Key Highlights

| Study Period | 2019 - 2032 |

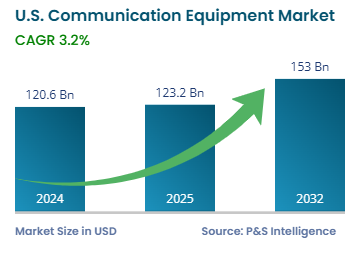

| Market Size in 2024 | USD 120.6 Billion |

| Market Size in 2025 | USD 123.2 Billion |

| Market Size by 2032 | USD 153 Billion |

| Projected CAGR | 3.2% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

Report Code: 13543

This Report Provides In-Depth Analysis of the U.S. Communication Equipment Market Report Prepared by P&S Intelligence, Segmented by Product Type (Wired Communication, Wireless Communication Equipment, Networking & Infrastructure Equipment, Enterprise Communication Equipment), Technology (Telecommunications, Data Centers & Cloud Computing, Industrial & Manufacturing, Media & Entertainment, Public Safety & Emergency Response, Aerospace & Defense), Distribution Channel (Online Retail, Offline), End User (Individuals, Healthcare, Telecom Service Providers, IT and Data Centers, Government Agencies, BFSI, Media, Military and Defense Organizations), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 120.6 Billion |

| Market Size in 2025 | USD 123.2 Billion |

| Market Size by 2032 | USD 153 Billion |

| Projected CAGR | 3.2% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. communication equipment market valued USD 120.6 billion in 2024 and is expected to grow at a CAGR of 3.2% during 2025-2032, reaching USD 153 billion in 2032. The market is driven by the rising adoption of wireless and 5G technologies for faster internet connections in multiple sectors, growing work-from-home trend, and digital transformation of industries. Moreover, the government is putting efforts to improve rural broadband connectivity and public safety communication system.

The growth in population, rate of urbanization, and industrial production drives the demand for reliable short- and long-range communications. Another reason for the market growth is the government investment in strengthening its space and cyber defense infrastructure and space exploration initiatives.

Furthermore, the market is witnessing the integration of AI and IoT into communication systems to improve network capabilities and scalability and the emergence of cloud-based and software-defined networking solutions.

Wireless communication is the largest category, with a share of 40% in 2024. This dominance is because of the consumer acceptance of smartphones and tablets, technological advances, and an overall high demand for higher connectivity. The many conveniences and applications of smartphones from internet browsing and working to shopping and creative arts have made them an indispensable part of the everyday life. As per studies, more than 300 million people in the country have a smartphone.

Product types studied in the report:

Cellular is the largest category, with 35% share in 2024. This is because customers heavily depend on mobile communication and smartphones compatible with 4G and 5G networks. Modern telecommunication services and IoT applications depend on cellular networks to enable enterprise mobility and consumer connectivity. Base stations, antennae, and small cells provide the basic support for network infrastructure. The category is also growing with the increasing demand for corporate communication solutions, mobile broadband services, and connected devices from enterprises.

Technologies analyzed in the report:

The telecommunications category is the largest, holding 40% share in 2024. The development of 5G networks leads to an increasing demand for optical fiber, network switching, routers, base stations, and transmission systems. In today’s world, life without effective telecommunications is unimaginable. People need uninterrupted internet and cellular connectivity for socializing, working, shopping, and just about everything else.

Applications analyzed in the report:

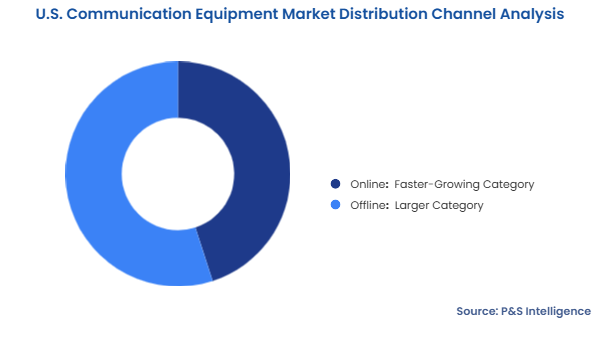

Offline is the larger category with a share of 55% in 2024. This is primarily because large enterprises, government agencies, and telecom operators need customized, high-performance communication equipment. They usually buy these things in bulk from established vendors and resellers, who also provide technical support, installation services, and long-term contracts. Consumer electronics stores are still a major channel for retail customers purchasing smartphones, routers, and other communication devices. These places boast interactive product demonstrations, individual recommendations, and on-the-spot availability of products.

Distribution channels analyzed in the report:

Telecom service providers are the largest category in the market with 30% share in 2024. This is because telecommunications companies are making significant capital investments in 5G networks, fiber-optic broadband, and wireless communication systems. Telecom operators require a range of communication equipment to provide service to consumers and businesses. The category is growing because of the surging demand for faster internet connectivity, mobile service, and cloud computing solutions.

End users studied in the report:

Drive strategic growth with comprehensive market analysis

The western region is the largest, with 35% share in 2024, primarily due to the presence of leading technology centers and major telecom corporations in Silicon Valley and Washington. This encourages heavy spending on network advancement, AI communications, and 5G technology rollout. The region also has a tech-savvy population, which continues to buy the latest smartphones, tablets, laptops, smart home appliances, gaming consoles, AR/VR equipment, and other connected devices. California is also the national leader in autonomous vehicle development and testing, which requires high-speed, low-latency telecom infrastructure.

Regions covered in the report:

The market is fragmented, as many companies compete in networking hardware, consumer electronics, telecom infrastructure, and enterprise communication solutions. This stops any company from having a monopoly. Companies such as Cisco and Juniper Networks are focused on networking solutions, Apple and Samsung on consumer communication devices, and Nokia and Qualcomm on telecom infrastructure and wireless technologies. The presence of several Chinese companies, especially in the consumer electronics sector, primarily fragments the broader communication equipment domain of the country.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages