U.A.E. Facility Management Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024 - 2030)

Get a Comprehensive Overview of the U.A.E. Facility Management Market Report Prepared by P&S Intelligence, Segmented by Service (Property, Cleaning, Security, Catering, Support, Environment Management), End User (Business and Corporate, Education, Industry and manufacturing, Healthcare, Public Administration, Hospitality, Construction), Mode (Inhouse, Outsource), Type (Hard Services, Soft Services), Sector (Private, Public), and Geographic Regions. This Report Provides Insights From 2017 to 2030.

U.A.E. Facility Management Market Data

Market Statistics

| Study Period | 2017 - 2030 |

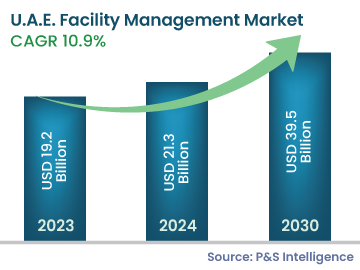

| 2023 Market Size | USD 19.2 Billion |

| 2024 Market Size | USD 21.3 Billion |

| 2030 Forecast | USD 39.5 Billion |

| Growth Rate (CAGR) | 10.9% |

| Largest Service Category | Cleaning |

| Largest End User Category | Business and Corporate |

| Nature of the Market | Fragmented |

Market Size Comparison

Key Players

Key Report Highlights

|

Explore the market potential with our data-driven report

U.A.E. Facility Management Market Analysis

The U.A.E. facility management market generated USD 19.2 billion revenue in 2023, and it is projected to witness a CAGR of 10.9% during 2024–2030, reaching USD 39.5 billion by 2030. This is mainly due to the growing tourism industry and increasing investments in the construction sector.

The emergence of new and advanced technologies is further expected to fuel the market advance. When the latest technologies, such as building information modelling (BIM), advanced heating, ventilation, air conditioning (HVAC), and automated facility management software, are integrated, companies are able to deliver excellent solutions to customers. The expansion of the real estate sector and the development of smart cities are some key factors propelling the need for facility management.

Further, the growing adoption of cloud-based solutions is a key trend in the U.A.E. facility management market. The newly launched SaaS platforms and better accessibility allow for enhanced security and management of material components and manpower, which assists in cost reductions for the players as well as customers. In addition to scalability, real-time collaboration, easy accessibility, and disaster recovery, SaaS platforms can also offer insights into ongoing operations.

U.A.E. Facility Management Market Trends & Growth Drivers

Rising number of mergers and acquisitions

- In recent years, there has been a significant increase in the number of mergers and acquisitions among facility management companies for their expansion and strengthening of services proposition and geographical reach, while driving their operational and financial performance forward.

- For instance, Khidmah announced the acquisitions of Pactive Sustainable Solutions and Mace Macro Technical Services in December 2022. This help Khidmah and its clients open new opportunities, enabling them to provide various sustainable solutions that help built environments become greener, as well as grow its portfolio and geographical footprint throughout the Gulf region.

- In addition, in September 2022, Aldar Properties PJSC announced that it is scaling up its property and integrated facility management platform through the full acquisition of Spark Security Services, a U.A.E.-based manned security service provider.

- Moreover, Eltizam Asset Management Group acquired Fixis in March 2021 to expand its service portfolio and generate up to $40 million annual revenue.

Growing Tourism Industry

- The growth in the U.A.E.’s tourism industry is expected to play a vital role in driving the country’s facility management market. The prime minister of Dubai, Sheikh Mohammed bin Rashid Al Maktoum, launched the UAE Tourism Strategy 2031 in November 2022, which comes under the Projects of the 50 as one of the biggest projects of the next few years.

- The strategy aims to strengthen the position of the U.A.E. as one of the best destinations in the world for tourists. Additionally, the prime minister took to Twitter to state that the country has a target of welcoming 40 million tourists within the next seven years. This comes at the back of the U.A.E.’s target of increasing the tourism sector’s contribution to its gross domestic product (GDP) to AED 450 billion by 2031, with an annual increase of AED 27 billion.

- Additionally, as per The National, in 2023, Abu Dhabi has launched a new fund aimed at further increasing corporate events and incentive travel in the emirate, as the U.A.E.’s capital seeks to expand business tourism.

- The fund will leverage public–private partnerships to boost business-to-business events, providing financial support and incentives to event organizers, agencies, and companies to host their meetings in the emirate.

- The Abu Dhabi Convention and Exhibition Bureau (ADCEB), part of the Department of Culture and Tourism — Abu Dhabi (DCT Abu Dhabi), signed an initial agreement with Adnec Group, the owner and operator of the Abu Dhabi National Exhibition Centre, to jointly form the fund.

Workforce Management

- Facility management is a labor-intensive industry, which demands a high number of unskilled workers for soft services such as manned security, catering, cleaning, and janitorial services.

- The U.A.E. attracts a lot of workforces from Asian countries. Most of the companies face issues in handling the workforce due to the presence of strict labor laws, which mandate a good working environment and accommodation for laborers.

- This complicates the job of facility management companies, as their services are entirely reliant on this workforce; however, efficient management of workforce provides a successful delivery of agreement and workforce retention.

- Hence, workforce training, management and retention are other challenges that companies are facing.

U.A.E. Facility Management Industry Outlook

Service Insights

Cleaning is the largest service with a market share of around 30% in 2023 and it is also the fastest-growing category. This can be majorly attributed to the growing awareness about cleaning services post-COVID-19. Since people are conscious about hygiene, which includes sanitizing homes and washing hands several times a day, there has been a significant rise in demand for cleaning services. Due to the strong online presence and technological advancement in customer services, the demand for these services is expected to increase significantly in the coming years.

During the study, these services were analyzed:

- Property

- HVAC Maintenance

- Mechanical and Electrical

- Maintenance

- Others

- Cleaning (Largest and Fastest-Growing Category)

- Security

- Catering

- Support

- Environment Management

- Others

End User Insights

The business and corporate is the largest end user with a market share of around 45% in 2023 and it is the fastest-growing category too. According to the Smart Dubai 2021, Dubai has formalized its goal to be a smart city that embraces advanced technologies. There are an immense number of opportunities for information technology (IT) firms, web development companies, and consulting firms to offer application development, online public relations, online marketing, online security, and business consulting services. These companies are expected to attract a large number of facility management service providers in the country.

Further, this segment is divided into eight categories:

- Business and Corporate (Largest and Fastest-Growing Category)

- Education

- Industry and manufacturing

- Healthcare

- Public Administration

- Hospitality

- Construction

- Others

Mode Insights

Inhouse is the larger mode and held a market share of over 65% in 2023. This dominancy is due to the players are relying on in-house services for the management of assets and other services such as catering, security, and others. Due to the growing awareness of outsourced facility management services, the market is gaining momentum.

Outsource is a rapidly growing category at a CAGR of 11.0% from 2024-2030 in the market. This growth is due to the increasing demand primarily coming from the public sector of the country.

Further, this segment has two categories:

- Inhouse (Larger Category)

- Outsource (Faster-Growing Category)

- Integrated

- Bundled

- Single

Type Insights

The soft services are the largest with a market share of around 70% in 2023 and it is also the fastest-growing service. This is ascribed to the surging demand for facility management services that are indirectly integrated into businesses and directly benefiting the workforce of the companies including building security, cleaning, landscaping, office decorating, catering, and office moves. These services are non-essential but are considered critical in cultivating a well-run workplace. Since these services directly impact variables like productivity and job satisfaction of the employees, these are considered investments in a more productive and functional workplace. These factors have pushed the demand for soft services in the country.

During the study, three types have been found:

- Hard Services

- Soft Services (Largest and Fastest-Growing Category)

- Others

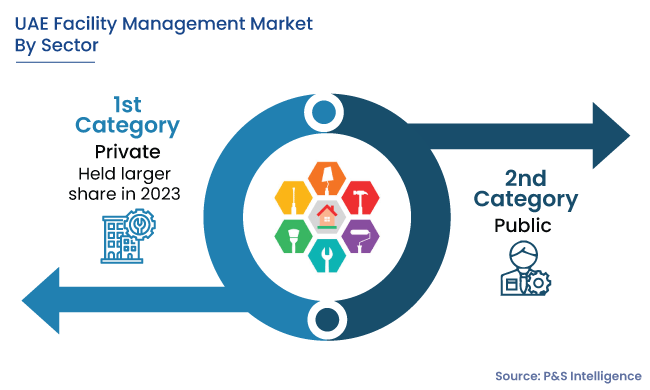

Sector Insights

The private category is the larger with a market share of around 75% in 2023 and it is the fastest-growing category too. In recent years, the private sector has recognized the benefits of outsourcing the facility management services to optimize and transform the delivery aspects and support their functions. The strategic approach based on acquiring value-added skills from the private sector has created high demand for facility management services in the U.A.E. Furthermore, rising number of contracts between facility management providers and private institutions has pushed the market for facility management services in the country.

Further, this segment contains two categories:

- Private (Larger and Faster-Growing Category)

- Outsourced

- In-house

- Public

- Outsourced

- In-house

U.A.E. Facility Management Market Share

The U.A.E. facility management market is fragmented in nature and has intense competition among domestic and international players in the U.A.E. These players are working continually to expand their products and services to fulfill the growing demands of customers. International players are operating with the help of local players through collaborations which contributes to the growth of the overall market.

Facility Management Companies in U.A.E.:

- Emrill Services LLC

- Farnek Services LLC

- Imdaad LLC

- Transguard Group

- Engie Cofely

- Etisalat Facilities Management LLC

- Blue Diamond Facilities Management LLC

- Reliance Facilities Management

- Deyaar Development PJSC

- AG Facilities

- ServeU Facilities Management L.L.C.

U.A.E. Facility Management Market News

In April 2024, Emrill partnered with Clemtech to provide innovative technical resource solutions for the UAE rail sector with Emrill Rail.

In April 2024, Farnek expanded its business operations throughout the emirate of Abu Dhabi following a raft of new and retained FM contract across various industry sectors.

In March 2024, Emrill awarded facilities management services contract for Dubai’s iconic One Za’abeel.

In March 2023, Imdaad joined IAAPA to further grow business and better serve the U.A.E.’s attractions sector.

In February 2024, Farnek launched a dedicated mobile application that is specifically designed to improve the uptime and lifespan of commercial kitchen equipment.

In February 2024, Transguard Group signed a Memorandum of Understanding with Zand Bank, the UAE’s first digital bank. Under this agreement, which is subject to regulatory approval, Transguard Cash is signalling its interest in exploring, through strategic partners, the expansion of its already robust portfolio of services to include Digital Asset Collection Solutions and Digital Asset Custody Services.

In December 2023, Transguard Group revealed its security division, which is exclusively contracted for security services at the event Global Climate Conference COP28.

In November 2022, ServeU launched two B2B mobile applications for clients with residential and commercial properties.

In June 2022, ServeU LLC announced its partnership with Microsoft to upgrade their Computer-Aided Facilities Management (CAFM) system. The company also revealed its partnership with NSquareXperts, in order to configure and customize its Microsoft Dynamics 365 Field Services. The new partnerships are in line with the company’s vision to diversify and enhance their services in the FM industry.

Frequently Asked Questions About This Report

During 2024-2030, the facility management market in the U.A.E. will grow at a 10.9% CAGR.

The U.A.E. facility management industry is fragmented, and has strong competition among international and domestic companies.

The U.A.E. facility management market will reach USD 21.3 billion in 2024.

Business and corporate is the leading end-use area in the facility management industry in the U.A.E.

The rising acceptance of cloud-based solutions is the biggest trend in the U.A.E. facility management market.

The flourishing tourism sector and rising investments in the construction industry are the major drivers for the facility management industry in the U.A.E.

Request the Free Sample Pages

Want a report tailored exactly to your business need?

Request CustomizationWe are Trusted by

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws