Student Information System Market Future Outlook

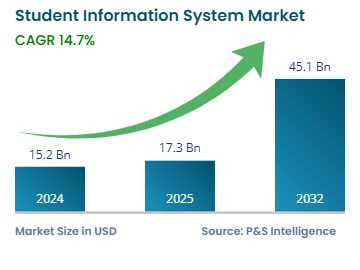

The global student information system market generated $15.2 billion in 2024, which is forecast to reach $45.1 billion by 2032, growing at a CAGR of 14.7% between 2025 and 2032. The primary factors driving the demand for these solutions include the rising interest in e-learning, digitalization of the education sector, and improving educational standards. Further, the increasing adoption of cloud-based systems along with the innovations in data gathering and analysis techniques, is expected to push the market in the near future.

A student information system, student management system, school administration software, or student administration system is an information management system for educational establishments which are used to manage learner data. It combines the administration, instructors, parents, and pupils. SIS gives educational institutions the ability to register learners for classes, record grades, analyze the transcripts of academic and extracurricular accomplishments, and track the results of their assessments.

Teachers, parents, scholars, and administrators can all access comprehensive data like learners’ names, grades, test results, attendance, and performance reviews, which are collected online through the SIS system. These technologies can be used at a school to collect data on individuals or the entire institution. Furthermore, the platforms can be utilized to oversee several institutions on a district level.