Report Code: 10022 | Available Format: PDF

Sports Nutrition Market Size and Share Analysis by Product Type (Sports Supplements, Sports Drinks, Sports Foods, Meal Replacement Products, Weight Loss Products), Application (Pre-Workout, Post-Workout, Weight Loss), Formulation (Tablets, Capsules, Powder, Softgels, Liquid, Gummies), Consumer Group (Children, Adult, Geriatric), Activity (Heavy Users, Light Users), Distribution Channel (Brick & Mortar, E-Commerce) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 10022

- Available Format: PDF

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

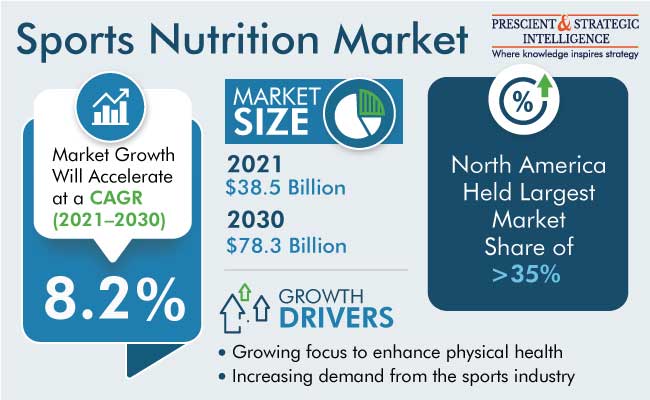

The global sports nutrition market was valued at $38.5 billion in 2021, and it is projected to reach $78.3 billion by 2030, growing at a CAGR of 8.2% between 2021 and 2030. This growth can be primarily attributed to the increasing demand from the sports industry, the surging focus to enhance physical health, the rising participation in sports and physical activities, and the increasing number of competitive sporting events across the world.

Moreover, the increased adoption of health supplements by athletes boosts product demand in the market. These products can help athletes to attain their maximum potential via training, recover more quickly between sessions and competitions, maintain a healthy weight, perform consistently, and decrease their risk of injuries. In addition, the growing prevalence of lifestyle diseases such as obesity and the increasing consumer awareness about the benefits of supplements are expected to boost the sales of nutrition products.

Furthermore, it is predicted that the industry will be driven by the availability of a range of formulations, including ready-to-drink, gel, bar, and powder. Also, in order to improve the nutritional value, manufacturers are adding flavors and additives such as natural ingredients, caffeine, and reduced sugar content in ready-to-drink drinks. In addition, the surging demand for probiotics, vitamins and mineral supplements, meal replacement products, weight management products, and during-workout supplements among consumers, and the increasing popularity of supplements among active lifestyle users will foster the market growth in the near future.

Sports Supplements Are a Major Revenue Contributor to the Market

Sports supplements accounted for the largest revenue share, of over 52.0%, in 2021. This is due to the growing consumption of protein supplements such as whey protein for muscle strengthening by athletes and gym-goers. Furthermore, the availability of various plant proteins, such as soy, spirulina, pumpkin seed, hemp, rice, and pea, and other variety of protein supplements in retail facilities including Walmart and Amazon will support the growth of product sales in the sports nutrition market.

Whereas, the sports food category is expected to expand at the highest growth rate over the forecast period. Sports foods such as protein and energy bars are gaining popularity as on-the-go snacks. Also, the demand for healthy snacking for weight management is rising, owing to the increasing prevalence of obesity.

Post-Workout Supplements Are High in Demand

The post-workout category held the largest revenue share, of over 34.0%, in 2021. This is because post-workout supplements offer benefits such as repairing damaged muscles, enhancing muscle gain, helping in recovery, and maintaining muscle mass. Moreover, post-workout supplements, such as branched-chain amino acids, glutamine, and casein, are gaining traction globally, owing to the growing awareness regarding their benefits.

Nutrition Products Are Majorly Used by Adults

The adults category dominates the market. This is attributed to a large number of consumers falling in the age group of 18–64 years. Additionally, consumers in this age group are actively involved in fitness and sports activities. Also, the increasing working women population is driving the demand for women's nutrition products in this age group. Moreover, the rising disposable income and growing concerns about maintaining a healthy lifestyle are boosting the adoption of sports supplements.

Additionally, it is expected to emerge as the fastest-growing category over the forecast period. This can be ascribed to the surging spending on health products and supplements, the growing awareness regarding well-being, the increasing availability and demand for sugar-free, vegan, and convenient supplement formats, and the rising trend of holistic well-being. Moreover, the demand for plant-based supplements is rapidly increasing. Companies are addressing the rising trend of plant-based or vegan products by launching compatible products in the industry.

| Report Attribute | Details |

Historical Years |

2017-2021 |

Forecast Years |

2022-2030 |

Market Size in 2021 |

$38.5 Billion |

Revenue Forecast in 2030 |

$78.3 Billion |

Growth Rate |

8.2% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Segmentation Analysis of Countries; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product Type; By Application; By Formulation; By Age Group; By Activity; By Distribution Channel; By Region |

Explore more about this report - Request free sample

Brick & Mortar Sales Channel Captures Highest Revenue Share

The brick & mortar category held the largest revenue share, of over 70.0%, in 2021. This is due to the easy availability of a large number of products in brick-and-mortar stores, such as specialty stores, small retail stores, fitness institutes, grocery stores, and general discount stores. Moreover, brick & mortar stores offer customer loyalty programs and membership benefits.

On the other hand, the online category is expected to grow at a significant CAGR over the next few years. The COVID-19 pandemic and associated lockdowns boosted online sales. Additionally, e-commerce retailers such as Amazon are delivering nutritional products to consumers’ doorsteps. An increase in the number of self-directed consumers is one of the important factors driving the adoption of online channels for the purchase of supplements because of discounts offered by online stores.

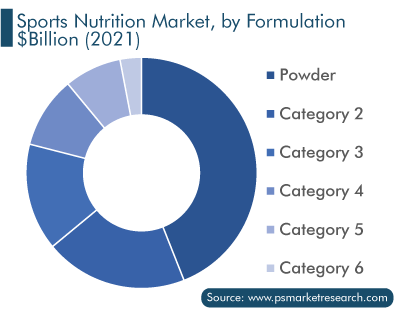

High Consumption of Powdered Form Supplements

The powder category held the largest revenue share, of over 44.0%, in 2021 in the sports nutrition market. This is to the high consumption of protein powder. Moreover, the use of nutrition powder by athletes and fitness enthusiasts is also growing as a result of the innovation in the powdered form of supplements, including powder that creates thick shakes to assist athletes to sustain longer by giving concentrated nutrients and the inclusion of active components to powder composition.

Whereas, the gummies category is expected to witness the fastest growth over the forecast period. This can be attributed to the surging consumption of gummies due to their benefits such as convenience, taste, and easy consumption. Moreover, consumers suffering from pill fatigue are looking for alternatives to capsules, pills, and tablets, which, in turn, drives the demand for gummies.

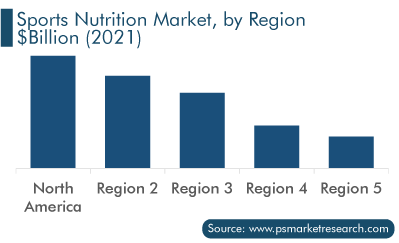

Consumers Are More Health Conscious in North America

North America accounted for the largest revenue share, of over 35.0%, in the market. This is attributed to the increasing demand for supplements, the surging awareness regarding health and well-being, and the presence of a large number of players and various strategies adopted by these companies, in the region.

The U.S. led the North American market with a prominent share in 2021, as the country has a large number of fitness clubs in the world. According to IBIS World, as of now, there are 112,676 fitness centers in the country. The number of gyms, fitness clubs, and other fitness-related organizations in the U.S. is increasing, as consumers are more conscious about their physical fitness.

On the other hand, the European market is projected to grow at a significant CAGR over the next few years. This can be ascribed to the increase in sports participation and the rise in initiatives by public and private organizations in regional countries. Additionally, the majority of the German population is a member of fitness clubs. As a result, nutrition products have increasingly gained popularity among athletes and common people in the region.

Top Players in Sports Nutrition Market Are:

- Abbott

- Iovate Health Sciences International Inc.

- Cardiff Sports Nutrition

- Quest Nutrition

- PepsiCo Inc.

- Clif Bar & Company

- The Coca-Cola Company

- The Bountiful Company

- Post Holdings Inc.

- BA Sports Nutrition

Market Size Breakdown by Segment

The study offers a comprehensive market segmentation analysis along with market estimation for the period 2017-2030.

Based on Product Type

- Sports Supplements

- Sports Drinks

- Sports Foods

- Meal Replacement Products

- Weight Loss Products

Based on Application

- Pre-workout

- Post-workout

- Weight Loss

Based on Formulation

- Tablets

- Capsules

- Powder

- Softgels

- Liquid

- Gummies

Based on Consumer Group

- Children

- Adult

- Geriatric

Based on Activity

- Heavy users

- Light users

Based on Distribution Channel

- Brick & Mortar

- Specialty Stores

- Small Retail Stores

- Fitness Institutes

- Grocery Stores

- General Discount Stores

- Discount Clothing Retailers

- E-Commerce

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

The sports nutrition market size stood at $38.5 billion in 2021.

During 2021–2030, the growth rate of the sports nutrition market will be around 8.2%.

Sports Supplements is the largest product type in the sports nutrition market.

The major drivers of the sports nutrition market include the growing focus to enhance physical health, the increasing demand from the sports industry, the rising participation in sports & physical activities, and the surging number of competitive sporting events.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws