Key Highlights

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 27.5 Billion |

| Market Size in 2025 | USD 29.0 Billion |

| Market Size by 2032 | USD 45.0 Billion |

| Projected CAGR | 6.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13561

This Report Provides In-Depth Analysis of the U.S. Advanced Materials Market Report Prepared by P&S Intelligence, Segmented by Product Type (Lightweight Materials, Ceramics, Glass, Nanomaterials), Industry (Aerospace & Defense, Automotive, Electricals & Electronics, Healthcare, Petrochemicals), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 27.5 Billion |

| Market Size in 2025 | USD 29.0 Billion |

| Market Size by 2032 | USD 45.0 Billion |

| Projected CAGR | 6.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

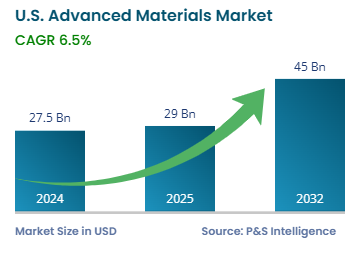

The U.S. advanced materials market size was USD 27.5 billion in 2024, and it will grow by 6.5% during 2025–2032, reaching USD 45.0 billion by 2032.

The market is driven by the rising demand for high-performance materials that offer higher strength, durability, conductivity, and heat resistance in the aerospace, automotive, electronics, energy, healthcare, and construction sectors. The strict environmental regulations and increasing corporate attention to sustainability push up the need for advanced sustainable materials. This has been driving the demand for biodegradable plastics and recyclable composites, for instance, in high volumes.

In January 2025, the U.S. Department of Commerce designated the SRC to receive USD 285 million from the CHIPS for America Act to set up and manage the CHIPS Manufacturing USA Institute in Durham, North Carolina.

The lightweight materials category held the largest market share, of 65%, in 2024. This is because of an increasing demand for materials that can reduce weight and yet offer the desired strength and durability. These requirements are the most prominent in the automotive, aerospace, energy, and defense industries.

The nanomaterials category will grow at the highest CAGR during the forecast period. This is because these materials have enhanced strength, conductivity, and reactivity, which are prized by several industries, particularly medicine, electronics, and energy.

The products types analyzed in this report are:

The automotive category held the largest market share, of 70%, in 2024, and it will grow at the highest CAGR during the forecast period. The growing demand for energy-efficient and eco-friendly vehicles drives the use of lightweight materials, such as aluminum alloys, carbon fiber, and high-strength steel, to reduce weight and improve fuel efficiency.

Technological advancements in vehicles, such as smart materials and autonomous driving, require the use of advanced materials for improved performance, safety, and functionality. The IEA reports that EV sales in the U.S. went up by 40% in 2023 compared to 2022. EVs require lightweight materials for better energy efficiency; so, an increasing number of OEMs are using high-strength alloys and lightweight composites in place of the traditional iron and steel.

The industries analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The Midwest region of the U.S. held the largest market share, of 40%, in 2024. This is because of its productive automotive industry and its transition to EVs, which propel the demand for advanced materials, especially lightweight ones.

The Southern region of the U.S. will grow at the highest CAGR during the forecast period, because of the rampant industrialization here. Texas, Alabama, Georgia, and Tennessee are receiving a lot of investments in electric vehicles (EVs), renewable energy, and battery production. In September 2024, the government allocated over USD 3 billion to 25 projects in 14 states to bolster domestic battery and critical material production. A substantial part of this government funding is allocated to facilities in the southern region.

The regions analyzed in this report are:

The market is fragmented because of the presence of numerous players, each offering a diverse range of products and solutions across various sectors such as automotive, aerospace, electronics, and energy. The wide variety of materials creates many smaller, specialized markets within the larger advanced materials industry. Furthermore, there is intense competition, and companies differentiate themselves via advanced material technologies, customer service, sustainability practices, and pricing. With heavy investments, new technologies, such as nanomaterials, bio-based plastics, and composite materials, are being created by research groups and startups. These new innovations increase competition and make the market more fragmented.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages