Key Highlights

| Study Period | 2019 - 2032 |

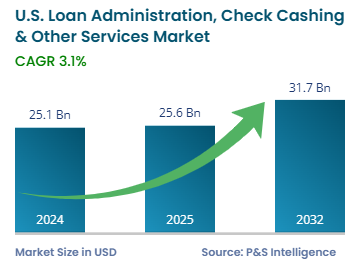

| Market Size in 2024 | USD 25.1 Billion |

| Market Size in 2025 | USD 25.6 Billion |

| Market Size by 2032 | USD 31.7 Billion |

| Projected CAGR | 3.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13555

This Report Provides In-Depth Analysis of the U.S. Loan Administration, Check Cashing & Other Services Market Report Prepared by P&S Intelligence, Segmented by Type (Loan Administration, Check Cashing Services, Other Financial Services), Service Provider (Traditional Financial Institutions, Alternative Financial Service Providers (AFSPs), Fintech & Digital Platforms, Retail & Third-Party Financial Service Providers), End User (Individual Consumers, Businesses & Institutions), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 25.1 Billion |

| Market Size in 2025 | USD 25.6 Billion |

| Market Size by 2032 | USD 31.7 Billion |

| Projected CAGR | 3.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The size of the U.S. loan administration, check cashing, & other services market in 2024 was USD 25.1 billion, and it will reach USD 31.7 billion by 2032 at a CAGR of 3.1% during 2025–2032. The market is growing due to the increasing use of digital finance platforms, the expanding gig economy, and increasing demand for these solutions in service sectors. The rising investment of the government and private sector in financial inclusion has broadened the scope for service providers.

Technical advancements and new regulations drive the demand for financial solutions that are adaptable and effortless for users. The enhanced efficiency of digital platforms makes loan management easy and provides check-cashing and money transfer services on an immediate basis.

Other significant market drivers include the large population underserved by banking services, fluctuating interest rates, volatility of income and employment rates, high demand for alternative credit solutions and short-term liquidity, rampant urbanization, and changing demographics.

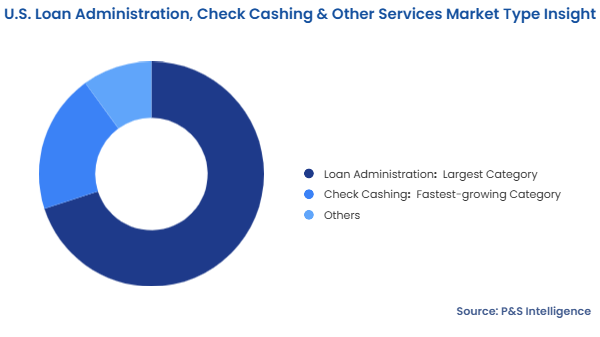

Loan administration services lead the market with a share of 70%. This is because of the stringent compliance requirements when buying homes, the complexity of the whole process, and high loan and mortgage rates. Fintech firms are improving service delivery through AI-powered customer support, automated collections, and predictive analytics. In 2023, Fiserv invested over USD 600 million to digital servicing platforms, operations, and customer engagement.

The types analyzed here are:

Traditional financial institutions hold the major market share, of 60%. Banks, credit unions, mortgage lenders, and investment firms possess advanced platforms and an extensive North American customer base. Moreover, they operate extensive branch networks, with comprehensive product offers for diverse loans. Their usage of advanced technologies and knowledge of regulatory requirements make them popular among customers.

The service providers analyzed here are:

The market is led by banked individuals with a share of 35%. Financial institutions provide banked individuals with several loan options, such as mortgages, auto loans, and personal loans, because of their existing member relationships. People with traditional banking access gain easy and fast access to loans, favorable interest rates, and customized assistance.

The end users analyzed here are:

Drive strategic growth with comprehensive market analysis

The Southern region had the largest share, of 40%, because of its large population, a lot of which is underbaked or unbanked. A large number of payday lending services operate in regional states because of their weak regulations. The financial environment in Texas poses risks of potential predatory lending activities and other financial challenges, which increases the need for loan administration, check cashing and other services.

The regions analyzed here are:

The market is fragmented because it includes many small-to-medium-sized enterprises and established financial institutions. The biggest reason for the fragmented market is the presence of both traditional and alternative financial institutions that provide loans and other services. Moreover, a huge number of local businesses and community providers cater to consumers in their respective geographical territories, thus effectively competing with the financial industry stalwarts.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages