Key Highlights

| Study Period | 2019 - 2032 |

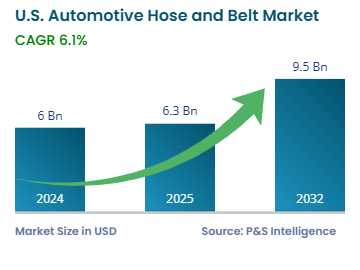

| Market Size in 2024 | USD 6.0 Billion |

| Market Size in 2025 | USD 6.3 Billion |

| Market Size by 2032 | USD 9.5 Billion |

| Projected CAGR | 6.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13571

This Report Provides In-Depth Analysis of the U.S. Automotive Hose and Belt Market Report Prepared by P&S Intelligence, Segmented by Belt Type (Timing Belt, Drive Belt), Hose Type (Fuel Delivery System Hoses, Braking System Hoses, Power Steering System Hoses, Heating and Cooling System Hoses, Turbocharger Hoses), Material Type (Rubber, Polymer, Fabric Reinforced, Thermoplastic, Silicone), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), Sales Channel (OEM, Aftermarket), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 6.0 Billion |

| Market Size in 2025 | USD 6.3 Billion |

| Market Size by 2032 | USD 9.5 Billion |

| Projected CAGR | 6.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. automotive hose and belt market was valued at USD 6.0 billion in 2024, and this number is expected to increase to USD 9.5 billion by 2032, advancing at a CAGR of 6.1% during 2025–2032.

This is due to the rise in automotive manufacturing, routine maintenance requirements, and important role of belts and hoses in power transmission and fluid management systems. Moreover, manufacturers are currently working under strict government norms regarding fuel efficiency and emissions, which drives the adoption of performance-enhancing components.

The usage of advanced rubber and polymer composites provides higher durability and efficiency to belts and hoses. The aftermarket demand for these parts continues to grow for replacement because vehicles require periodic maintenance, especially as they become older.

The timing belt category dominates the market with a revenue share of 70% in 2024. This is because it coordinates with the engine components to provide high performance. The rising vehicle manufacturing and the increasing use of fuel injection engines drive the requirement for superior timing belts. The growth of the category is also supported by the frequent replacement of these components by the aftermarket.

Drive belts will witness the higher CAGR, over the forecast period. Modern vehicles have serpentine belts because just one of them can power multiple accessories, thus making vehicle engines simpler and cheaper. They also satisfy the demands for weight reduction and better fuel efficiency.

Here are the belt types studied in the report:

Heating and cooling systems accounted for the largest revenue share, of around 65%, in 2024, and this category is further expected to maintain its position during the forecast period. This is because of the importance of hoses in maintaining the optimal engine temperature and preventing the engine from overheating by ensuring efficient fluid circulation. With the rising production of passenger and commercial vehicles, there is an increasing demand for durable, heat-resistant materials, such as reinforced rubber and silicone, for these components.

Turbochargers are the fastest-growing category because of the increasing adoption of turbocharged engines for improved fuel efficiency and performance. Turbocharger hoses sustain high temperatures and pressures, which makes them vital parts for contemporary engines.

The hose types covered in the report are:

The rubber category dominates the market with a revenue share of 60% in 2024, because rubber belts and hoses are common in fuel delivery systems, braking systems, power steering components, and engine cooling systems. Rubber provides versatility, durability, and cost-effectiveness with its high resistance to heat and pressure.

Thermoplastics is the fastest-growing category, because the automotive industry is expanding its usage of efficient fuel lines and air conditioning systems within modern lightweight automobiles.

The following are the material types studied in the report:

The passenger car category holds the largest share, of around 75%, and it is further expected to maintain its position during the forecasted period. This is because of the growing demand for cars for personal and public transportation. Passenger cars require various hoses and belts for fuel delivery systems, cooling components, and power steering mechanisms. Passenger cars have timing belts, serpentine belts, radiator hoses, and fuel delivery hoses to ensure optimal performance.

Light commercial vehicles are the fastest-growing-category due to their rising sales. This is because of the increasing e-commerce activity and higher requirement for efficient deliveries. Vans, mini-trucks, and pickup trucks are vital part of the e-commerce delivery ecosystem, and they require higher power at lower emissions. This makes advanced belts and hoses important for a range of engine and transmission components.

The vehicle types covered in the report are:

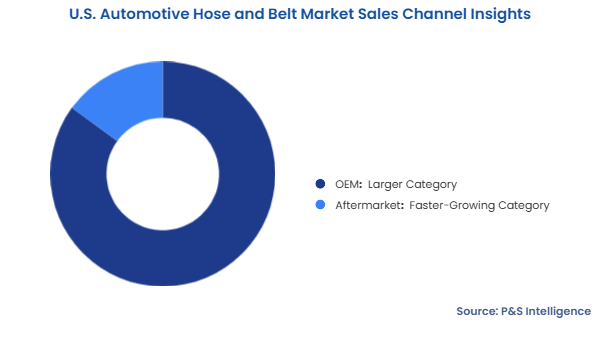

The OEM category dominates the market with a revenue share of 85% in 2024, because most hoses and belts are integrated into vehicles at the time of manufacturing itself. Hence, as automotive production rises in the country to meet the needs of personal, public, and freight transportation, OEMs’ procurement of belts and hoses will rise in tandem. Moreover, amidst the EPA’s regulations for emission reduction and corporate average fuel economy, lighter materials that offer high performance are being chosen for belts and hoses by OEMs.

Aftermarket is the faster-growing category, because of the frequent need for repairs, maintenance, and repalcements. The aging of vehicles creates a constant demand for new belts and hoses, along with cost-effective performance upgrades. Apart from private-label parts, aftermarket entities now also offer genuine OEM parts, which increases the trust of vehicle owners.

The report examines the following sales channels:

Drive strategic growth with comprehensive market analysis

The Southern region is the market leader with 40% revenue due to its huge vehicle customer base, high production volumes, and extensive aftermarket parts and service demand. Due to the large production hubs and distribution networks for a wide range of vehicles, the Southern region demands durable, heat-resistant hoses and belts for efficient cooling and fluid management.

Here are the regions covered in the report:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages