Report Code: 12888 | Available Format: PDF | Pages: 340

Timing Devices Market Size and Share Analysis by Type (Oscillators, Atomic Clocks, Resonators, Clock Generators, Clock Buffers, Jitter Attenuators), Material (Crystals, Silicon, Ceramic), Application (Consumer Electronics, BFSI, Telecommunications and Networking, Automotive, Industrial, Military & Aerospace, Healthcare) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12888

- Available Format: PDF

- Pages: 340

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Timing Devices Market Outlook

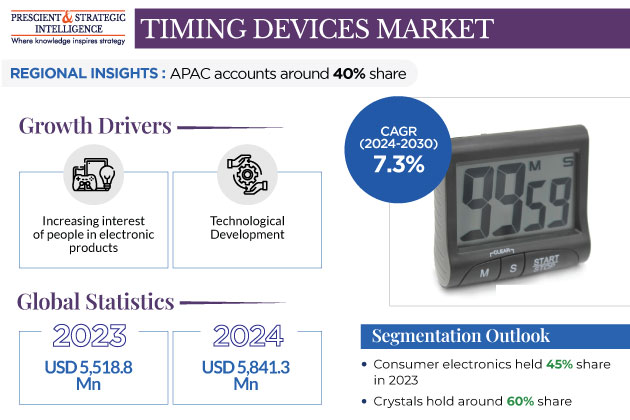

The global timing devices market generated USD 5,518.8 million revenue in 2023, and it is projected to witness a CAGR of 7.3% during 2024–2030, reaching USD 8,893.2 million by 2030. It is attributed to the increasing interest of people in electronic products, such as wearable devices, to improve their lifestyle. Timing devices provide such electronic gadgets with signals for transmitting information at the exact time. Applying these principles to MEMSs, quartz crystals, and ceramic resonators makes it possible to generate oscillations with stable frequencies.

Furthermore, the wide range of applications of timing devices in every sector is driving the growth of the market.

- Timing devices are widely used in electronic devices, telecommunications, aerospace systems, and automobiles.

- In addition, rising demand for these components in medical equipment in the healthcare sector is acting as a driving force for the market.

- In the healthcare sector, every second is important when it comes to treating a patient.

- Therefore, these devices play a crucial role in the healthcare sector.

The increasing pace of technological development is creating a demand for more-precise and -reliable timing devices for various applications, such as 5G networks, vehicles, and IoT devices. This is because the performance of 5G networks relies on highly accurate timing to ensure synchronization and low latency.

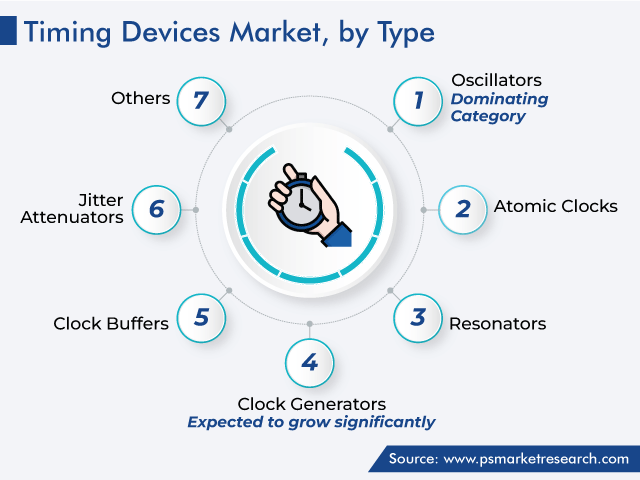

Oscillators Accounted for Largest Share

By type, the oscillators category accounted for the largest share, of 40%, in 2023. Companies are expanding their portfolio with new and advanced variants of oscillators.

- In January 2023, SiTime Corporation announced the launch of two new Endura precision timing oscillator families.

- These devices are made to deliver high performance even in the extreme conditions in aerospace for the defense applications, such as navigation, positioning, tactical communications, timing, surveillance, and network synchronization.

- In addition, the newly launched product provides better stability, which is crucial in all these applications.

- Crystal oscillators are crucial in timing devices, giving clock signals an exact and constant reference frequency. Timing devices are used in many applications. Moreover, the benefits associatedQ with crystal oscillators include cost-effectiveness due to a compact size, low phase noise, high Q factor, high stability, and high operating frequency.

- The MEMS oscillators subcategory under oscillators, is expected to have a high growth rate of, 9%, during the forecast period.

- As they generate highly stable reference frequencies to measure time, they are used in various applications, such as to manage the transfer of data, sequence electronic systems, and measure elapsed time.

- MEMS oscillators are primed to replace older oscillators with quartz crystals, offering stronger stability amidst mechanical shock and vibration and reliability amidst constant temperature variations.

- Ceramic oscillators also held a significant share in the market as they have high tolerance to vibrations and physical shock as compared to other variants.

Further, the clock generator category is expected to witness rapid advance in the forecast period, attributed to the rising pace of advancement in these devices. Moreover, companies are focusing on product launches to increase their market share. For instance, in November 2022, Renesas Electronics Corporation launched the VersaClock 7 clock generator, which consumes less power, is cost-efficient, and available in a small size.

Increasing Investment for IoT Solutions Is Major Driving Force

The increasing participation of government associations and market players in the form of funding has a pivotal role in the growth of the global IoT market, Which, in turn, propels the growth of the timing devices market.

- The IoTUK, a three-year national program, received an investment of USD 52.8 million (GBP 40 million).

- The program aimed to increase the adoption of IoT throughout the public and private sectors in the U.K.

- It accelerated IoT entrepreneurship and facilitated collaborations among organizations throughout various industries.

- Due to these initiatives by the U.K. government, the country has become one of the key markets for IoT at the global level.

Similarly, the Affordable Care Act and HITECH Act of the U.S. government promote the adoption of EHRs in the healthcare industry. Incentives are also offered under these legislations to healthcare providers to use EHRs, train the workforce, and improve the overall HIT infrastructure. Similarly, the Affordable Care Act supports medication management services and programs to improve healthcare quality.

Crystals Are Widely Used in Timing Devices

By material, crystals held the largest share, of 60%, in the market.

- This is attributed to their high accuracy, excellent frequency tolerance, long service life, and high stability.

Silicon is expected to be the fastest-growing category in the market.

- This is attributed to the low power consumption and relatively inexpensive nature of silicon.

- Moreover, silicon-MEMS-based timing devices offer high reliability, wide operating temperatures, and strong shock and vibration resistance.

Consumer Electronics Hold Largest Share

Timing devices are used in various industry or in various application such as medical & healthcare, telecommunication, automotive, military and banking, financial services and insurance (BFSI). Consumer electronics hold the largest share in the application segment because timing devices are extensively used in computers, cell phones, and other consumer goods. Here, these instruments provide timing signals for transmitting data at the right time and speed and for synchronizing.

The medical devices and healthcare category also held a significant share in 2023.

- Healthcare systems are fragmented across the globe, i.e., there are several healthcare providers treating an individual for a particular illness.

- The lack of coordination among healthcare professionals and patients has negatively impacted the quality of healthcare and its cost.

- This has led to the fragmentation of healthcare information, such as diagnosis, medical history, patient demographics, billing, and administrative data.

- This, in turn, has been increasing the demand for advanced, integrated healthcare systems for compiling the fragmented information into a single channel.

IoT healthcare applications, such as telemedicine, medication management, clinical operations and workflow management, and inpatient monitoring, help in compiling patient information related to diagnosis, treatment, care, and rehabilitation. The technology enhances doctor–patient communication, in order to reduce medication errors and provide better coordinated care. The growing demand for advanced healthcare information systems and IoT is expected to, ultimately, boost the sale of timing devices.

The telecommunications category is growing rapidly.

- This is because timing devices are used in telecommunications to synchronize the transmission of data from one device to another.

- This is essential for ensuring reliable and efficient data transmission, on which all aspects of modern life depend.

| Report Attribute | Details |

Market Size in 2023 |

USD 5,518.8 Million |

Market Size in 2024 |

USD 5,841.3 Million |

Revenue Forecast in 2030 |

USD 8,893.2 Million |

Growth Rate |

7.3% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Material; By Application; By Region |

Explore more about this report - Request free sample

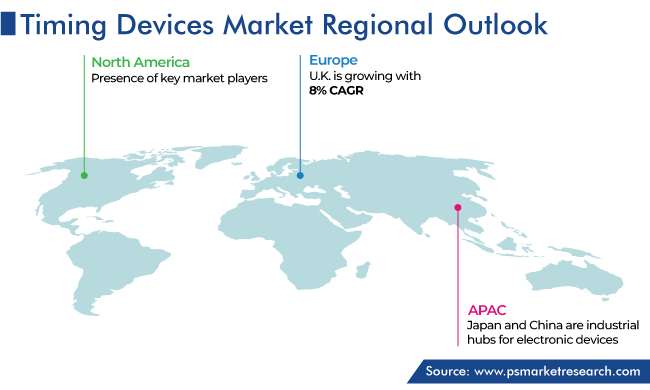

North America Accounted for Second-Largest Share in Market

North America held around 30% revenue share in 2023, and it is expected to grow with a significant rate over the forecast period. It is attributed to the presence of key market players, increasing demand for highly precise timing across applications, growing semiconductor industry, burgeoning adoption of IoT, and advancing timing technologies. Essentially, the rising adoption of these instruments in advanced medical equipment, BFSI, telecommunications, and automobiles and the ongoing R&D activities are expected to enhance the market growth potential.

APAC is predicted to be the largest and fastest-growing market during the forecast period.

- In the APAC region, China is the largest market due to the presence of many automotive and electronics companies.

- Further, Japan and China are industrial hubs for electronic devices and their components, which require timing devices.

Top Companies Manufacturing Timing Devices:

- Rakon Limited

- KYOCERA Corporation

- TXC Corporation

- Seiko Epson Corporation

- Renesas Electronics Corporation

- Infineon Technologies AG

- Microchip Technology Inc.

- Texas Instruments

- Abracon

- IQD Frequency Products Ltd.

- NXP Semiconductors N.V.

- STMicroelectronics

- SiTime Corporation

- MtronPTI

- CTS Corporation

- Crystek Corporation

- Greenray Industries Inc.

- Frequency Electronics Inc.

Market Size Breakdown by Segment

This fully customizable report gives a detailed analysis of the timing devices market from 2017 to 2030, based on all the relevant segments and geographies.

Based on Type

- Oscillators

- Atomic Clocks

- Resonators

- Clock Generators

- Clock Buffers

- Jitter Attenuators

Based on Material

- Crystals

- Silicon

- Ceramic

Based on Application

- Consumer Electronics

- BFSI

- Telecommunications and Networking

- Automotive

- Industrial

- Military & Aerospace

- Healthcare

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The industry for timing devices will reach USD 5,841.3 million in 2024.

The timing devices market value will reach USD 8,893.2 million in 2030.

The APAC market for timing devices is the largest.

The rising investment in IoT solutions by industry players and government bodies are the key timing devices industry drivers.

Crystals hold the larger timing devices market share.

Consumer electronics is the leading application in the timing devices industry.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws