Market Statistics

| Study Period | 2019 - 2030 |

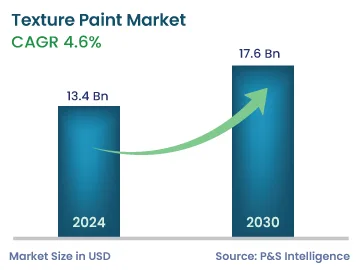

| 2024 Market Size | USD 13.4 Billion |

| 2030 Forecast | USD 17.6 Billion |

| Growth Rate(CAGR) | 4.6% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Report Code: 12753

Get a Comprehensive Overview of the Texture Paint Market Report Prepared by P&S Intelligence, Segmented by Type (Smooth Textured Paints, Sand Textured Paints, Orange Peel Texture Paints, Popcorn Texture Paints), Technology (Water-Based, Solvent-Based), Product Type (Interior, Exterior), Distribution Channel (Direct, Indirect), Application (Residential, Commercial, Industrial) , and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 13.4 Billion |

| 2030 Forecast | USD 17.6 Billion |

| Growth Rate(CAGR) | 4.6% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global texture paint market size stands at an estimated USD 13.4 billion in 2024, and it is expected to grow at a CAGR of 4.6% during 2024–2030, to reach USD 17.6 billion by 2030. This is due to the rising industrialization and urbanization levels, along with the increasing nuclearization of families, surging number of government initiatives to boost construction activities, and improving standards of living.

These paints offer excellent protection from atmospheric changes; they are able to withstand cold, heat, and rain fairly well. There are special additives in them that provide protection against water, humidity, ultraviolet rays, and alkalis. Moreover, they remain bright, while being highly resistant to fungus, algae, peeling, flaking, and fading. They are also thick enough to conceal tiny dents, uneven surface damage, and wall defects. Additionally, surfaces coated with them require little care, due to their exceptional durability and abrasion resistance.

The increasing degree of urbanization has led to a rise in the construction of commercial buildings, schools, public spaces, and private spaces, which require premium quality and appealing finishes. Therefore, these paints are used to create unique and aesthetic looks that stand out from those made using traditional paints. Moreover, they are used to hide imperfections on walls, such as bumps and cracks. Additionally, the demand for environment-friendly paints that are made from natural and sustainable material and do not contain any harmful chemicals, is rising.

In 2022, India's urbanization level increased to 36% of the total population, thereby fueling the demand for real estate and support infrastructure. This is reflected in the greater focus on the construction of housing units, which will, in turn, raise the consumption of these paints. In addition to this, the growing demand for interior designing in developed nations is expected to fuel the market growth.

Rising Construction Activities

The rapid increase in infrastructure construction, aided by the rising investment in this aspect of the economy, boosts the sale of these paint across the globe. Paints are a versatile and affordable way to create a visual interest and depth to any building or construction project, such as hotels, apartments, and offices. These materials are widely used on a variety of surfaces, such as walls and ceilings, and they can be customized to meet the specific needs of the project. Moreover, they are used to create protective coatings that are resistant to corrosion, which further increases the lifespan of buildings.

The number of government initiatives for the development of infrastructure is increasing worldwide. For instance, China is currently investing in the massive Belt and Road Initiative, which involves the construction of roads, railways, ports, and other pieces of infrastructure across Asia, Europe, and Africa. Similarly, in 2023, ADCO Constructions won the contract to construct a new train station in Queensland, Australia.

Furthermore, in India, the government has initiated the construction of smart cities, which has led to an increase in the demand for building and construction materials. Thus, as more buildings are constructed and renovated, there will be an increase in the need for painting products to create unique and appealing spaces. Moreover, the Indian government emphasizes the use of environment-friendly and sustainable construction chemicals and materials.

Based on technology, the water-based category holds the larger share in 2023, as water-based paints are an environment-friendly and cost-effective alternative to those based on the conventional solvent-based technology. They are made with water as the primary solvent, which means they are much easier to clean and have a lower VOC content. This makes them environment-friendly with minimal-to-zero harmful effects on human health. Moreover, they are non-flammable and non-toxic, which allows them to be used and stored easily. In Addition to this, these paints have minimal or no smell, which creates a more-pleasant painting experience as well as an odor-free environment for occupants.

Moreover, water-based paints have wide-ranging applications from roofing to railings, swimming pools to barns, and floors to cladding. In view of the burgeoning demand for these materials, in 2022, Akzo Nobel expanded its footprint in China and invested in a new production line.

Based on application, the residential category holds the largest share in 2023. This is due to the rising demand for personalized finishes on the exterior and interior surfaces of houses, particularly in developing nations. Texture paints will be used in an increasing volume to provide visual appeal and depth to the walls of rooms as more people seek to create unique and personalized spaces. Additionally, since they are non-toxic, made from natural or recycled materials, and contain low amounts of VOCs, the growing trend of sustainable and eco-friendly construction products will continue accelerating the progress of the industry.

Moreover, the expansion of residential construction activities is the biggest factor contributing to the growth of the industry in this category. According to industry experts, 129,000 residential buildings were permitted to be constructed in Germany in April 2021.

The commercial sector also holds a significant market share. In commercial spaces, such as hotels, restaurants, and retail stores, these paints are used to develop the particular ambiance that reflects the brand or style of the enterprise. Additionally, in high-traffic areas, such as hallways and stairwells, texture paints can help hide scuffs and scratches and improve the durability of the walls.

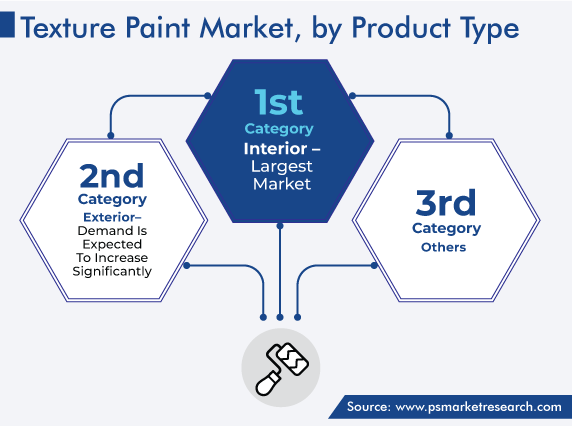

Based on product type, the interior category will hold the largest share in the coming years. This is mainly due to the increasing demand for home decor, itself driven by the rising living standards. These paints are applied on interior walls and ceilings to create a range of effects, such as a smooth, sand, stucco, or popcorn finish, which are difficult to achieve with traditional coloring products. With the rising living standards, customers are willing to spend more on home interior designing. In addition to this, these paints can be used to complement any décor style, be it traditional or modern.

Furthermore, with the increasing number of hotels and restaurants under construction, the usage of these paints to create distinctive ambiances is increasing. For example, stucco-finish paints can be used in fine-dining restaurants to create an atmosphere that is more formal and elegant. Moreover, the construction of shopping malls is driving the market as their interiors are expected to give off an inviting and pleasing vibe to shoppers, diners, and casual visitors.

Based on type, sand texture category holds the largest revenue share in 2023. These alternatives are used to create a rough and grainy texture, to give interior and exterior surfaces a rustic and natural appearance. Moreover, they are made from natural materials such as quartz and silica, which fits well in the sustainable and environmentally friendly initiatives of present times. Additionally, the increasing demand for natural and organic finishes on interior and exterior surface, especially in developing countries such as India and China.

The smooth texture category holds the second-largest revenue share due to the increasing construction of commercial buildings, especially restaurants and hotels. These paints are used to create a range of effects, from a subtle to a high-gloss finish. Additionally, they help create a more-modern and sophisticated look inside the space. The smooth surface of the paint helps reflect light and create a sense of openness and airiness in a room. Hence, the increasing demand for premium building finishes is likely to propel the demand for smooth-texture paints.

Drive strategic growth with comprehensive market analysis

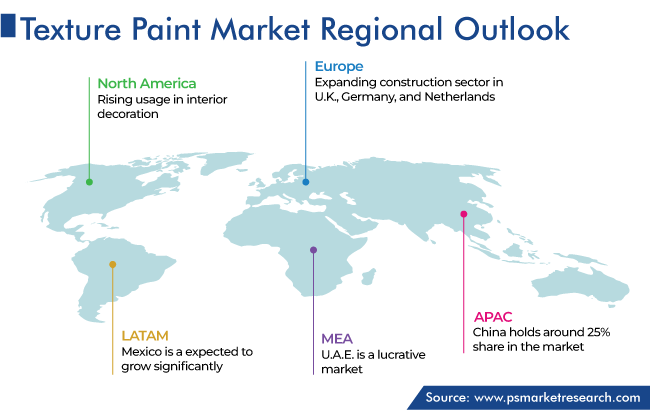

The APAC region holds the largest share, of 55%, in 2023. The regional market is rapidly growing owing to the rising count of infrastructure projects in India, Japan, and China. This will augment the demand for these paints as they are used in a wide range of construction applications, including interior and exterior walls and ceilings. Moreover, India will be the third-largest construction market in the world in the next 2–3 years, reaching a value of USD 1.4 trillion by 2025, as per Invest India. Thus, the real estate sector will offer huge opportunities to businesses across the construction chemicals industry, including the manufacturers of paints and coatings.

Moreover, North America will hold the second-largest market share during the forecast period. This will be due to the rising usage of these paints for interior decoration and the presence of several key market players. In addition, many small-scale companies are actively investing in R&D activities to introduce new products and enhance their presence across the region. Moreover, the increasing demand for eco-friendly and low-VOC products made from natural materials, such as clay, which reduces their environmental impact, will drive the market. This will be aided by the serval infrastructure projects that are ongoing and are expected to be initiated in the years to come.

In the same way, the expanding construction sector in various countries, including the U.K., Germany, and the Netherlands, is expected to boost the product demand over the forecast period in Europe. Moreover, Germany has the largest construction industry in Europe; so, the opportunities for the players could be vast here.

This fully customizable report gives a detailed analysis of the texture paint market from 2019 to 2030, based on all the relevant segments and geographies.

Based on Type

Based on Technology

Based on Product Type

Based on Distribution Channel

Based on Application

Geographical Analysis

The estimated revenue of the market for texture paints is USD 13.4 billion in 2024.

During 2024–2030, the texture paint industry will witness a CAGR of 4.6%.

Eco-friendliness is trending in the market for texture paints.

The water-based technology is preferred in the texture paint industry.

The smooth texture category generates the second-highest revenue in the market for texture paints.

The texture paint industry is dominated by the Asia-Pacific region.

The market for texture paints is driven by the growing construction activities and the rising demand for premium finishes.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages