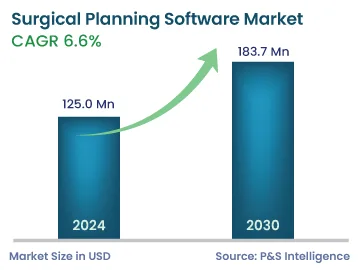

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 125.0 Million |

| 2030 Forecast | USD 183.7 Million |

| Growth Rate(CAGR) | 6.6% |

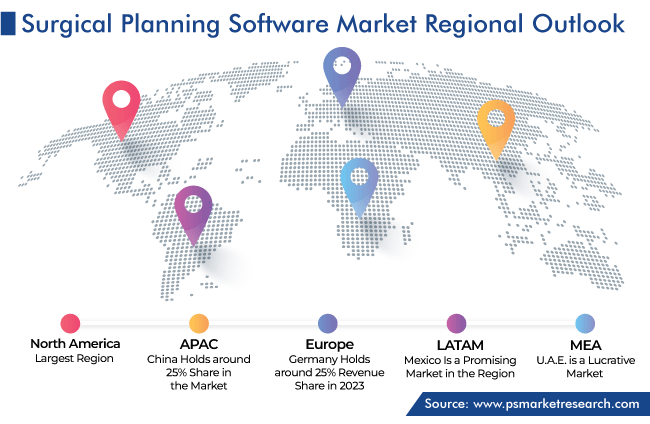

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12781

Get a Comprehensive Overview of the Surgical Planning Software Market Report Prepared by P&S Intelligence, Segmented by Deployment (Cloud-Based, On-Premises), End User (Hospitals, Orthopedic Clinics, Ambulatory Surgery Centers), Application (Orthopedic Surgery, Neurosurgery, Dentistry and Orthodontics, Bariatric Surgery, Breast Surgery, Gynecological Surgery, Hernia Surgery, Ophthalmic Surgery, Thoracic Surgery, Urologic Surgery, Endocrine Surgery, Colon and Rectal surgery), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 125.0 Million |

| 2030 Forecast | USD 183.7 Million |

| Growth Rate(CAGR) | 6.6% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The surgical planning software market size stands at an estimated USD 125.0 million in 2024, and it is expected to grow at a CAGR of 6.6% during 2024–2030, to reach USD 183.7 million by 2030.

These tools help surgeons in generating accurate digital data, so that they can plan the ideal surgery. This aids in providing an accurate treatment to patients and saves time and cost in the whole process. In this regard, a rise in the number of surgeries, several technological advancements in healthcare IT, and boom in the geriatric population are the major factors contributing toward the market growth.

Further, the increasing number of car accidents and sports injuries in the young and old populations is expected to contribute toward the market growth. This is because of the ever-present demand for rapid interventional access into the body during such medical emergencies. Additionally, the growing adoption of digital platforms leads to the minimization of invasion, satisfies individuals, and reduces anomalies.

Further, older people are more likely to need procedures such as joint replacements and coronary artery bypass. It is difficult at this age to visit the hospital many times, which is boosting the market advance, as the usage of software for interventional planning reduces the number of hospital visits. According to government reports, in the U.S., 1 in 6 Americans are aged 65 years or older in 2023. The growing geriatric population drives an increase in the volume of orthopedic surgeries because older people commonly suffer from bone, joint, and muscle issues.

Surgical planning software is also helpful in enhancing billing performance, by simplifying and optimizing billing with the usage of correct codes; this also aids in decreasing the frequency of manual errors. Moreover, it offers enhanced protection over patient data with the usage of passwords.

Personalized treatment investigates insights into diseases using innovative technology and provides people with the required treatment. It helps in providing precise and quick surgeries with the use of patient-matched instruments, taking into account that every individual has a different physiology and anatomy. In some cases, a digital model is created for better understanding and allowing doctors to provide the best possible procedure within a short duration. For instance, in March 2022, Materialise showcased its latest shoulder surgery 3D planning and MIS software at the American Academy of Orthopaedic Surgeons Annual Meeting.

The cloud-based category is expected to witness the higher CAGR, of 6.8%, over the coming years, attributed to the availability of numerous development tools, scalable storage, access to a wider range of computer programs, and on-demand computing cycles with cloud-based software.

Moreover, it carries no requirement for a major initial investment for providing the complete functionality, which helps make operations cost-effective. Users avail of a yearly or monthly subscription plan, which also includes support, updates, and training. In addition, it stores the data in a cloud server, allowing surgeons to have easy access to it from anywhere before operation.

The on-premises category is also growing at a significant rate, because deploying the software at one’s own systems just requires an up-front permanent license fee. These tools are, additionally, secure and dependable and offer users total control and ownership. For this deployment type, the company takes the responsibility for paying for maintenance, upgrades, and training. These systems often provide more security and power over individuals’ data.

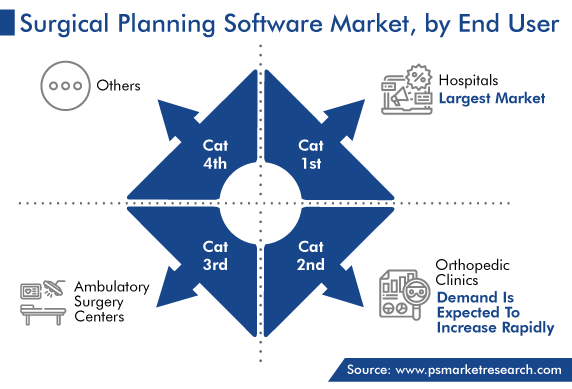

Hospitals are the major users of these software because it helps these entities automate communication between the individual and doctor, enhance operational efficiency, and deliver transparent and consistent operative care to patients. Advanced planning for the ideal operational approach to the surgery enables procedural optimization and reduces the invasiveness for the patient.

One of the essential steps in the treatment regimen is the preoperative designing of the treatment approach, for which the usage of these platforms is rising. It allows surgeons to plan for various types of operations by increasing communication with the patient, which, ultimately, minimizes the risk of complications during the operating procedure. These factors can also benefit healthcare centers directly, such as effective management of the implant stock and major reduction in patient complaints.

The ambulatory surgery centers category is expected to witness the fastest growth during the forecast period, attributed to the delays in elective surgeries at hospitals. This has had a significant impact on necessitating a dedicated workforce, inpatient management, strict visiting hour policies, and patient isolation. As hospitals often find achieving these objects difficult, the footfall is rising at ambulatory surgery centers. Besides this, surgical planning software has reduced the need for face-to-face interaction between the hospital staff and patients, thus speeding up the process of surgery planning.

The orthopedic surgeries category will grow at a significant rate, owing to the criticality of pre-operative planning in this area. For elective surgical treatments, such as total joint replacements and knee replacements, a pre-operative discussion is known to support the shortening of the patient’s length of stay (LoS) and operative times.

Advanced versions of software for orthopedic intervention planning are designed to help surgeons improve intraoperative accuracy and plan their schedule and the actual procedure more accurately. The ideal size and location for an orthopedic implant can be decided precisely with the help of orthopedic design software, so as to ensure that it is compatible with the patient's unique anatomy. According to government websites, approximately 7 million surgeries for musculoskeletal conditions are performed every year in the U.S.

The neurosurgery category is expected to witness the fastest growth over the coming years, ascribed to it being the most-complicated surgical field and the advancements in technology aimed at making it easy for neurologists. Precision is the key requirement that needs to be addressed to make a neurological surgery successful. The details of the brain architecture can be viewed accurately with the help of advanced imaging techniques, the data from which can be easily fed to surgery planning tools. Thus, these computer programs can be useful for both complicated and routine procedures with their automated workflows and intuitive user interfaces.

Drive strategic growth with comprehensive market analysis

North America has the leading position in the surgical planning software market with a value of USD 0.06 billion in 2023. This is attributed to the fast adoption of new, advanced healthcare technologies in the region. Moreover, massive funds are allocated by various government agencies for medical research and development, especially in the critical areas, such as cardiology, oncology, and neurology.

In North America, the U.S. holds the leading position, and it will grow with a CAGR of 6.5%, attributed to the robust healthcare infrastructure and existence of a large number of key players. Furthermore, the key players are focusing on the launch of new digital platforms to make preoperative planning easier and more efficient. For instance, in September 2022, Stryker Corporation launched the Q Guidance System with spine guidance software. It offers optical tracking with a camera, to aid in advanced planning and navigation capabilities for spinal procedures.

.

.

This fully customizable report gives a detailed analysis of the surgical planning software industry, based on all the relevant segments and geographies.

Based on Deployment

Based on End User

Based on Application

Geographical Analysis

The value of the market for surgical planning software is an estimated USD 125.0 million in 2024.

The 2024–2030 CAGR of the surgical planning software industry will be 6.6%.

Cloud is witnessing the faster advance in the market for surgical planning software, based on deployment.

Hospitals generate the highest surgical planning software industry revenue.

APAC is the most-lucrative market for surgical planning software for solution providers.

The surgical planning software industry is growing with the increasing surgery volume and rising preference for personalized treatments.

Orthopedic surgeries are a rapidly growing application in the market for surgical planning software.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages