Key Highlights

| Study Period | 2019 - 2032 |

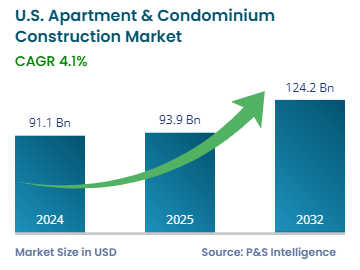

| Market Size in 2024 | USD 91.1 Billion |

| Market Size in 2025 | USD 93.9 Billion |

| Market Size by 2032 | USD 124.2 Billion |

| Projected CAGR | 4.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13534

This Report Provides In-Depth Analysis of the U.S. Apartment & Condominium Construction Market Report Prepared by P&S Intelligence, Segmented by Building Type (High Rise Buildings, Mid Rise Buildings, Low Rise & Garden-Style Apartments), Construction Type (New Construction, Redevelopment & Adaptive Reuse, Sustainable & Smart Housing), Price Range (Luxury Apartments & Condos, Mid Range Housing, Affordable & Workforce Housing), End User (Owner Occupied Condominiums, Rental Apartments, Senior Living & Assisted Housing, Student Housing), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 91.1 Billion |

| Market Size in 2025 | USD 93.9 Billion |

| Market Size by 2032 | USD 124.2 Billion |

| Projected CAGR | 4.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. apartment and condominium construction market valued at USD 91.1 billion in 2024, and this number is expected to increase to USD 124.2 billion by 2032, advancing at a CAGR of 4.1% during 2025–2032.

The market is driven by the stabilizing inflation, decreasing interest rates, and overall rising demand for houses in the suburban and urban areas of cities such as New York, Dallas, and Austin. The completion of more than 500,000 rental units by developers in 2024 was a record. Moreover, 666,000 units were sold or rented out in 2024, which was a rise of 450,000 units YoY. The occupancy rate was 94.8% as the rental price growth decreased because developers rapidly added new units.

Sustainable materials, smart building technology, and mixed-use developments are a major trend and strategy in the market. For enhancing tenant experience, meeting regulatory requirements, and gaining green certifications, developers are now integrating energy-efficient systems and digital management tools. Real estate investment trusts (REITs) and private equity funds support major projects in the Sunbelt areas, which are witnessing an increase in population and subsidies in taxes.

Low-rise and garden-style apartments are the largest category, with 45% share. Suburban and exurban areas have more land for builders, which allows families and individuals to buy such units at lower costs than mid-rise and high-rise houses. Moreover, builders can implement these projects quickly for multifamily requirements.

The building types covered in this report are:

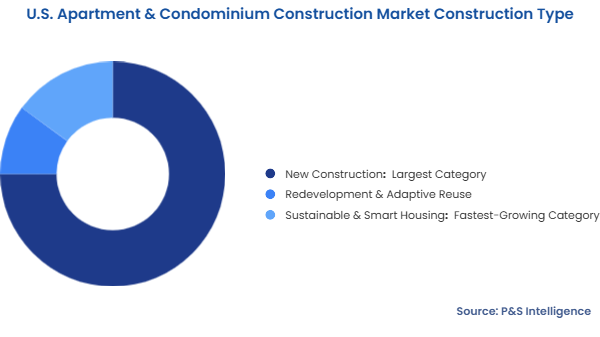

New construction is the largest category, with 75% share, because of the increasing housing requirement of an expanding population. As per the U.S. Census Bureau, the country’s population rose by 1%, to 340.1 million in 2024 from 2023. The growth of cities drives the need for houses for sale in suburban areas and for rent within core cities. The government's affordable housing and infrastructure development schemes drive the volume of new construction projects. New constructions now boast modern amenities, energy-efficient designs, and customized spaces.

The construction types covered in this report are:

Mid-range dominates the market with 55% share because it satisfies middle-class families, professional renters, and first-time buyers with affordable rates and higher comforts. During this rising home price period, people who want to purchase homes are choosing mid-range condominiums and apartments as they provide better value than single-family homes. Apartments and condominiums priced moderately attract professionals working alone, families, and retirees searching for comfort and cost-effectiveness.

The price ranges covered in this report are:

Rental apartments are the largest category with 80% share because of the rising migration to urban areas for employment and amenities. Since most migrants live in a city temporarily, they see little long-term value in buying an apartment, which is the key reason renting remains popular among people. Further, the U.S. has a rich culture of living with roommates on rent as it is an important aspect of the social life, showcased in numerous TV shows and movies over the years.

The end users covered in this report are:

Drive strategic growth with comprehensive market analysis

The South is the prime revenue contributor with 45% share because this region finished 359,000 new apartment units in 2024, which was 53% of the U.S. total multifamily construction output. Apartment construction is propelled by the rapidly growing metropolitan areas, such as Dallas, Austin, Miami, Orlando, Houston, and Atlanta. More than half of all projected apartment unit deliveries are expected in Sunbelt areas because of their high employment rate, increasing population, and strong demand for rental housing.

These regions are analyzed:

The market is fragmented as a huge number of real estate developers exist in the country. Moreover, the localized construction activities and the diverse needs of customers allow contractors of all sizes and capabilities to thrive. While a few major companies develop large-scale residential projects in cities and expansive tract housing colonies in the suburbs, small, independent contractors often cater to individual owners having their houses built to their specifications.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages