with comprehensive market analysis

The South held the largest market share, over 65%, in 2024 due to its large population size, strong economy, and rising consumer spending. In recent years, Texas and Florida have become business, tourism, and migration hubs.

The West will have the highest CAGR during the forecast period. This is because Silicon Valley and Seattle are major tech hubs that attract young, affluent, and tech-savvy people. This demographic is more likely to use tools, such as digital payments and credit cards. Moreover, the high disposable income in this region leads to higher spending via credit cards and an overall greater need for them.

The regions and countries analyzed for this report include:

The market is consolidated because a few major players dominate the industry. The top credit card issuing firms are JPMorgan Chase, American Express, Visa, Mastercard, Citibank, Capital One, and Bank of America. They benefit from economies of scale, customer loyalty, and major investments in technology, marketing, and customer acquisitions. Smaller banks and credit unions often cannot match these larger companies in terms of rewards and digital features.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages