Market Statistics

| Study Period | 2019 - 2032 |

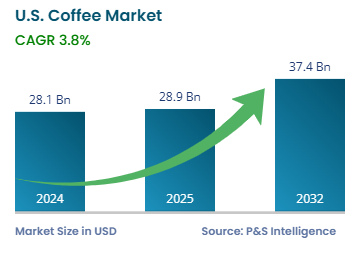

| 2024 Market Size | USD 28.1 billion |

| 2025 Market Size | USD 28.9 billion |

| 2032 Forecast | USD 37.4 billion |

| Growth Rate(CAGR) | 3.8% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13448

This Report Provides In-Depth Analysis of the U.S. Coffee Market Report Prepared by P&S Intelligence, Segmented by Source (Arabica, Robusta, Liberica, Blended Sources), Process (Natural Process, Wet Process, Wet Hulled, Honey Process), Product (Whole Bean, Ground Coffee, Instant Coffee, Coffee Pods and Capsules, Speciality Coffee), Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Online Retail, Direct Sales), Application (Households, Food Service, Industrial), Price Range (Low-Medium, High, Premium), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 28.1 billion |

| 2025 Market Size | USD 28.9 billion |

| 2032 Forecast | USD 37.4 billion |

| Growth Rate(CAGR) | 3.8% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. coffee market was valued at USD 28.1 billion in 2024, and it is forecast to grow at a CAGR of 3.8% from 2025 to 2032 to reach USD 37.4 billion in 2032. The market is growing because of evolving consumer preferences, the penetration of European culture, booming population, and rampant urbanization. As a rising number of consumers want to experience the delight of premium coffee, its consumption is becoming a trend among people. According to the National Library of Medicine, around 154 million adults, or 75% of the U.S. population older than 20, consume coffee, of which 49% drink it daily.

Ready-to-drink and cold-brewed coffee products are gaining popularity among health-focused consumers. The growing popularity of coffee is also credited to the increasing number of people working on assignments and completing office tasks in coffee shops. The prospect for social interaction and workspace at such places leads to greater coffee consumption since many customers buy several beverages and food items while staying for extended periods.

Mid-tier brands are the most popular due to their solid brand value, wide distribution network, and accessibility for a broad consumer base. They can maintain a better balance in prices and consumers’ perception of quality. Hence, they are preferred by both true coffee drinkers and occasional ones.

Arabica is the largest category, with 65% share in 2024 because it provides a refined flavor profile and a superior quality rating than the Robusta and other types. Specialty and premium coffee products use Arabica primarily because U.S. consumers strongly prefer it. The market appeal of Arabica coffee continues to rise because of ethical and sustainable sourcing practices, which draw consumers who want premium yet sustainable coffee experiences.

Sources analyzed in the report:

Wet process is the dominant category with 70% share in 2024. Meeting the palate of specialty coffee enthusiasts and premium coffee brands alike, this method imparts a crisper, clearer, and more-consistent flavor. The dominance of this process is also due to the high demand for premium coffee and single-origin options.

Processes studied in the report:

Ground coffee dominates the market with 37% share because it is preferred by most consumers for home brews and food-service-related consumption. This is because it provides convenience for traditional drip coffee-makers. From price-sensitive buyers to quality-sensitive consumers, ground coffee retains a broad consumer base. Its versatility and appeal for the mass market drive its dominance.

Products covered in the report:

Supermarkets/hypermarkets are the largest category with 40% share in 2024 due to their vast customer reach, broad product assortment, and affordability. One-stop shopping, as well as a wide variety of popular and specialty brands, fit well with contemporary consumer preference. Further, promotional discounts and loyalty programs boost sales for the channel considerably.

Distribution channels analyzed in the report:

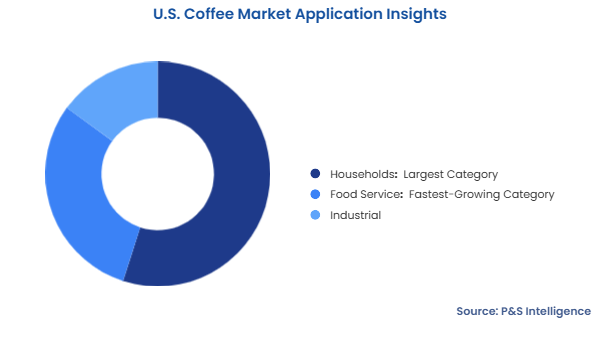

The household category is the largest, with 55% share in 2024 due to consumers’ preference for self-brewed coffee at home. The COVID-19 pandemic pushed this trend, consequently increasing the sales of coffee pods, ground coffee, and home brewing equipment. The category also benefits from innovations designed for convenience, including subscription services and premium instant coffee. Beyond this, consumers recreate specialty coffee experiences at home, which further drive coffee consumption among individuals.

Applications studied in the report:

The low–medium category is the largest, with a 60% share in 2024. This category largely includes mass-market brands, which are generally sold in supermarkets, convenience stores, and big-box retailing. Consumers in this category are wide-ranging, as the broad accessibility and affordability of these products boost sales volume. This category is driven more by brand loyalty than by the frequency of purchases, particularly by low- and middle-income households.

The price ranges analyzed are:

Drive strategic growth with comprehensive market analysis

West is the dominant region with a 35% share in 2024. This is mainly due to the presence of several large cities, such as Seattle, Los Angeles, and San Francisco, which are known for their individual coffee cultures and innovations. The shifting preference toward health-oriented, organic, and sustainable attributes buoys the demand for premium, costlier products.

Regions covered in the report:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages