Market Statistics

| Study Period | 2019 - 2032 |

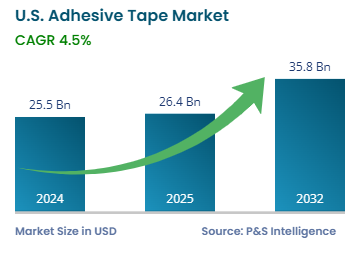

| 2024 Market Size | USD 25.5 billion |

| 2025 Market Size | USD 26.4 billion |

| 2032 Forecast | USD 35.8 billion |

| Growth Rate(CAGR) | 4.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13480

This Report Provides In-Depth Analysis of the U.S. Adhesive Tape Market Report Prepared by P&S Intelligence, Segmented by Type (Commodity, Specialty), Technology (Water-Based, Solvent-Based, Hot-Melt-Based), End Use (Packaging, Consumer and Office, Healthcare, Automotive, Electrical and Electronics, Building and Construction), Resin (Acrylic, Rubber, Silicone), Backing Material (Paper, PVC, PP), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 25.5 billion |

| 2025 Market Size | USD 26.4 billion |

| 2032 Forecast | USD 35.8 billion |

| Growth Rate(CAGR) | 4.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. adhesive tapes market size was USD 25.5 billion in 2024, and it will grow by 4.5% during 2025–2032, reaching USD 35.8 billion by 2032.

This market is driven by technological advancements, especially in environment-friendly materials, and the growing demand for adhesive tapes in packaging, healthcare, automotive, and electronics applications. All this is itself a result of the growing population and its move to cities, rising disposable income, and changing definitions of everyday comfort and convenience. Adhesive tapes serve multiple industrial applications as binding elements, closure mechanisms, protection, and insulation tools.

For instance, e-commerce packaging faces challenges such as right-sizing, changing consumer expectations, and sustainability. Right-sizing reduces waste by creating custom packaging for each product, provided adhesives perform across various conditions. Since the current consumer trends emphasize well-designed, easy-to-open, and recyclable packaging, the adhesive formulations must evolve accordingly.

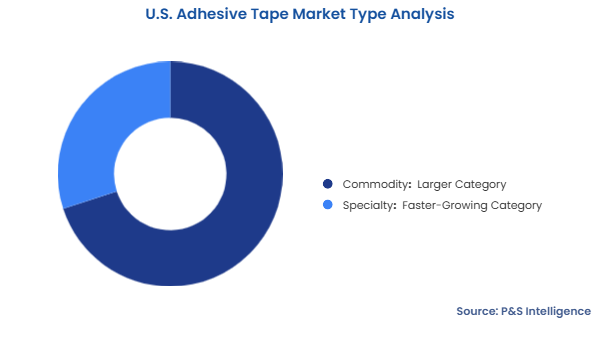

The commodity category held the larger market share, of 70%, in 2024. This is because of their widespread usage for packaging, construction, and general repairs. These tapes are cheap and easily available at the local stationery store or bodega in a variety of textures and colors (such as for school crafts projects).

The specialty category will grow at the higher CAGR, during the forecast period, because they are widely used across the medical, automotive, aerospace, electronics, construction, and packaging sectors. They possess properties, such as skin-safe adhesion, thermal management, vibration dampening, EMI shielding, and durable sealing, making them essential for high-performance and industry-specific applications.

The types analyzed in this report are:

The water-based category held the largest market share, of 45%, in 2024. This is because these adhesives use water as the main solvent, which makes them more environment-friendly than those with chemical solvents. In this regard, the rising customer need for sustainable and green products enhances their popularity. Water-based adhesive tapes also find extensive usage in packaging, construction, and labeling because they reduce operational expenses.

The hot-melt-based category will grow at the highest CAGR, during the forecast period. This is because they are fast to apply and generate strong bonds between materials. Their growing adoption for packaging and labeling is driven by their efficiency and high performance. Additionally, these tapes offer advantages such as mess-free application, versatility on various surfaces, and instant bonding as they cool.

The technologies analyzed in this report are:

The packaging category held the largest market share, of 65%, in 2024. This is because the rise in e-commerce has led to a growing need for packaging to keeps products safe during shipping. Alongside this, the demand for sustainable packaging consisting of recyclable and biodegradable materials is driven by consumer expectations and tighter regulations. At the same time, smart packaging innovations, such as QR codes and RFID tags, are improving product tracking and enhancing the customer experience.

The electric & electronics category will grow at the highest CAGR, during the forecast period. This is because of the growing need for smartphones, laptops, wearable technologies, electric vehicles (EVs), and renewable energy. Electronic components such as printed circuit boards (PCBs), mobile devices & wearables, displays & touchscreens, automotive electronics, and communication equipment heavily rely on adhesive tapes for bonding, isolation, and protection from heat and electromagnetic interference.

The end uses analyzed in this report are:

The acrylic category held the largest market share, of 55%, in 2024. This is because these tapes stick well, work on many different surfaces, and can handle tough conditions, such as heat, moisture, and dust. These qualities make them popular for packaging, automotive, construction, and electronics applications. Moreover, these tapes are valued for long-term outdoor use due to their resistance to UV light, weather, and aging.

The silicone category will grow at the highest CAGR, during the forecast period. This is because silicone tapes can endure extreme temperatures, UV exposure, and harsh chemicals, making them ideal where traditional adhesives fail. They are commonly used in automotive engines, solar panel installations, and aircraft wiring. These tapes also perform well in marine and chemical environments, where their durability and flexibility ensure reliable performance in demanding conditions.

The resins analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The Southern region of the U.S. held the largest market share, of 60%, in 2024. This is because of its various significant industries, including automotive, construction, and packaging. Texas, Alabama, Georgia, and other states in the Southern region therefore require high amounts of adhesive tapes for bonding, sealing, and insulation. Additionally, the strong regional base of manufacturing plants, warehouses, distribution centers, transportation networks, local suppliers, and customers drives the demand for adhesive tapes for packaging and logistics operations. Tapes are used here to ensure efficient production, sealing, bundling, labeling, storage, and timely delivery. The regions analyzed in this report are:

The market is highly fragmented because it consists of diverse manufacturing entities, including international corporations and domestic businesses. There are also companies focused on distinct tape types, including pressure-sensitive, masking, and double-sided, or particular industries, including automotive, medical devices, and construction. Additionally, low barriers to entry in the market exist due to the relatively low initial capital investment, simple manufacturing processes, and readily available raw materials. This creates opportunities for startups and small enterprises entering the market.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages