Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 9.1 Billion |

| 2030 Forecast | USD 11.9 Billion |

| Growth Rate(CAGR) | 4.7% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12648

Get a Comprehensive Overview of the Textile Finishing Chemicals Market Report Prepared by P&S Intelligence, Segmented by Type (Softening, Repellent, Wrinkle-Free, Coating, Mothproofing), Process (Pad-Dry Cure, Exhaust-Dyeing), Application (Clothing Textile, Home Textile, Technical Textile), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 9.1 Billion |

| 2030 Forecast | USD 11.9 Billion |

| Growth Rate(CAGR) | 4.7% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global textile finishing chemicals market size stood at USD 9.1 billion in 2024, and it is expected to advance at a compound annual growth rate of 4.7% between 2024 and 2030, to reach USD 11.9 billion by 2030. This is because these chemicals are widely used in the textile, furniture, and other industries, and the increasing demand for home textile finishes and high-tech textile products. The main purpose of these chemicals is to advance the functional and aesthetic properties of clothes and make textile materials environment-friendly and eye catchy.

Moreover, these chemicals help improve the wearability and smooth functionality of the clothes and other items where they are used; protect the apparel from discoloration, damage from soiling, stain, and many environmental factors; and make fabrics smoother, softer, and easier to clean. These chemicals also help turn knitted or woven clothes into usable products.

The technical textile category is expected to grow at the highest CAGR, over 5%, in the coming years. This can be because the technical textile has higher performance capabilities as compared to regular textiles, due to its unique characteristics and features (elasticity, reinforcement, tenacity, thermal & fire resistance, mechanical resistance, insulation, UV & IR resistance, and anti-dust). Also, it is broadly adopted in many industries, such as agriculture, sports, aerospace, medical, and construction.

Moreover, technical textiles are comprised of synthetic and natural fibers. Synthetic fibers are made from a mixture of some special chemicals and have different qualities such as higher strength. Thus, these are used not only in the textile industry but also in other sectors such as medical and automobile. In addition, the rising awareness about the benefits and superior functionalities of this material is encouraging its usage in the home furniture and clothes industries, which, in turn, propels the growth of the market in this category.

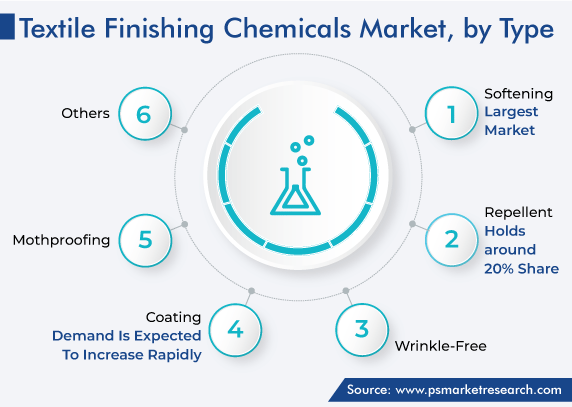

The softening finishes category accounted for the largest revenue share, around 35%, in 2022, and it is also expected to retain its position over the next few years. Softeners are lubricating coatings on fibers to make fabrics softer (pliant, sleek, fluffy, and supple), smoother, better drape, flexibility, reduce fiber-to-fiber friction, and advance wrinkles resistance. In addition, softening finishes help soak mechanical strains of fibers in a good manner. Thus, these factors are escalating the market growth in this category.

Moreover, softeners are majorly used in the textile industry. There are several types of fabric care products available in the market such as fabric softeners, bleach, stain removers, detergents, and other fabric additives. All of these are used massively because of their great popularity among consumers, and these are the most common household cleaning products that are used for softening apparel and making them easy to iron by eliminating crumples in clothes, providing a fresh fragrance, and eradicating the risk of germs.

Furthermore, the increasing launches of softening finishes are driving the market growth. For instance, in May 2022, Cosmo Speciality Chemicals unveiled a Silky SF, which is a cationic softener that gives marvelous softening on all types of textiles and is also pocket-friendly.

The pad-dry cure process category is expected to grow at the highest CAGR during the forecast period in the textile finishing chemicals market. With the help of a pad-dry cure process, all types of finishing chemicals are easily applied to textiles. It is an alternative process for different treatment approaches. It is also a very common approach for the application of cloth finishing chemicals. Further, multiple finishes are applied to a solution bath and finishing treatments through this process. Thus, these factors are propelling the growth of the market in this category.

Drive strategic growth with comprehensive market analysis

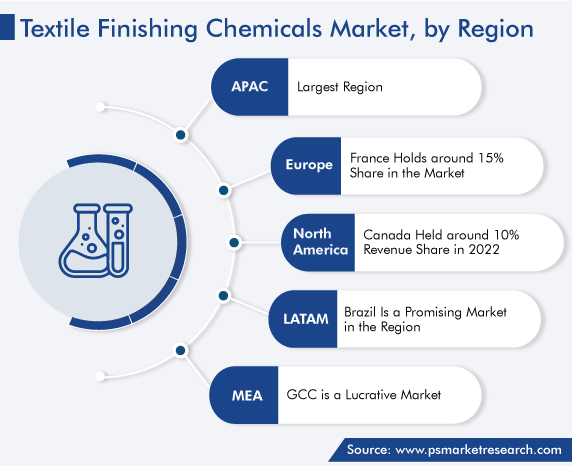

The APAC region accounted for the largest market share in 2022, and it is also expected to remain in its position over the next few years. This is primarily ascribed to the rising demand for these chemicals from the textile industry, enhancement in technology, surging comfort level of customers, and rapidly growing income that boosts the consumption power of people in the region.

In APAC, India is a key market. This is because the Indian government has taken several initiatives to improve the textile industry. For instance, in 2022, the government launched Scheme for Integrated Textile Parks (SITP) to encourage more employment and provide livelihoods in the textile industry. Also, the nation is majorly focused on the development of small and medium textile enterprises. Moreover, the industry is growing with the increased usage of clothing & apparel items, the rapidly growing economic development, and the changing lifestyles. These factors drive the demand for these chemicals.

Furthermore, the demand for finishing materials is increasing because of their use in various applications such as footwear, healthcare, automotive, and sports clothes; the rapidly growing population; supportive government policies; and rapid urbanization in APAC. In addition, the advent and expansion of industries have been rising. In the textile sector, high-performance chemicals are mostly preferred to function efficiently. Also, the automobile industry is growing significantly, which is a key customer of such chemicals.

In the region, China is the largest market for these chemicals. This is due to the high economic growth, high import & export, increased industrial output, high capital investment in the industry, and rapidly growing consumer consumption in the country.

The North American market is expected to grow at a significant growth rate in the coming years. This can be ascribed to economic and infrastructure development, the strong presence of industry companies with new product launches and strong investments in research and development, and the high growth in the textile sector. Furthermore, laws imposed to reduce the usage of old chemicals are propelling the demand for eco-friendly textile chemicals in the region. This is forcing textile companies to use organic chemicals to enhance the quality of their clothes. Thus, this is a key factor escalating the demand for textile finishing chemicals.

The LATAM market is expected to grow at a steady growth rate in the coming years. This can be ascribed to the growing local demand for clothes, the surging textile exports, and the changing buying behavior and purchasing pattern of customers in the region.

Moreover, the demand for Peruvian fibers is rising because of their high quality and integrated production process, which is also boosting the need for finishing chemicals in Peru. In addition, the trade agreement between Mexico with other countries like the U.S. and Canada is increasing the demand for such chemicals in this region.

In the region, Brazil is the largest market because it is a major producer of cotton in LATAM, which is used for making clothes and apparel items. For instance, according to the Brazilian Textile and Apparel Industry Association, in 2021, textile production increased by almost 35% in the country.

Based on Type

Based on Process

Based on Application

Geographical Analysis

The textile finishing chemicals market size stood at USD 9.1 billion in 2024.

During 2024–2030, the growth rate of the textile finishing chemicals market will be 4.7%.

APAC is the largest region in the textile finishing chemicals market.

The major drivers of the textile finishing chemicals market include the rising demand for such chemicals in the textile, furniture, automobile, construction, and other industries and the increasing demand for home textile finishes and high-tech textile products.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages