Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 234.9 Billion |

| 2030 Forecast | USD 289.8 Billion |

| Growth Rate(CAGR) | 3.6% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Report Code: 12641

Get a Comprehensive Overview of the Testing, Inspection, and Certification Market Report Prepared by P&S Intelligence, Segmented by Sourcing Type (In-House Services, Outsourced Services), Service Type (Testing, Inspection, Certification), Application (Medical & Life Sciences, Consumer Goods, Food & Beverages, Retail, Agriculture, Chemicals, Construction, Energy & Power, Manufacturing, Mining, Oil & Gas, Automotive, Aerospace), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 234.9 Billion |

| 2030 Forecast | USD 289.8 Billion |

| Growth Rate(CAGR) | 3.6% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global testing, inspection, and certification market size was valued at USD 234.9 billion in 2024, and it is expected to increase to USD 289.8 billion by 2030, advancing at a CAGR of 3.6% between 2024 and 2030. This is ascribed to the increasing demand for quality products, mounting construction activities, burgeoning healthcare infrastructure, growing modes of public transportation, and surging engagement of enterprises in safe and effective TIC practices.

In addition, governments’ strict regulations for quality assurance of pharmaceutical products and the growing end-use sectors such as consumer goods & retail due to expanding consumer base are contributing to the market growth.

The medical and life sciences category will witness the fastest growth during the forecast period, advancing at a CAGR of more than 4%. This can be ascribed to the surging need for medical equipment, including PPE kits, ventilators, sterilizers, oxygen cylinders, masks, and others; high government spending in the healthcare sector along with several favorable policies and subsidies; and the rising count of life sciences laboratories. Moreover, the increasing need for TIC services for medical implants, surgical equipment, and other related tools, which play a vital role to ensure patient safety and well-being, is further contributing to the growth of the industry.

In addition, the construction category will register significant growth in the coming years. This growth can be ascribed to the burgeoning infrastructural practices primarily in developing nations, high requirements for quality assurance, high construction spending and development programs run by governments, and the growing industrial and manufacturing sectors.

Furthermore, the food & beverages category contributes significant revenue to the market. This is because this sector needs close monitoring of quality adherence, dependability, and product lifecycle. Additionally, the rising incidences of food contamination, adherence to regulatory frameworks for food and beverages, and surging individual awareness regarding health and healthy food, further help the market in this category to grow at a significant pace in the coming years.

The in-house category accounted for a larger revenue share, over 60%, in 2022, and it is further expected to maintain its position during the predicted period. This is due to its several advantages, such as on-site availability, flexibility to employ expertise, and setting up particular processes in accordance with an organization’s requirements and objectives. Also, in-house inspection and testing procedures allow businesses to practice actual TIC operations. Moreover, deploying in-house procedures offers enhanced control and an in-depth understanding of enterprise operations, which may be advantageous to businesses, and further contribute to the market growth in this category.

On the other hand, the outsourced category will witness faster growth in the coming years. This can be due to its cost-efficiency, less resource requirement, and growing trend for outsourcing services, along with an upsurge in the number of outsourcing companies.

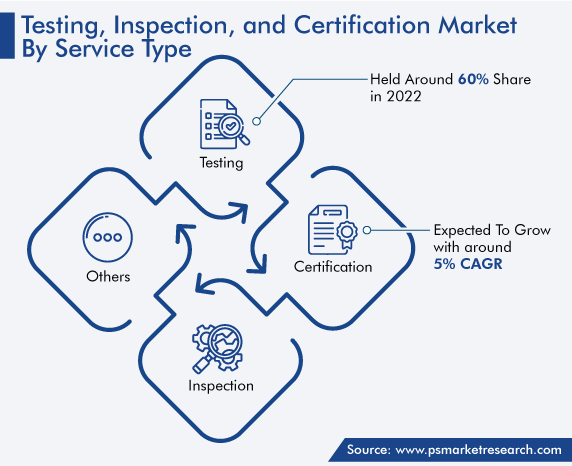

The certification services category will witness the fastest growth in the coming years. This can be due to the mounting requirement for product certification, the increasing number of authorities that approve certifications in the related field of operation, the growing agriculture & food industry that needs certifications by several authorities, and the burgeoning efforts from regional or local government authorities to enhance safety practices in numerous end-use sectors.

On the other hand, the testing services category accounted for the largest revenue share in 2022, and it is also expected to maintain its position during the forecast period. This is due to the widespread utilization of such services in the manufacturing, energy & utilities, oil & gas, and automotive industries. Moreover, such practices help organizations to maintain high standards and safety and the high operational expenses for testing products across industrial verticals further contribute to the expansion of the industry in this category.

Moreover, the inspection services category will register significant growth in the coming years. This can be due to the burgeoning demand for these services for product inspection, quality control, supplier audits, and others, to ensure the quality of end products.

Drive strategic growth with comprehensive market analysis

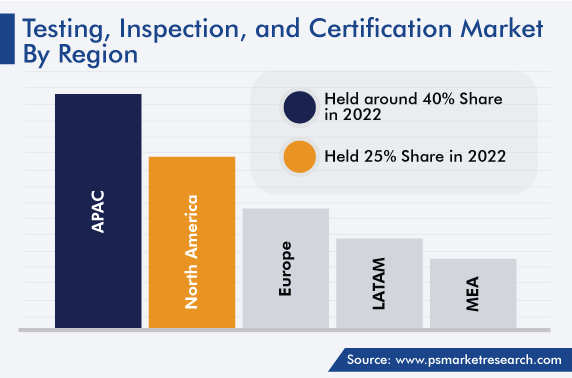

The APAC market accounted for the largest revenue share, around 40%, in 2022, and it is further expected to maintain its dominance during the forecast period. This is attributed to the upsurge in economic development in countries such as China, India, Japan, and South Korea; the growing end-use industries, including consumer goods & retail, industrial & manufacturing, and IT & telecommunication; and the rising consumer spending associated with the increase in per capita income, in the region.

The North American market will witness significant growth during the predicted period. This can be due to the presence of a large number of industry giants, an upsurge in trading activities, a well-established healthcare sector, high spending in the aerospace industry, and the growing mining industry in the region.

Europe contributes significant revenue to the global market. This is ascribed to the implementation of strict environmental laws, rising health safety measures, a growing trend for regular testing and inspection across industrial verticals, and the surging adoption of digital inspection services.

Based on Sourcing Type

Based on Service Type

Based on Application

Geographical Analysis

The testing, inspection, and certification market size stood at USD 234.9 billion in 2024.

During 2024–2030, the growth rate of the testing, inspection, and certification market will be 3.6%.

APAC is the largest region in the testing, inspection, and certification market.

The major drivers of the testing, inspection, and certification market include the rapid digitalization and industrialization coupled with globalization, the increasing need for improving productivity and the quality of products and services, the surging preference for outsourced TIC services, and the rising government regulatory standards.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages