Market Statistics

| Study Period | 2019 - 2032 |

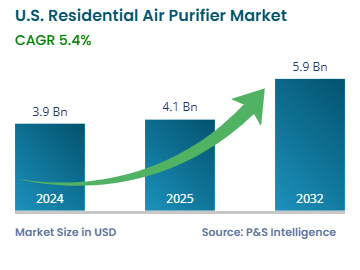

| 2024 Market Size | USD 3.9 billion |

| 2025 Market Size | USD 4.1 billion |

| 2032 Forecast | USD 5.9 billion |

| Growth Rate(CAGR) | 5.4% |

| Largest Region | South |

| Fastest Growing Region | Northeast |

| Nature of the Market | Fragmented |

Report Code: 13473

This Report Provides In-Depth Analysis of the U.S. Residential Air Purifier Market Report Prepared by P&S Intelligence, Segmented by Filteration Technology (HEPA, Activated Carbon, Ionic Filters), Type (Portable/Stand Alone Air Purifier, In-Duct Air Purifier), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 3.9 billion |

| 2025 Market Size | USD 4.1 billion |

| 2032 Forecast | USD 5.9 billion |

| Growth Rate(CAGR) | 5.4% |

| Largest Region | South |

| Fastest Growing Region | Northeast |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. residential air purifier market revenue was USD 3.9 billion in 2024, and it is expected to witness a CAGR of 5.4% from 2025 to 2032, reaching USD 5.9 billion in 2032. This growth of the market is due to the rising health concerns, especially respiratory issues due to the poor indoor air quality.

Therefore, the government is setting up environmental rules and regulations on air quality for public health improvement, which drives the demand for air purifiers. Moreover, technological advancements, such as the HEPA filters, smart technology and connectivity, UV-C technology for germ and virus removal, ionization technology, and air quality sensors, make these appliances better and more-effective at cleaning indoor air.

In August 2023, the U.S. Department of Energy (DOE) established new rules and regulations for the conservation standards for air cleaners, which will reduce energy consumption.

The HEPA category held the largest market share of 50%, in 2024, as it is highly efficient in removing airborne pollutants, allergens, and pathogens. Additionally, HEPA filters are approved by health and regulatory organizations, such as the Environmental Protection Agency (EPA), American Lung Association, and the Centers for Disease Control and Prevention (CDC). Furthermore, major air purifier companies are developing new technologies, such as multi-layer HEPA filtration systems with activated carbon and UV-C light, to offer more value for money.

The smart and IoT-enabled category will grow at the highest CAGR of 6%, during the forecast period, due to the increasing integration of smart home technologies. Smart and IoT-enabled air purifiers offer features such as personalized air quality management and automation, which lead to added convenience for consumers.

In June 2023, the U.S. General Services Administration (GSA) announced a plan to invest USD 975 million via the Inflation Reduction Act for integrating smart and advanced technologies into buildings across the country.

Based on the filtration technology, the market has the following categories:

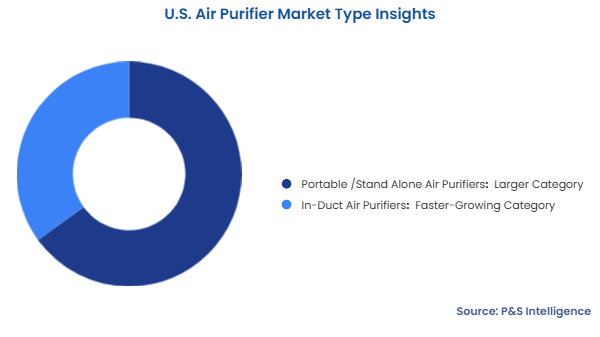

The portable/standalone category held the larger market share of 65%, in 2024 due to their affordability, convenience, and flexibility in usage. This type of air purifier is best suited for residential complexes due to its compact size, which makes them ideal for bedrooms, living rooms, and home offices.

The in-duct category will grow at the higher CAGR, of 6.5%, during the forecast period, due to the increasing demand for whole-home air purification systems. They often come integrated into the home’s HVAC system, which means they clean all the air coming in. This also reduces the noise and clutter associated with portable/standalone appliances significantly.

Based on the type, the market has the following categories:

Drive strategic growth with comprehensive market analysis

The South region held the largest market share, of 35%, in 2024 as it has the highest population in the country, which is demanding residential air purifiers. The southern region also witnesses a high frequency of dust storms and higher level of pollen, which necessitates air purifiers for the improvement of indoor air quality.

The Northeast region will grow at the highest CAGR, of 7%, during the forecast period, due to the rising air pollution in highly urbanized states, such as New York, New Jersey, and Massachusetts. The high population in these states also means a large number of vehicles on the roads and high volumes of fossil fuel consumption, which worsen both indoor and outdoor pollution.

The market has been categorized into the following regions:

The market is fragmented due to the wide number of market players. Both large and small companies provide air purifiers with different technologies. Furthermore, there are a variety of distribution channels, such as e-commerce platforms, through which companies provide their offerings to the consumer. With the continuous evolution in technology, new companies are entering the market with innovative offerings with a promise of cleaner and healthier indoor air. Moreover, apart from a few well-known domestic companies, a large number of equally popular South Korean, Japanese, and Chinese firms offer ever-advancing air purifiers in the U.S.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages