U.S. Auto Parts Manufacturing Market Emerging Trends

Technological Advancements in Components and Assembly Methods Are Major Trends

In recent years, auto parts markers in the U.S. have suffered a strong compulsion to adapt to the changing client needs and strict environmental restrictions. New technologies, such as robotics, 3D printing, AI, and IoT, are becoming popular as a means to improve the accuracy, efficiency, and quantity of production.

The usage of 3D printing is growing as it helps reduce material waste and produce more sustainably. Similarly, robotics enhance precision and cut labor requirement, thus adding to cost-efficient operations in two ways. Moreover, with the increasing demand for software-defined vehicles, autonomous driving, and ADAS features, an array of sensors and cutting electronic components are being developed and integrated into automobiles.

Similarly, more-efficient engines, which burn less fuel to propel the vehicle across the same distance, thus driving down emissions, are becoming popular. Another key trend is lightweight materials, which help cut the vehicle weight and emissions significantly. To integrate them into the automobile, more of adhesives and sealants are required over the conventional nuts, bolts, and welds.

Moreover, with the growing demand for personalization and more convenience, automobiles are being integrated with comprehensive digital cockpits, drive-by-wire controls, ambient and mood-based lighting, NVH materials, high-speed 5G connectivity, and self-updating computer systems.

Even EVs are continuously being enhanced to offer longer driving distances for the same amount of electricity. This offers lucrative opportunities for companies developing critical components, such as onboard chargers, traction motors, battery management systems, and battery packs.

Expanding Automotive Industry Is Key Market Driver

The quintessential driver of the demand for auto parts in the country is the expanding production of automobiles. As per OICA, automotive sales in the U.S. rose from 1,42,30,324 units in 2022 to 1,60,09,268 units in 2023, driven by the growing demand for public, personal, and freight transportation.

Trucks remain the most-important carrier of freight within the country. As per the Bureau of Transportation Statistics, they carried 12,975 million tons of the total 17,867 million tons of freight shipped around the country in 2023. Further, by 2050, 17,545 million tons of the total 24,911 tons of freight will be carried by lorries domestically. Moreover, as per the American Automobile Association (AAA), people in the country spend over an hour driving around each day.

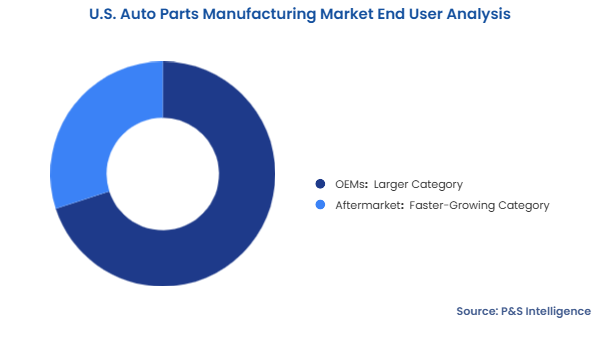

In response, automobile production in the country rose from 10,060,339 units in 2022 to 11,189,985 units in 2023, according to OICA. While the expanding automotive production drives the demand for vehicle components among OEMs, the rising average automobile age makes the aftermarket a lucrative customer for Tier 1, 2, and 3 suppliers. The BTS reports an increase in the average passenger car age in the U.S. from 13.6 years in 2023 to 14 years in 2024. In the same way, the average operational life of light-duty trucks increased from 11.8 years to 11.9 years in the same period.

Growing Adoption of Electric Vehicles Is Main Opportunity

The growing penetration of EVs is a key opportunity since electric power trains, the latest generation of high-capacity battery packs, sophisticated thermal management systems, and lightweight materials are substantially dissimilar from the components used in the conventional IC engine vehicles. Because the federal and state governments are imposing more-stringent emission standards and providing support to EVs, OEMs are expanding EV production.

As per the International Energy Agency (IEA), EV sales in the U.S. increased by 40% in 2023 from 2022. Moreover, CNBC notes a 20% share of EVs in the total sales of vehicles in the country in 2024. The U.S. hopes to have ZEVs make up 100% of the automobile sales by 2050.

EVs have a lot more sophisticated electronic components than a traditional ICE automobile, which is why semiconductor companies with a strong focus on the automotive sector of the U.S. stand to benefit handsomely in the coming years.