Market Statistics

| Study Period | 2019 - 2032 |

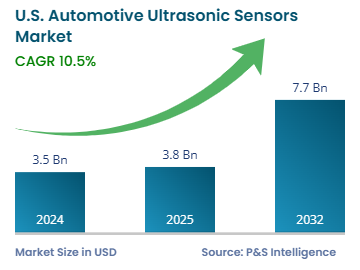

| 2024 Market Size | USD 3.5 billion |

| 2025 Market Size | USD 3.8 billion |

| 2032 Forecast | USD 7.7 billion |

| Growth Rate(CAGR) | 10.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13477

This Report Provides In-Depth Analysis of the U.S. Automotive Ultrasonic Sensors Market Report Prepared by P&S Intelligence, Segmented by Vehicle Autonomy (Semi-Autonomous Vehicle, Fully-Autonomous Vehicle), Medium and heavy commercial vehicle (Passenger Car, Commercial Vehicle), Type (Proximity Detection, Range Measurement), Application (Park Assist, Self-Parking, Blind Spot Detection), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 3.5 billion |

| 2025 Market Size | USD 3.8 billion |

| 2032 Forecast | USD 7.7 billion |

| Growth Rate(CAGR) | 10.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. automotive ultrasonic sensors market size was USD 3.5 billion in 2024, and it will grow by 10.5% during 2025–2032, reaching USD 7.7 billion by 2032.

The market is driven by the increasing adoption of advanced driver-assistance systems (ADAS) for improving vehicle safety, elevation in vehicle safety requirements, and need for collision avoidance systems.

Ultrasonic sensors enable obstacle sensing and route navigation during self-driving operations. Enhancements in sensor technology allow these instruments to operate more efficiently and economically, thus driving their adoption among more automakers. The market is driven by the rising vehicle manufacturing, increasing smart vehicle demand, and rising number of automotive OEMs and suppliers integrating ADAS and autonomous driving features.

In April 2024, Micron Technology Inc. introduced its complete series of memory and storage products designed for vehicles that connect with Qualcomm Incorporated’s Snapdragon Digital Chassis platform.

The semi-autonomous vehicle category held the larger market share, of 85%, in 2024. This is because these are the only kind of autonomous vehicles currently available in the U.S., with the fully autonomous driving technology still in the testing phase and in limited operations on private properties. These vehicles have both a human operator control and automated systems rated at level 2 and level 3 autonomy. The vehicles depend on ultrasonic sensors for parking assistance, collision avoidance, and adaptive cruise control. Moreover, most vehicle manufacturers now include semi-autonomous features in their newer models, which drives their sales.

The fully autonomous vehicle category will grow at the higher CAGR, during the forecast period. This is because driverless vehicles depend on various ultrasonic and other kinds of sensors to achieve safety and operational efficiency. These sensors enable vehicle navigation and obstacle detection, ensuring safe communication with other road users. They operate autonomously when no driver is present at the wheel, which is why the sensors must be that much more precise. In addition, the development of automation technology, supported by funding from car makers and tech companies, will help commercialize self-driving vehicles and make them safe and compliant with regulations.

The vehicle autonomies analyzed in this report are:

The passenger car category held the larger market share, of 70%, in 2024 and it will grow at the higher CAGR, during the forecast period. This is because most cars on the road are used for passenger transportation, and any new automotive technology is first deployed in cars. Ultrasonic sensors witness high adoption in passenger vehicles because they enable parking assistance, collision avoidance and other ADAS functionalities.

The vehicle types analyzed in this report are:

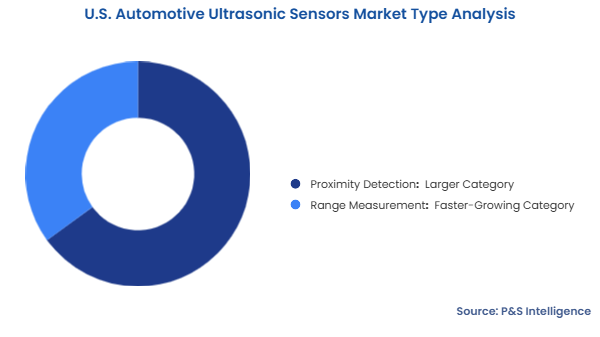

The proximity detection category held the larger market share, of 65%, in 2024. This is because many vehicles use proximity detection sensors for safety and convenience. These specific applications include parking assistance, collision avoidance, and blind spot detection.

The range measurement category will grow at the higher CAGR, during the forecast period. This is because accurate distance measurement supports the safe operations of ADAS and autonomous driving technologies.

The types analyzed in this report are:

The park assist category held the largest market share, of 40%, in 2024. This is because park assist systems appear across different vehicle classes, from economy to luxury. The system uses ultrasonic sensors to detect objects in the path while drivers park their vehicles in narrow spaces, providing audible alerts or visual cues.

The self-parking category will grow at the highest CAGR, during the forecast period. This is because of the rapid developments in the autonomous driving technology and ADAS for modern vehicles. The functionality of self-parking systems depends on the ability of ultrasonic sensors to identify obstacles and execute secure parking movements without human involvement.

The applications analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The Southern region of the U.S. held the largest market share, of 35%, in 2024. This is because Texas, Florida, and Georgia are home to numerous automotive production sites. Moreover, the huge population in the region drives the sale of semi-autonomous cars and, in turn, ultrasonic sensors.

The Western region of the U.S. will grow at the highest CAGR, during the forecast period. This is because Nevada, Arizona, and California are rapidly adopting electric vehicles and progressive automotive technologies. The state of California in electric and autonomous vehicle development, encouraging OEMS to integrate ultrasonic sensors for safety and operational efficiency.

The regions analyzed in this report are:

The market is fragmented in nature because of the fast progress of automotive technology, autonomous systems, and ADAS functions. These factors create business opportunities for new corporations and smaller firms to offer advanced auto components. The varied applications of ultrasonic sensors, such as park assist, blind spot detection, and self-parking, further fragment the market. Moreover, players are establishing strategic alliances and partnerships with OEMs, tier suppliers, and tech companies for implementing state-of-the-art sensor technologies.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages