Report Code: 12835 | Available Format: PDF | Pages: 270

Testing and Measurement Equipment Market Size and Share Analysis by Technology (GPTE, MTE), Service (Calibration Services, Repair Services/Aftersales Services), End User (Automotive and Transportation, Aerospace and Defense, IT and Telecommunication, Education, Government, Semiconductor and Electronics, Healthcare) - Global Industry Growth Forecast to 2030

- Report Code: 12835

- Available Format: PDF

- Pages: 270

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Testing and Measurement Equipment Market Size & Share

The testing and measurement equipment market size stands at an estimated USD 34.8 billion in 2023, and it is expected to grow at a compound annual growth rate of 4.8% during 2024–2030, to reach $47.9 billion by 2030.

A diverse range of devices are utilized to test, measure, examine, demonstrate, and record electronic data across various industries. These instruments generate electrical signals and record responses from different devices during testing, to identify faults and ensure proper equipment functionality. General-purpose test equipment (GPTE) includes oscilloscopes, logic analyzers, multimeters, spectrum analyzers and other equipment, while mechanical testing equipment (MTE) includes machines used to assess the mechanical properties of different materials, such as breaking point, tensile strength, adhesion, compression strength, and other aspects.

These tools are designed to check for specific parameters, such as current, voltage, length, weight, and temperature. Moreover, some of the modulation and signal level analyzers are specifically designed for deploying terrestrial air navigation systems and performing maintenance. These devices must be easy to operate and ensure full functionality even in harsh environments.

The testing and measurement equipment market growth is supported by the surge in connected devices’ penetration and the increase in the demand for the manufacturing of electrical devices used in industrial production with utmost quality and safety. Additionally, the increase in the investments in R&D to enhance the accuracy and efficiency of the equipment is propelling the market growth. Further, these tools are gaining acceptance for the testing of the packaging materials used for medical & pharmacological products, industrial goods, food & beverages, and other products. Here, they are used for ascertaining tensile strength, vibration, resistance to shock, flexibility & rigidity, and sheer strength of packaging solutions.

Burgeoning Electronics Sector Boosting Demand for Testing and Measurement Tools

The demand for measuring and testing equipment is propelled by the rapid industrial expansion, specifically of the electronics industry in developing nations. These tools play a decisive role in detecting defects in high-performance consumer electronics, including those used for wireless communication, microwave applications, and optical communication. Moreover, quality and safety testing has become a critical production step with electronic devices becoming smaller in size, but with increasing sophistication in their wireless competencies. With prompt tests, the timely elimination of faults and prevention of equipment failure at a later stage become possible. This not only helps companies ensure the quality of the products but also eliminate the risk of recalls and bring down the testing time and costs for repairs and replacements.

Further, these devices are massively used for regular testing and fault diagnosis in airplanes, helicopters, and other aerospace & defense machinery. Moreover, in the automotive industry, these instruments gauge the performance of several components, such as engines, steering, suspensions, transmissions, and brakes. Therefore, with the technological advancements in these industries and their strong focus on ensuring the quality of their products, the market continues to boom.

| Report Attribute | Details |

Market Size in 2023 |

USD 34.8 Billion |

Market Size in 2024 |

USD 36.0 Billion |

Revenue Forecast in 2030 |

USD 47.9 billion |

Growth Rate |

4.8% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Technology; By Service; By End User; By Region |

Explore more about this report - Request free sample

Growing Usage of Wireless Technologies Worldwide

In the current world, wireless communication is the preferred method for internet connectivity. 5G, wireless LAN (WLAN), LTE, Bluetooth, IoT, and other technologies are significantly used for wireless communications.

Bluetooth, Wi-Fi, and cellular IoT dominate the IoT market globally. Among these, the Wi-Fi technology is extensively used in healthcare devices and smart homes, with more than 30% of the IoT connections using it. Further, in 2022, more than half the Wi-Fi-enabled devices were using the latest Wi-Fi 6 and Wi-Fi 6E technologies. The communication between IoT devices has become more efficient as a consequence of the acceptance of such technologies, thus leading to enhanced user experiences and performance.

However, with the pace at which they are being manufactured, IoT devices can encounter some challenges, such as a short communication range, drop in connectivity, and increased maintenance expenses. In order to avert such situations, the requirement for testing and measuring tools is expected to further increase in the future among IoT device developers and manufacturers to assess the wireless communication quality during the development and manufacturing stages.

Further, IoT devices are susceptible to cyberattacks as they gather and communicate personal data. This is why they require scalable testing solutions to ascertain their capability to protect sensitive data and user privacy and comply with data protection protocols. Further, these devices interact with various other internet-connected systems, which makes comprehensive testing extremely important for compatibility and smooth integration.

In addition, the burgeoning number of mobile subscriptions, coupled with the growing demand for data-intensive applications and services, has led to a heightened data traffic at the global level. To accommodate the escalating data storage demand, the 5G network’s reliability and performance require extensive testing, which, in turn, is expected to boost the demand for a range of testing and measurement equipment.

Rising Demand for EVs Offers Great Opportunity to Market Players

The growing EV adoption worldwide is correspondingly supporting testing tool demand as each vehicle requires extensive testing before launch. The key EV components that need to be ascertained in performance include the battery, motor, and on-board charger. Additionally, the associated systems, such as charging stations, back-office systems, and telematics modules, require testing.

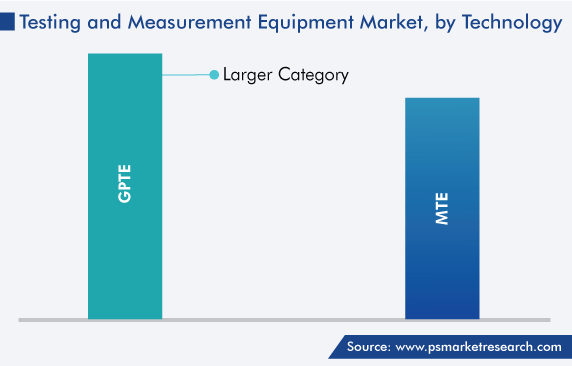

GPTE Product Type Is Projected To Hold Larger Market Share

Between GTPE and MTE, the GPTE bifurcation holds the larger testing and measurement equipment market share, of around 60%, in 2023. This is majorly due to the growing adoption of the 5G network. Moreover, these devices measure the voltage, wattage, frequency, and other operational parameters of various electronic devices.

In this regard, the growing investment in the telecom industry is supporting the GTPE market growth. For instance, India has seen huge investments from major telecom companies for 4G service provision. Currently, the country has the second-largest telecom network with nearly 1.2 billion subscribers, the second-highest number of internet users, and the fastest-growing mobile app market in the world. This is mainly due to the increasing accessibility, low prices, and favorable regulatory conditions, which have extensively helped in expanding 3G and 4G coverage. Hence, the requirement of telecom companies for testing solutions for their carrier networks continues to rise.

Further, the deployment of 5G services and the increase in the construction of data centers for edge computing in developing nations are boosting the requirement for testing and measurement tools.

Within GTPE, oscilloscopes are increasing in demand, as they are extensively used to detect the behavior of electrical signals in real time. These devices display voltage variations over time and are, thus, an essential piece of electronics test equipment. Further, they are widely used in laboratories as they make it easier to unearth faults in electronic circuits. Further, the oscilloscopes category is propelled by the increase in R&D investments across industries and introduction of wireless sensors.

Rapid Technological Interventions in Medical Devices

The healthcare vertical is expected to grow at the highest of growth rate, of 5.6%, during the forecast period. This is credited to the strong focus on the development of novel medical devices, as they can encounter performance decline or failures, which could lead to serious repercussions. To avoid such an issue, the usage of testing tools is expected to increase in the future.

Further, the healthcare sector has witnessed significant technological interventions in the recent past, including the emergence of wearable devices, such as smartwatches. Such devices enable the collection of health data, allowing for real-time health monitoring and the proactive treatment of health conditions before symptoms develop.

Key Testing and Measurement Equipment Manufacturers Are:

- Fortive

- Keysight Technologies Inc.

- Rohde & Schwarz GmbH & Co. KG

- Advantest Corporation

- National Instruments Corporation

- VIAVI Solutions Inc.

- ANRITSU CORPORATION

- Yokogawa Electric Corporation

- EXFO INC.

Market Size Breakdown by Segment

This fully customizable report gives a detailed analysis of the testing and measurement equipment market from 2017 to 2030, based on all the relevant segments and geographies.

Based on Technology

- General-Purpose Test Equipment (GPTE)

- Mechanical Test Equipment (MTE)

Based on Service

- Calibration Services

- Repair Services/Aftersales Services

Based on End User

- Automotive and Transportation

- Aerospace and Defense

- IT and Telecommunication

- Education

- Government

- Semiconductor and Electronics

- Healthcare

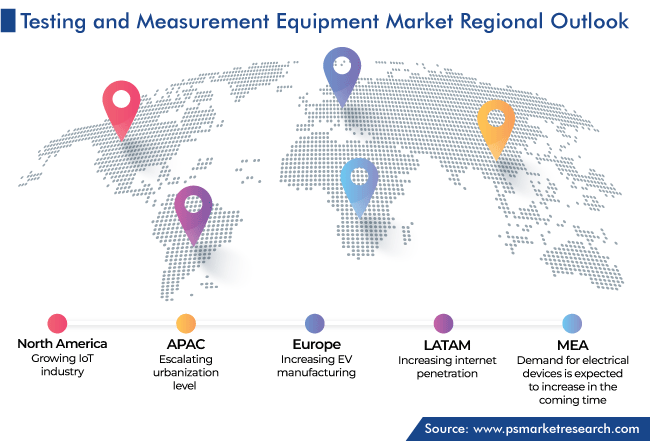

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for testing and measurement equipment values USD 34.8 billion in 2023.

The testing and measurement equipment industry 2030 revenue will be USD 47.9 billion.

The market for testing and measurement equipment is driven by the growing automotive industry, rising usage of wireless communication technologies, and rapid digitization.

GPTE generates the higher testing and measurement equipment industry revenue.

The healthcare vertical is witnessing the highest CAGR in the market for testing and measurement equipment.

China, South Korea, India, Japan, the U.S., the U.K., Germany, and France offer growth opportunities in the testing and measurement equipment industry.

APAC is the fastest-growing market for testing and measurement equipment.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws