Key Highlights

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 16.8 billion |

| Market Size in 2025 | USD 20.2 billion |

| Market Size by 2032 | USD 76.9 billion |

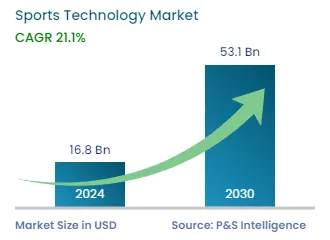

| Projected CAGR | 21.1% |

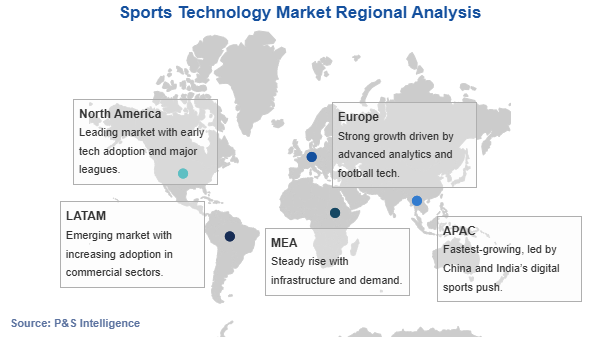

| Largest Region | Europe |

| Fastest Growing Region | APAC |

| Market Structure | Fragmented |

Report Code: 12534

This Report Provides In-Depth Analysis of the Sports Technology Market Report Prepared by P&S Intelligence, Segmented by Technology (Devices, Smart Stadiums, Esports, Sports Analytics), Sport (Soccer, Baseball, Basketball, Ice Hockey, American Football/Rugby, Tennis, Cricket, Golf), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 16.8 billion |

| Market Size in 2025 | USD 20.2 billion |

| Market Size by 2032 | USD 76.9 billion |

| Projected CAGR | 21.1% |

| Largest Region | Europe |

| Fastest Growing Region | APAC |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The sports technology market size stood at USD 16.8 billion in 2024, and it is expected to advance at a compound annual growth rate of 21.1% during 2024–2032, to reach USD 76.9 billion by 2032.

This market is driven by the rising focus on entertaining and managing fans at stadiums, the increasing focus on player improvement and team performance, the surging adoption of e-sports technology, and the presence of a large number of game associations across the globe.

The usage of artificial intelligence in games has resulted in automated ticket sales, enhanced athlete output in leagues or matches, improved athlete training, and boosted athlete performance. For instance, AI can offer real-time feedback during weight training to maximize the results of an exercise and develop specialized training plans. It is projected that throughout the forecast period, the application of AI and IoT will present a profitable potential for the expansion of the market.

Additionally, industry participants today are making efforts to boost the usage of technologies in games, with the aid of AI and cameras, which nowadays capture sporting events and also select highlights of a game for distribution to TV platforms or mobile devices. Also, a natural language feature has been developed that converts raw data from minor league games into readable blogs.

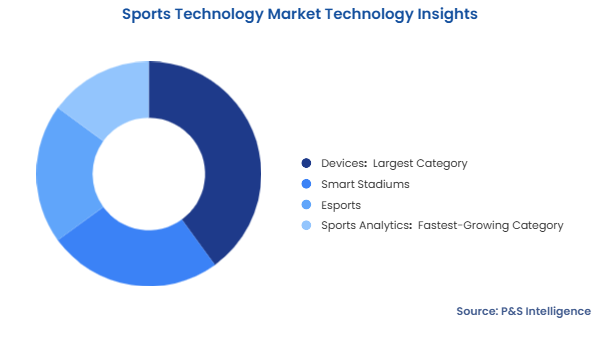

The devices category is the largest, holding 40% of the revenue share in 2024. This is because they have become popular in professional and consumer sports. Portable wearable gadgets accessible to all users present quantitative fitness indicators through built-in heart rate monitors and distance trackers that provide instant practical benefits for recovery scoring, and caloric and heart rate measurements. These devices serve professional athletes, but amateur players, coaches, and fitness enthusiasts have adopted them, thus expanding their market reach. The market segment keeps thriving because health-conscious living, focus on injury prevention, and enhanced personal performance continue to grow.

The sports Analytics is the fastest-growing category as it is expected to grow at a CAGR of 21.2% during the forecast period. This is because professional sports organizations increasingly use data to make decisions in competitive sports. Sports organizations and professional teams dedicate significant resources towards analytics platforms to support both their strategic decisions regarding player acquisition, injury prevention efforts, real-time strategy making functions, and team assessment tasks. Analytics platforms serve multiple operations ranging from player monitoring through video examination, health evaluation, and audience engagement thus serving as essential equipment for sporting businesses in all game-related and administrative sports decisions.

AI and machine learning advancements and extensive sports data accessibility drive quick innovation throughout this field. The segment of analytics will experience sustained rapid growth in the forthcoming years because analytics has become essential for gaining competitive advantage.

The technologies analyzed here are:

The soccer is the largest category, as it held 35% revenue share in 2024. The sport continues to rule as a result of its enormous worldwide fan support along with the universal implementation of improved technologies to track athletes and please fans. Advanced technologies that connect real-time performance tracking devices with VAR systems, which provide semi-automated offside decisions to enhance referee accuracy and enrich viewing experiences, are being used in soccer. Modern technological developments, together with soccer's worldwide popularity, have made the sport dominate its market position.

The basketball is the fastest-growing category, as it is expected to grow at a CAGR of 21.5% during the forecast period. The market growth results from how organizations apply data analytics and wearable technologies for tracking player performance data through heart rate metrics, speed measurements, and movement pattern analysis. The NBA and other organizations dedicate resources to buying advanced analytics systems and sensor-based technologies that lead to better player performance and better strategic decisions. VR and AR enhancements create better connections between fans which boosts basketball technology expansion in the market.

The sports analyzed here are:

Drive strategic growth with comprehensive market analysis

The Europe is the largest category, as it held 35% revenue share in 2024. This is because the Europe has some of the most popular and successful sports leagues in the world. These leagues have big budgets and lots of loyal fans, which leads to strong investment in sports technology. European countries also have advanced sports facilities, including smart stadiums that use things like IoT, virtual and augmented reality, and real-time data tracking. Sports clubs and organizations in Europe are quick to use new technologies like wearable devices, video analysis tools, and AI-powered coaching systems.

The Asia-Pacific is the fastest-growing category, as it is expected to grow at a CAGR of 22% during the forecast period. This is because countries like India and China are seeing a big rise in interest in sports, especially in cricket, football, and esports. As people have more money to spend, more of them are buying things like fitness trackers, smart sports clothing, and home workout devices.

This region is also quick to use new technology, especially on smartphones, which is helping things like sports streaming, fantasy sports, and fitness apps grow fast. Esports are growing really fast here too and is now seen as a big part of sports tech. Things like wearables, VR/AR fitness apps, and online coaching are becoming more common, especially in cities.

The regions analyzed here are:

The sports technology market displays fragmentation since it contains both worldwide technology leaders Apple Inc., IBM, and Samsung alongside specialized companies Hawk-Eye Innovations and Catapult Sports. Various technology solutions exist within sports technology markets because these companies focus on wearable devices in addition to sports data analysis, AI video platforms, and smart stadium developments. Each company controls a different segment of the market since they focus on specialized technologies that serve individual sports conditions. Market competitiveness increases because of diverse providers which makes innovation alongside strategic partnerships essential for companies to establish their market position.

The market fragmentation exists because sports technology solutions serve multiple applications throughout soccer, basketball, tennis and American football. New market participants and startups emerge due to rising customer needs for tailored solutions extending from athlete performance analytics to safety protection systems, stadium connection services, and official sports referee assistance systems. Specialized providers entering the market continuously leads to the prevention of market consolidation while fostering ongoing technological progress.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages