Key Highlights

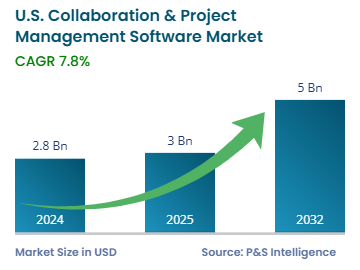

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 2.8 billion |

| Market Size in 2025 | USD 3.0 billion |

| Market Size by 2032 | USD 5.0 billion |

| Projected CAGR | 7.8% |

| Largest Region | West |

| Fastest Growing Region | Northeast |

| Market Structure | Fragmented |

Report Code: 13558

This Report Provides In-Depth Analysis of the U.S. Collaboration & Project Management Software Market Report Prepared by P&S Intelligence, Segmented by Component (Software, Services), Deployment (Cloud, On-Premises), End Use (Banking, Financial Services and Insurance, IT and Telecom, Manufacturing, Retail and Consumer Goods, Healthcare, Transportation and Logistics, Education), Enterprise Size (Large Enterprises, Small & Medium-sized Enterprises), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 2.8 billion |

| Market Size in 2025 | USD 3.0 billion |

| Market Size by 2032 | USD 5.0 billion |

| Projected CAGR | 7.8% |

| Largest Region | West |

| Fastest Growing Region | Northeast |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. collaboration and project management software market generated USD 2.8 billion in 2024, and it is expected to expand at 7.8% CAGR during 2025–2032, reaching USD 5.0 billion by 2032.

The major drivers for the market are the expansion in remote and hybrid work models, the geographically dispersed workforces of U.S.-based MNCs, the rising adoption of cloud technologies, increasing focus on using data to enhance the decision-making process, easy availability of high-speed, low-latency internet, and presence of a large number of software vendors.

The burgeoning demand for remote and hybrid work environments gives rise to a massive market for cloud-based platforms, whereby people connect and collaborate effectively in real time. Other trends in the market include the introduction of artificial intelligence, enhanced user interfaces, and integration of other corporate workflow tools, as per evolving consumer needs. In response, IT firms are developing better project management and collaboration software that improves efficiency and reduces work complexity.

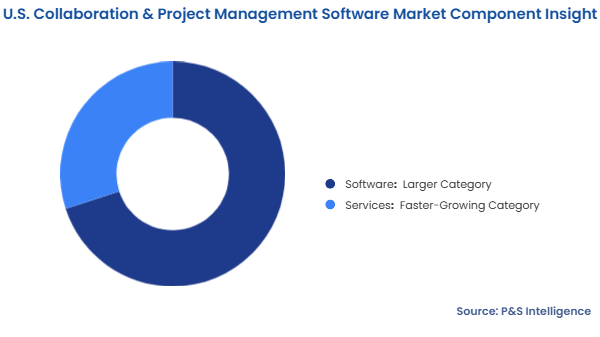

The software category is the larger, holding a market share of around 70% in 2024. Many companies need single-platform solutions for task scheduling, resource planning, and document sharing. Many software products generate regular revenue because customers pay monthly or yearly for their use. Their popularity is further boosted by their scalability and flexibility, especially in the software deployed on the cloud. The constant innovations in features such as AI-based features and advanced tracking propel product demand. Further, digitalization across sectors encourages companies to adopt these solutions for enhanced productivity and transparency.

Components included in the report:

The cloud category dominates the segment, and it has a higher CAGR, of 7.1% as cloud-based solutions are scalable, affordable, and adaptable. Cloud solutions allow users unlimited on-demand access to business resources, without making a huge upfront investment in onsite hardware. This, coupled with subscription-based pricing or monthly payment plans, makes such software even more affordable. Cloud platforms enable people to work remotely and share documents in real time, which is now becoming vital given the emerging trend of hybrid and remote work. Furthermore, regular updates and easy integration enable organizations to utilize the latest features.

Deployment type covered in this report:

The BFSI category is the largest in the market with a share of about 20% in 2024. Since the operations here are complex, coordination among many teams, from project initiation through fast-paced digital changes, is critical. This is largely due to the strict regulations for the safety of sensitive data, which drives the usage of advanced project management tools.

The end uses studied in the report are:

Large Enterprises dominate the market because of their complex, large-scale projects, which require advanced tools for managing resources, tracking progress, and enabling collaboration. These bigger enterprises also have larger budgets to spend on AI and automation solutions. Another key reason for their dominance is that they operate across numerous locations not just within the country but around the world. This creates a huge demand for real-time collaboration and project management tools, including video conferencing.

The segment is bifurcated as below:

Drive strategic growth with comprehensive market analysis

The West dominates the market with a share of approx. 35% in 2024 because large multinational banks and tech companies here need advanced project management systems for complex work. The region's comprehensive IT system and numerous technology companies help organizations use collaboration and project management solutions efficiently.

Regions covered in the report:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages