Report Code: 11823 | Available Format: PDF | Pages: 143

Structural Adhesives Market Research Report: By Type (Epoxy, Polyurethane, Acrylic, Cyanoacrylate), Technology (Solvent-Based, Water-Based, Solid Reactive), Application (Building & Construction, Aerospace, Automotive, Footwear, DIY, Woodworking, Wind Energy) - Global Industry Growth Forecast to 2024

- Report Code: 11823

- Available Format: PDF

- Pages: 143

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

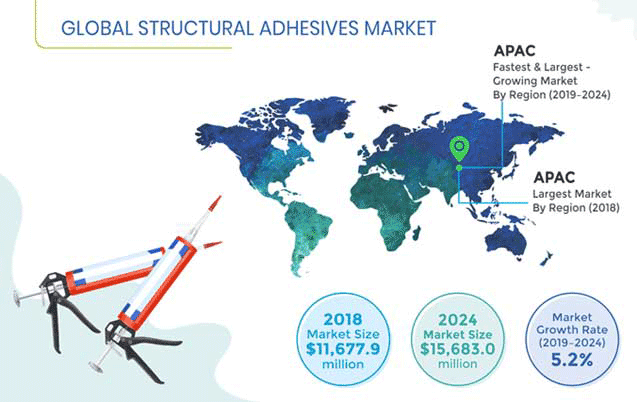

The structural adhesives market revenue was $11,677.9 million in 2018, and it is expected to reach $15,683.0 million by 2024, progressing at a CAGR of 5.2% during 2019–2024.

Geographically, the Asia-Pacific (APAC) region is projected to record the highest growth rate in the coming years. This can be ascribed to the high infrastructure investments, vast number of housing projects, and growth of the real estate sector. All these factors have led to a surge in the demand for structural adhesives and other construction materials. These adhesives offer an improved product quality, high production speed, and reduced costs to fabricators and builders.

Trends & Drivers

The structural adhesives industry is witnessing a shift in preference to these adhesives from traditional fasteners. The transportation sector is increasingly using structural adhesives and reducing the consumption of fasteners and weaker adhesive formulations. This shift is can be owed to the low cost, low weight, eco-friendliness, and better aesthetics of these adhesives. They act as a natural watertight barrier and protective inert barrier between potentially corrosive metals. Moreover, owing to their low weight and the fact that they are replacing traditional fasteners, such as nuts and bolts, they make vehicles lighter, thereby increasing their fuel economy.

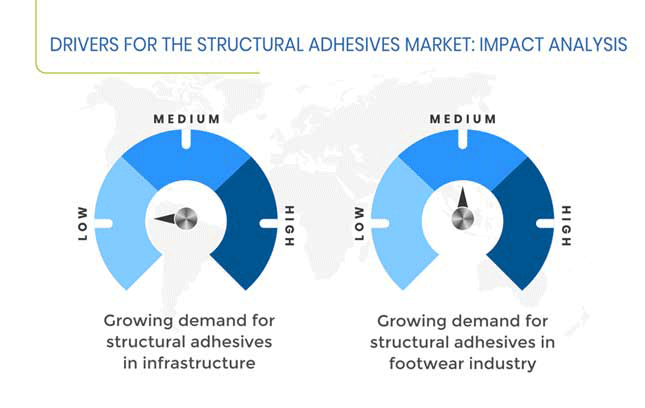

The burgeoning demand for these bonding materials from the infrastructure sector is one of the major factors driving the structural adhesives market growth. High strength and resistance to chemicals and weather are the key reasons behind their increasing usage in this sector. Structural adhesives are used for construction and repair work in a wide variety of infrastructure settings, for example, roads, railways, bridges, and buildings.

The increasing usage of structural adhesives in the automotive and electrical and electronics sectors will serve as an opportunity for the growth of the market for structural adhesives. The surging demand for electric vehicles (EVs) has resulted in the growing EV battery assembly and related operations, which involve the usage of these adhesives due to their high bonding strength. Additionally, the improvements in and amplified production of electrical equipment, such as junction boxes, transformers, and transmission towers, will boost the adoption of these adhesives in the future to minimize weight, costs, and assembly downtimes.

Segmentation Analysis of Structure Adhesives Market

The acrylic category, within the type segment, accounted for the highest revenue in 2018, of $4,261.9 million. In comparison to other structural adhesives, acrylic variants offer high shear and peel strength, which allows the formulation to bond with plastics and metals in several applications, such as woodworking, footwear, do-it-yourself (DIY), and building & construction.

The water-based category, within the technology segment of the structural adhesives market, generated the highest revenue in 2018, and it is expected to account for the largest share, of 53.7%, in 2024. The increasing preference for water-based adhesives over solvent-based adhesives can be ascribed to the low or no emission of harmful volatile organic compounds (VOCs) from the former.

The building and construction category, under the application segment, will record the fastest growth in the coming years. This can be credited to the usage of these adhesives for a wide range of applications, such as countertop lamination, drywall lamination, flooring underlayment, and house construction, and in heating, ventilation, and air conditioning (HVAC) systems, concrete, resilient flooring, ceramic tiles, cement, pre-finished panels, roofing, and wall covering.

Geographical Analysis

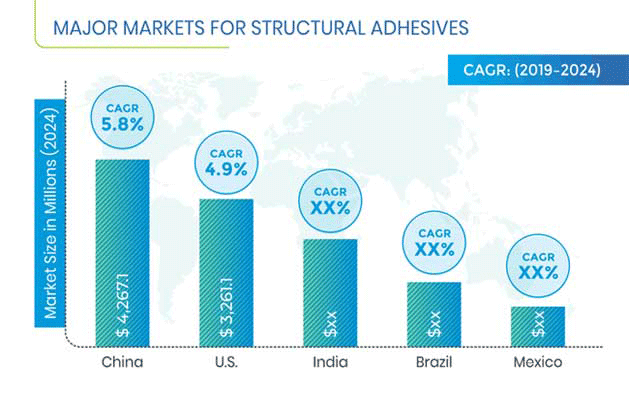

APAC acquired the largest share during 2014–2018, and it will likely grow the fastest till 2024. This can be primarily ascribed to the growth of the construction sector owing to the spike in infrastructure investments. Moreover, the usage of such adhesives for the bonding of ceramics, plastics, and metals is rising in the manufacturing, automotive, and packaging industries. In the coming years, China will dominate the APAC market, by generating revenue of around $4,267.1 million in 2024. The rapid infrastructure and industrial growth and large number of renovation projects in China will bolster the structural adhesives market growth the near future.

Recent Strategic Developments of Major Structural Adhesives Market Players

In recent years, major players in the structural adhesives market have taken several strategic measures, such as product launches, mergers & acquisitions, and geographical expansions, to gain a competitive edge in the industry. For instance, in October 2017, H.B. Fuller Company acquired Royal Adhesives & Sealants LLC for $1.6 billion. The acquisition was aimed to strengthen company’s specialty and high-value products used in electronics, medical, transportation, renewable energy, and construction industries.

Moreover, in June 2019, the Adhesives Technologies business unit of Henkel AG & Co. KGaA inaugurated a new production facility at Montornès del Vallès, Spain. The new site is expected to support the company’s structural adhesive and high-performance product portfolio for the aerospace sector.

Market Size Breakdown by Segment

The Structural Adhesives Market report offers comprehensive market segmentation analysis along with market estimates for the period 2014–2024.

Based on Type

- Epoxy

- Polyurethane

- Acrylic

- Cyanoacrylate

Based on Technology

- Solvent-Based

- Water-Based

- Solid Reactive

Based on Application

- Building & Construction

- Aerospace

- Automotive

- Footwear

- Do-It-Yourself (DIY)

- Woodworking

- Wind Energy

Geographical Analysis

- North America

- U.S

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Belgium

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of the World (RoW)

- Brazil

- Mexico

Key Questions Addressed

- What is the current scenario of the structural adhesives market?

- What are the emerging technologies for the development of structural adhesives?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the market players?

- Which are the key geographies from the investment perspective?

- What are the key strategies adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws