Market Statistics

| Study Period | 2019 - 2032 |

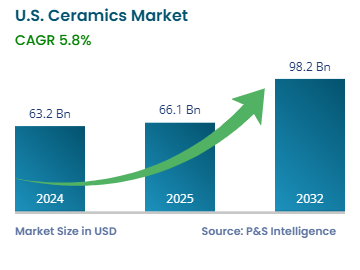

| 2024 Market Size | USD 63.2 Billion |

| 2025 Market Size | USD 66.1 Billion |

| 2032 Forecast | USD 98.2 Billion |

| Growth Rate(CAGR) | 5.8% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13445

This Report Provides In-Depth Analysis of the U.S. Ceramics Market Report Prepared by P&S Intelligence, Segmented by Product (Silicates, Oxides, Non-oxides, Glass), Application (Sanitary Ware, Abrasive, Bricks & Pipes, Tiles, Pottery), End Use (Building & Construction, Industrial, Medical), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 63.2 Billion |

| 2025 Market Size | USD 66.1 Billion |

| 2032 Forecast | USD 98.2 Billion |

| Growth Rate(CAGR) | 5.8% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. ceramics market size was USD 63.2 billion in 2024, and it will grow by 5.8% during 2025–2032, to reach USD 98.2 billion by 2032. Multiple sectors, such as construction, healthcare, consumer goods, automotive, and electronics, depend on ceramics. The durability, heat resistance, and chemical stability of ceramics drive their application in tile manufacturing, sanitary products, and high-end technical applications in the technology and healthcare sectors.

The market is growing due to the advancing technologies and expanding demand for sustainable materials. The market is expanding due to the rising urban development, architectural construction, and emergence of creative manufacturing techniques for ceramics. Consumers’ demand for energy-efficient and environment-friendly products drive the usage of advanced ceramic materials in various industries.

The silicates category held the largest market share, of 45%, in 2024. The production of tiles, bricks, and glass utilizes aluminosilicates-based ceramics because of their affordability, durability, and simplicity during the manufacturing process. Easy raw material access and budget-friendly manufacturing are also credited for this.

The non-oxides category will grow at the highest CAGR, of 7.5%, during the forecast period because these materials perform better under different working conditions than others. Research shows that technologically advanced industries favor silicon carbide and silicon nitride because they offer strong resistance to high temperatures and chemicals. The increasing electric vehicle and sustainable technology adoption drive the demand for these materials.

The product types analyzed in this report are:

The tiles category held the largest market share, of 40%, in 2024 because builders are seeking strong yet easy-to-maintain flooring and wall materials. The usage of ceramic tiles is propelled by urban development initiatives and infrastructure projects because they cost less, stand up well to moisture, and are simple to install.

The pottery category will grow at the highest CAGR, of 7.5%, during the forecast period because consumers are buying decorative and customized homeware products. Customers who value home design elements increase the demand for custom-made and creator pottery tableware and art pieces. The growing trend of eco-friendly and locally sourced products drives the market expansion in this category.

The applications analyzed in this report are:

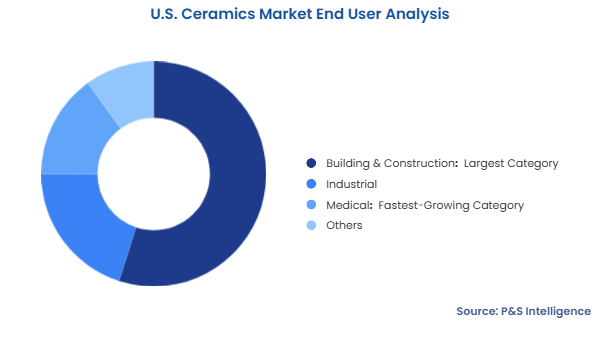

The building & construction category held the largest market share, of 55%, in 2024 because of the widespread application ceramics in tiles, sanitaryware, and pipes used in residential, commercial, and public works projects. The demand for ceramic products is growing because of the expanding cities, increasing real estate investments, and rising interest in environment-friendly and strong building materials. Already, 80% of the country’s population lives in cities, and this number is only expected to increase in the years to come. As per the U.S. Census Bureau, the spending on housing construction in January 2025 in the country stood at USD 932.7 billion. Ceramic tiles deliver durability, beautiful designs, and reduced maintenance requirements in new and renovated buildings.

The end users analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The Midwest category held the largest market share, of 40%, in 2024 due to its established industrial and existence of numerous ceramic producers. The region has an abundant supply of clay and feldspar, the primary raw materials needed for ceramics.

The South category will grow at the highest CAGR, of 6.5%, during the forecast period. This is because of the quick urbanization, increasing construction activities, and increasing consumer demand for ceramic products in residential commercial applications. The favorable economic policies, lower labor costs, and effective environment attract investments in the ceramics sector. The rising population and expanding housing market drive the demand for ceramic tiles, sanitary ware, and advanced ceramics.

The geographical breakdown of the market is as follows:

The market is fragmented because various small and medium-sized manufacturers operate in different ceramic product segments, such as ceramic tiles, advanced ceramics, and traditional ceramics. Multiple companies exist because these materials find multiple uses in the construction, electronics, automotive, and healthcare applications. Ceramics are among the oldest materials known to humans, which is why they are well-understood and easy and financially inexpensive to produce. Additionally, a lot of companies based in China sell these products in the U.S., since the former has a rich tradition of ceramics.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages