Market Statistics

| Study Period | 2019 - 2032 |

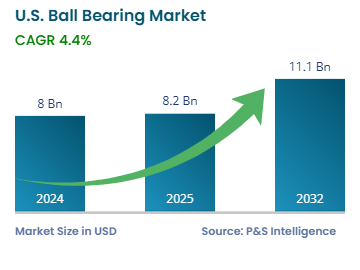

| 2024 Market Size | USD 8.0 Billion |

| 2025 Market Size | USD 8.2 Billion |

| 2032 Forecast | USD 11.1 Billion |

| Growth Rate(CAGR) | 4.4% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13447

This Report Provides In-Depth Analysis of the U.S. Ball Bearing Market Report Prepared by P&S Intelligence, Segmented by Type (Deep-Groove, Angular-Contact, Self-Aligning, Thrust), Material (Steel, Ceramic, Iron), Distribution Channel (Direct Sales, Distributors & Wholesalers, Online), Application (Automotive, Agriculture, Industrial Machinery, Mining & Construction, Railways, Aerospace & Defense), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 8.0 Billion |

| 2025 Market Size | USD 8.2 Billion |

| 2032 Forecast | USD 11.1 Billion |

| Growth Rate(CAGR) | 4.4% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The size of the U.S. ball bearing market in 2024 was USD 8.0 billion, and it will reach USD 11.1 billion by 2032 at a CAGR of 4.4% during 2025–2032.

The market is expanding because of the rising demand for automated systems, electric vehicles, and high-tech manufacturing. The aerospace, automotive, and energy sectors depend on high-quality bearings that minimize downtime and ensure smooth functions. The use of ceramic and hybrid bearings alongside material achievements leads to increased durability, speed, corrosion resistance, and durability.

All modern sectors rely on ball bearings as they power automobiles, aircraft, industrial machinery, and medical equipment. These small yet powerful mechanical components regulate the friction in the moving parts, which extends the product lifetime.

The leading type is deep-groove ball bearings with a share of 35% because they have diverse industrial applications, including automotive, aerospace, and industrial. This bearing type handles radial loads at elevated operating speeds, minimizing friction. The EV sector specifically needs these ball bearings because they require high efficiency and long-term reliability. Deep-groove ball bearings are gaining popularity due to the focus on industrial automation because they are used in robots and conveyor systems. The dual focus on energy efficiency and minimal maintenance costs encourage companies to develop better deep-groove ball bearings that handle heat and friction better.

The types analyzed here are:

Steel leads the market with a share of 45% due to robust composition, affordable costs, and strong resistance against substantial loads under tough operating environments. The key applications of steel bearings span automotive, aerospace, and heavy-duty equipment industries, which prioritize strength and reliability. Steel excels at high-speed applications because of its exceptional resistance to wear and hardness, thus finding use in industrial automation and EVs. The strong demand for steel bearings in construction and industrial machinery is because of the U.S. government’s rising infrastructure and manufacturing investments. The efficiency and longevity of steel bearings have increased due to alloy development and lubrication, which makes them more desirable for manufacturers.

The materials analyzed here are:

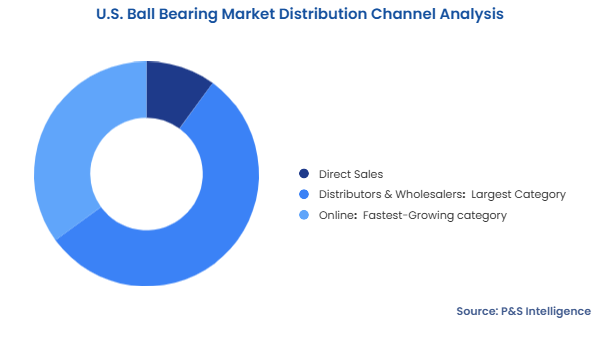

The distributors & wholesalers category dominates the market with a share of 55% because they provide reliable supply and bulk purchasing services to a wide array of industries. Manufacturers choose distributors for their wide product offerings, technical advice, and delivery speed, which result in low inventory expenses and efficient product delivery. Ball bearings bought through this channel prevent production interruptions because of reliable, on-time delivery. These distributors also provide services such as maintenance, quality assurance, and customization.

The distribution channels analyzed here are:

The automotive category has the largest share, of 30%, because of the technological and production-related advances in vehicles. Bearings optimize performance by minimizing friction in engine components, transmission parts, wheel hubs, and electric drivetrains. The rising demand for electric vehicles has triggered an increase in the requirement for efficient, lightweight, and high-performance bearings. Automakers now need next-generation bearings due to the government standards on fuel efficiency and emission control therefore they pursue solutions that boost both vehicle longevity and performance. The market growth in this category is due to the push for EVs and charging infrastructure with the U.S. government’s investments in domestic manufacturing under the Inflation Reduction Act. Moreover, automakers are continuously improving production counts and lifespan of vehicular components.

The applications analyzed here are:

Drive strategic growth with comprehensive market analysis

The Midwest region has the largest share in 2024, of 50%, because this area has a strong base of automotive production, manufacturing, and heavy machinery. All major automotive production facilities and industrial equipment manufacturers based in Michigan, Ohio, and Indiana buy ball bearings in bulk. The region’s integrated supply chain, qualified workforce, and continuous manufacturing advancement drive the market. Industrial growth in the region receives support from the CHIPS and Science Act and other initiatives for domestic manufacturing. Precision ball bearings are growing in demand because factories require automated systems and energy-efficient equipment.

The regions analyzed here are:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages