Market Statistics

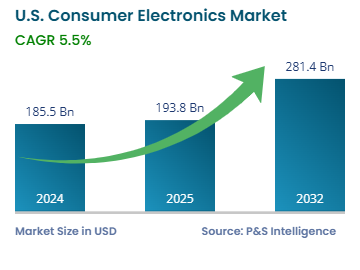

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 185.5 billion |

| 2025 Market Size | USD 193.8 billion |

| 2032 Forecast | USD 281.4 billion |

| Growth Rate (CAGR) | 5.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13493

This Report Provides In-Depth Analysis of the U.S. Consumer Electronics Market Report Prepared by P&S Intelligence, Segmented by Technology (5G-Enabled Consumer Electronics, AI-Powered Smart Devices, Augmented Reality & Virtual Reality Electronics, Smart Home & IoT-Connected Devices, Energy-Efficient & Sustainable Electronics, Cloud-Enabled & Edge Computing Devices, Next-Generation Display Technologies), Distribution Channel (Online, Offline), Price Range (Low-End, Mid-Range, Premium & Luxury Segment), End User (Residential Consumer, Commercial Users, Industrial and Enterprise Users), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 185.5 billion |

| 2025 Market Size | USD 193.8 billion |

| 2032 Forecast | USD 281.4 billion |

| Growth Rate (CAGR) | 5.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. consumer electronics market was valued at USD 185.5 billion in 2024, which is expected to increase at a CAGR of 5.5% during 2025–2032, to reach USD 281.4 billion by 2032. The biggest drivers for the market include the continuous technological innovations in electronic gadgets and the increasing disposable income of people. These devices are smart and interconnected with the help of technologies such as artificial intelligence, the internet of things, Wi-Fi, cellular connectivity, and Bluetooth.

People rely on these devices for both entertainment and professional purposes. The growing trend of working from home has compelled people to purchase products such as laptops, tablets, and headphones. Moreover, the increasing health-consciousness adds to the demand for wearable consumer devices, such as fitness trackers, bands, and smartphones with vitals tracking features. According to the National Heart, Lung, and Blood Institute, one-third of the U.S. population uses wearable devices, such as a smartwatch or band, to track their health and fitness.

The e-commerce sector is also a significant contributor to the growth in the sale of consumer products as it makes it convenient for them to buy these products online, without any hassle. It has increased the adoption of home entertainment devices, personal technology, and health monitoring equipment.

5G-enabled consumer electronics is the largest category with 70% revenue share in 2024, mainly because of the huge number of 5G smartphones sold in the U.S. each year. The major technology companies, such as Apple, Samsung, and Google, offer a wide array of 5G flagship devices, and U.S. wireless telecommunications carriers are making large investments to improve their 5G networks. Hybrid work, distance education, and online multiplayer gaming rely on devices that connect with high-speed 5G, including laptops, tablets, and home routers.

Product types studied in the report:

The online category is the faster-growing, with a CAGR of 6.5% during the forecast period because of the rising sales via e-commerce platforms, such as Amazon, Walmart.com, and Best Buy. The U.S. Census Bureau reports that online shopping platforms conducted total sales worth USD 1,192.6 billion in the U.S. in 2024. The popularity of online shopping continues to rise because customers appreciate home deliveries, broad product ranges, enhanced exchange policies, and with cost-saving benefits. Contactless purchasing methods allowed customers to continue shopping online as the COVID-19 pandemic became more severe. The popularity of online distribution systems is increasing because customers want online-exclusive launches, flash sales, and buy-now-pay-later options.

The distribution channels analyzed:

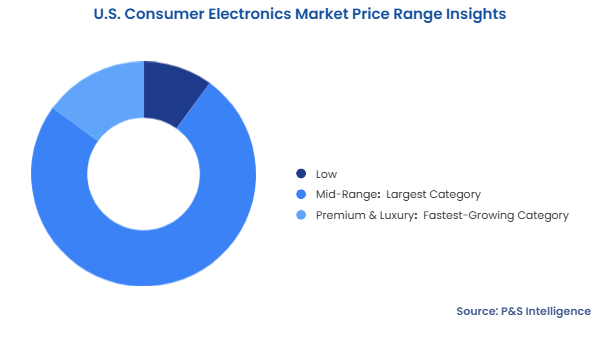

Mid-range is the largest category in the market, with 75% revenue share in 2024. This segment appeals to customers across different demographic groups because it offers a balance between affordability and advanced features. Therefore, customers from diverse backgrounds buy mid-tier smartwatches, smartphones, and smart home devices. Moreover, the latest demographic data suggests that most of the population of the country falls in the middle-income group.

Price ranges analyzed:

The residential consumer category is the largest, with 65% revenue share in 2024, because individuals here are always on the lookout for the latest smartphones, smart TVs, laptops, smart home devices, and wearables. More individuals now have connected lifestyles, automated entertainment devices, and smart homes, which reflects the rising demand for personal electronic devices and connected household products. Employees need them for working from home, while students use them for online learning, trends that emerged during the pandemic. The introduction of affordable home entertainment products and affordable smart home devices drives the market in this category.

End users taken into study:

Drive strategic growth with comprehensive market analysis

The South is the dominant region, with 35% revenue share in 2024, because of the large population, rapid urbanization, and developed retail facilities. Almost 40% of the U.S. population lives in the South, according to government sources. Texas, Florida, and Georgia are experiencing an increasing smart technology demand for smart, connected home entertainment systems because of the easy availability of fast internet access. The lower cost of living in the south, which leads to a higher disposable income, allows residents to spend more on these products.

Regions covered in the report:

The market is fragmented because of the huge variety of conventional and smart consumer electronics on offer. Major companies, such as Apple, Motorola, Nokia, Ericsson, Google, Samsung, LG, Huawei, Sony, HTC, and Xiaomi, often lead in specific product segments. The products are also available in various price ranges: while Chinese brands often lead in low- and mid-priced segments, U.S., European, South Korean, and Japanese firms sell more in the luxury and premium segments. Additionally, tablets and personal digital assistants may often need to be customized for specific uses, such as healthcare, defense, and manufacturing, which offers opportunities to newer players.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages