Key Highlights

| Study Period | 2019 - 2032 |

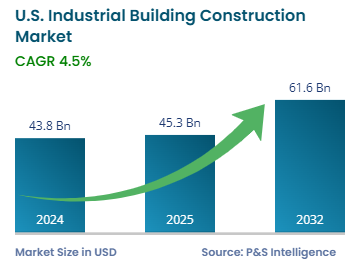

| Market Size in 2024 | USD 43.8 Billion |

| Market Size in 2025 | USD 45.3 Billion |

| Market Size by 2032 | USD 61.6 Billion |

| Projected CAGR | 4.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13596

This Report Provides In-Depth Analysis of the U.S. Industrial Building Construction Market Report Prepared by P&S Intelligence, Segmented by Industry (Manufacturing, Logistics & E-commerce, Technology & Telecommunications, Pharmaceutical & Biotechnology, Food & Beverage, Energy & Utilities, Data Center), Construction type (New Construction, Renovation & Expansion, Build-to-Suit, Speculative Construction, Sustainable & Green Building Construction), Materials (Traditional Construction, Modular & Prefabricated Construction, Advanced Construction Techniques), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 43.8 Billion |

| Market Size in 2025 | USD 45.3 Billion |

| Market Size by 2032 | USD 61.6 Billion |

| Projected CAGR | 4.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The size of the U.S. Industrial Building Construction Market in 2024 was USD 43.8 billion, and it will reach USD 61.6 billion by 2032 at a CAGR of 4.5% during 2025–2032.The U.S. industrial building construction market is a fundamental element which enables the country's manufacturing sector, its logistics operations and infrastructure development. America’s supply chain and economic expansion depend on industrial construction which includes massive warehouses, high-tech data centers and specialized manufacturing facilities.

The market grows because of rising e-commerce needs and higher demands for manufacturing amenities and sustainable buildings with efficient energy use, automation systems, cold chain facilities for pharmaceuticals and food storage companies build high-end warehouse complexes to support technology development. Government initiatives to expand infrastructure and give benefits to manufacturers domestically drive additional construction work.

The U.S. industrial building construction market leads in manufacturing industry and is expected to have the highest revenue share in the year 2024, with a share of 25% because of major investments is going to semiconductor and electric vehicle production sectors. Real construction activities within manufacturing industry have their highest levels because of increased spending in computer electronics and electrical production since early 2022. Manufacturing facility growth generates economic construction benefits that create employment opportunities and advances technological development thus making manufacturing sector leading industry.

The industry analyzed here are:

New construction is the leading category within the U.S. industrial building construction market and is expected to have the highest revenue share in the year 2024, with a share of 45% because of persistent strong demands from various market sectors. The market is expanding due to substantial investments made in manufacturing facilities focused on computer and electronic equipment production for domestic capability development, e-commerce development, warehouse construction grows new industrial development projects. New construction activities continue to grow because the market adapts to changing industrial requirements and technological developments.

The construction type analyzed here are:

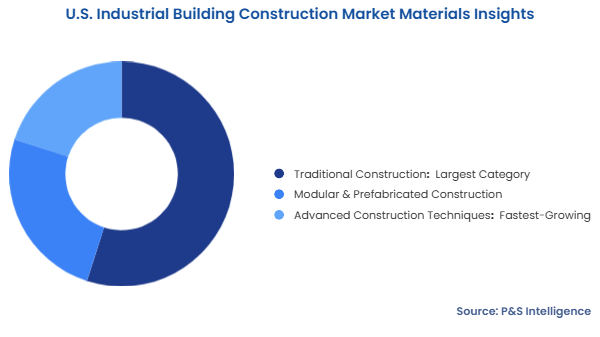

Concrete steel wood stone and brick is leading materials that construction professionals use in industrial buildings throughout the U.S. Builders choose these materials because they demonstrate effective durability, high structural strength while being easily accessible in the market. Concrete, steel stands as the preferred industrial construction materials because of their robust properties and adaptable nature. The preference for traditional materials in industrial projects due to durability and reliability remains strong.

The materials analyzed here are:

Drive strategic growth with comprehensive market analysis

Industrial building construction leads in the Southern region of United States and is expected to have the highest revenue share in the year 2024, with a share of 40% due to strong investments from manufacturers and technological companies. The Sunbelt region has successfully captured a lot of corporate investments for electric vehicles production facilities, semiconductor and other product plants. Taiwan Semiconductor Manufacturing Co. has invested $65 billion in a complex near Phoenix Arizona while Ford is investing $5.6 billion in a Tennessee plant. Economic growth in the region led to a rapid increase of associated infrastructure construction including warehouses alongside offices and residential properties.

The regions analyzed here are:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages