Key Highlights

| Study Period | 2019 - 2032 |

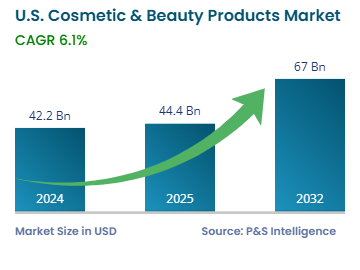

| Market Size in 2024 | USD 42.2 Billion |

| Market Size in 2025 | USD 44.4 Billion |

| Market Size by 2032 | USD 67 Billion |

| Projected CAGR | 6.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13536

This Report Provides In-Depth Analysis of the U.S. Cosmetic & Beauty Products Market Report Prepared by P&S Intelligence, Segmented by Product (Skin Care, Hair Care, Makeup & Color Cosmetics, Fragrances & Perfumes, Personal Care & Hygiene), Gender (Men, Women), Category (Mass Market Products, Premium/Luxury Products, Organic & Natural Products, Vegan & Cruelty-Free, Medical & Dermatological Products), Distribution Channel (Online Retail, Supermarkets & Hypermarkets, Specialty Beauty Stores, Department Stores, Pharmacies & Drugstores, Direct Selling & Subscription Services), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 42.2 Billion |

| Market Size in 2025 | USD 44.4 Billion |

| Market Size by 2032 | USD 67 Billion |

| Projected CAGR | 6.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. cosmetic & beauty products market size was USD 42.2 billion in 2024, which is expected to reach USD 67 billion by 2032, growing at a CAGR of 6.1% during the forecast period (2025–2032).

The expansion is because of the evolving cultural patterns, heightening consumer education, and novel product developments. The growing interest in personal care and appearance drives people to use a range of skincare, makeup, and haircare products. Through Instagram, TikTok, and YouTube, users become aware of new beauty trends, encouraging them toward such product experimentation. Endorsement by influencers and celebrities enhances people’s trust in new brands.

Customers are now demanding natural, sustainable products with clean labels. People today know more about these products; so, they seek precise information about the ingredients, production methods, and supply chain integrity. Therefore, brands that emphasize cruelty-free testing, vegan formulae, and environment-friendly packaging are gaining popularity. Established companies as well as startups are focusing on innovation to meet the evolving consumer demands for products for all skin tones, types, and purposes.

Advanced technologies and e-commerce enable customers to access beauty products more easily than ever. Online shopping websites enable shoppers to view merchandise through augmented reality, access real consumer evaluations, and conduct pseudo-product tests using smartphones. Speedy deliveries and adaptable return policies further make e-commerce a preferred channel for buying beauty products and cosmetics.

Skincare is the largest category, with a market share of 40% in 2024 due to the belief that proper skin maintenance improves appearance, health, and self-confidence. The rising awareness and incidence of dermatological issues and growing audience for influencers drive this category. As per the American Academy of Dermatology, skin conditions are the most common in the country, affecting over 50% of its population.

Personal care & hygiene is the fastest-growing category, with 7.1% CAGR, because of the rising demand for body washes, deodorants, hand sanitizers, and feminine care products. Personal care and hygiene products rose dramatically in demand following the COVID-19 pandemic because people established hygiene as their main concern. Products that cleanse and moisturize the skin, have pleasant aromas, and contain safe ingredients are currently popular.

Here are the products studied in the report:

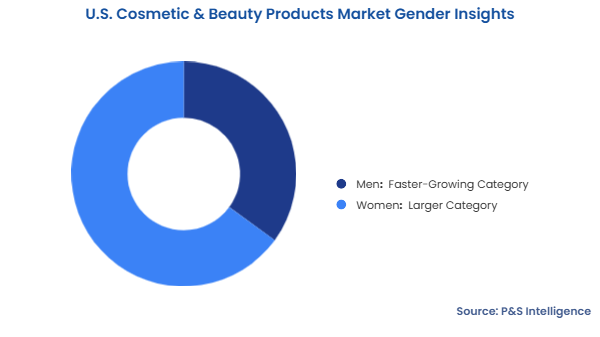

Women are the larger category, with a market share of 65% in 2024 due to the strong cultural focus on female beauty and personal grooming. This drives the demand for skincare, makeup, and haircare products. Beauty influencers and celebrity promotions on social media platforms have made personal care an essential routine for women in their everyday lives. As per the Washington State Department of Corrections, women in the U.S. spend up to 3,756 annually on personal care and beauty producs.

Men are the faster-growing category, with 7.9% CAGR due to the changing cultural standards, which now support and promote male maintenance and self-pampering. Traditional shaving creams are losing their appeal as men are now interested in skincare, haircare, and even makeup-based products. The young male population aged 18–34 is experimenting with multiple beauty products because of the rising acceptance of personal self-expression in beauty care.

Here are the categories of this segment:

Mass market products are the largest category, with a share of 55% in 2024. These products are easily accessible for a wide range of consumers because of their affordable prices. A huge variety of these products for different customers and preferences are available in supermarkets, drugstores, and online platforms.

Organic and natural products are the fastest-growing category, with 7.8% CAGR because consumers understand more about the risk of synthetic chemicals to their health. As a result, people are increasingly choosing plant-based, cruelty-free, and sustainable ingredient-based products. Millennials and the Gen Z desire clean beauty products because they are safe and transparent in terms of production.

Here are the categories of this segment:

Specialty beauty stores are the largest category, with a share of 35% in 2024. These stores offer selected brands and tailored service, as well as allow customers to try them out before buying. Moreover, their upscale locations and market-exclusive products draw customers who want premium beauty products, which is why these stores are generally found in cities.

Online retail is the fastest-growing category, with 7% CAGR due to home shopping convenience, wide product selection, and social media and online review influence. E-commerce businesses also provide competitive costs, subscription packages, and customized product suggestions.

The following distribution channels are analyzed:

Drive strategic growth with comprehensive market analysis

South is the largest region, with a market share of 35% in 2024 because of the large population, rampant urbanization, and strong economic activity. The South also has a warm climate, which leads to a high requirement for skincare and sun protection products. Moreover, the cultural diversity in the region drives the sale of beauty products suited to different skin types and complexions. Further, Miami and Atlanta are major destinations in the South for fashion and a high life.

West is the fastest-growing region, with 7.5% CAGR due to the hip fashion of California and its environmentally aware population. The iconic entertainment industry of the state and the strong social media influence here support well-established brands and startups. Moreover, the presence of an affluent population, especially in LA and San Francisco, and the rich performing arts tradition of Las Vegas propel the sale of premium cosmetics and beauty products. ​

Here are the categories of this segment:

The market is fragmented as L'Oréal, Estée Lauder, Procter & Gamble, and other luxury brands compete with smaller, independent brands combined, niche players, and startups. The changing consumer preferences for distinct, personalized, and ethical beauty products allow smaller brands to thrive. Social media platforms and e-commerce operations have eliminated barriers for new brands, enabling them to reach customers directly. Additionally, a large number of beauty product companies from Europe, Asia, and even LATAM sell their products in the U.S.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages