Report Code: 10664 | Available Format: PDF | Pages: 192

Specialty Chemicals Market Research Report: By Type (Agrochemicals, Construction Chemicals, Specialty Coatings, Surfactants, Food Additives, Polymer Additives, Electronic Chemicals, Cleaning Chemicals, Plastic Additives, Paper & Textile Chemicals, Adhesives & Sealants, Lubricant & Oilfield Chemicals) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 10664

- Available Format: PDF

- Pages: 192

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Specialty Chemicals Market Overview

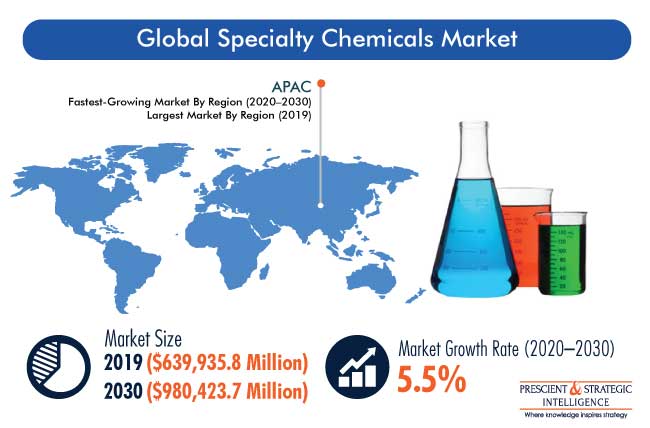

The global specialty chemicals market size was $639,935.8 million in 2019, and it is projected to witness a CAGR of 5.5% during the forecast period (2020–2030). The major driving factors for the market are the growing demand for these chemicals from the food, textiles, and automobile industries. In addition to this, the rapid industrialization and rising need for improved crop quality are driving the demand for low-cost and efficient chemical systems in developing countries, which, in turn, is propelling the specialty chemicals industry globally.

The COVID-19 pandemic has severely impacted the global specialty chemicals market owing to a drop in the demand for these chemicals in the automotive, construction, and consumer goods industries. The pandemic has negatively impacted supply chains worldwide, which is majorly responsible for the slump in the market growth rate.

Agrochemicals Are Largest Type Category owing to Their Rising Usage for Protecting Farmlands from Pests

In 2019, the agrochemicals category accounted for the largest share in the specialty chemicals industry, on the basis of type. This is majorly attributed to the increasing demand for food & horticulture crops, availability of off-patent molecules, export potential, and budgetary and policy support from governments. These types of specialty chemicals have several benefits, which range from yield increase and soil fertility to pest management and crop protection. Furthermore, opportunities such as the high usage of genetically modified seeds and bio-pesticides are paving the way for the adoption of agrochemicals in the coming years.

APAC — Largest & Fastest Regional Market owing to Increasing Demand for Food

During the historical period (2014–2019), Asia-Pacific (APAC) held the largest specialty chemicals market share due to the rising demand for these chemicals from the pharmaceutical, agriculture, personal care & cosmetics, automotive, and electrical & electronics industries of China and India. In addition, APAC is expected to be the fastest-growing market owing to the robust expansion in the construction industry, increasing demand for adhesives and plastics from the packaging industry, and rising installation of water treatment systems in various industries.

Furthermore, the extensive research & development (R&D) by the major market players in this region is responsible for driving the demand for specialty chemicals. The growing demand for rechargeable, miniaturized, and sustainable electronic components has created a significant requirement for specialty chemicals that can foster enhanced performance with minimum maintenance.

Shifting Production Base to APAC is Key Market Trend owing to Strong Economic Growth and Market Opportunities

The prominent trend in the specialty chemicals market is the shift of the production base of specialty chemical manufacturers from Western countries to the APAC region. This is due to the rising business opportunities and significant growth perceived by chemical companies in the APAC region. Due to the stringent environmental norms in other regions, particularly Europe and North America, various companies are shifting their manufacturing base to APAC. Moreover, the expensive labor and reducing profit margins are compelling manufacturers operating in the European and North American regions to move their production base to APAC, which is comparatively a low-cost location with an abundance of raw material.

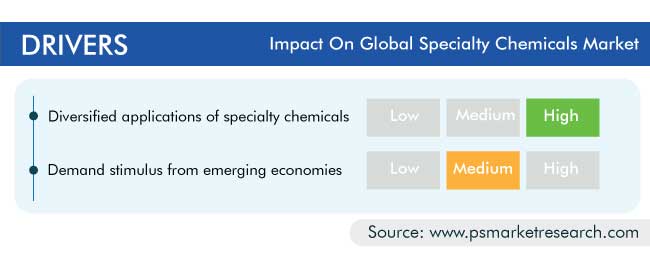

Diversified Applications of Specialty Chemicals and Demand Stimulus from Emerging Economies Aiding in Market Advance

Specialty chemicals are used as additives to create the desired effect in products or substances. Thus, owing to their diverse features and compatibility with various other chemicals and substances, specialty chemicals find application across a wide spectrum of end-use industries, such as consumer goods, packaging, food processing, automotive, and pharmaceuticals. For instance, in the automotive sector, specialty chemicals are extensively used as fuel additives to enhance the properties of the fuel. Similarly, specialty chemicals, including methyl oleate, are used as active pharmaceutical ingredients in a variety of lotions and creams.

Specialty chemicals are expected to witness a significant demand from emerging economies, such as India, Brazil, and China, due to the significant rise in the industrialization and urbanization rates here. Moreover, as a consequence of urbanization, there has been an appreciable rise in the standard of living of people and their spending capacity in these countries. For instance, the International Monetary Fund (IMF) has reported that the emerging & developing economies of Asia, such as China, India, Malaysia, and South Korea, collectively hold over 31.5% share in the global gross domestic product (GDP [purchasing power parity]). This has boosted the consumption of packaged food products, cosmetics, pharmaceuticals, and other consumer goods, thereby propelling the demand for specialty chemicals.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$639,935.8 Million |

Forecast Period CAGR |

5.5% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Companies’ Strategic Developments, Key Offerings of Major Players, Company Profiling |

Market Size by Segments |

By Type, By Geography |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Spain, Japan, China, India, Brazil, Mexico, Saudi Arabia, South Africa |

Secondary Sources and References (Partial List) |

American Chemical Society, American Petroleum Institute, Association of Chemical Industry of Texas, Brazilian Chemical Society, Chemical and Allied Industries’ Association, Chemical Business Association, Chemical Coaters Association International, Chemical Industries Association, China Plastics Processing Industry Association, Chlorine Chemistry Division of the American Chemistry Council |

Explore more about this report - Request free sample

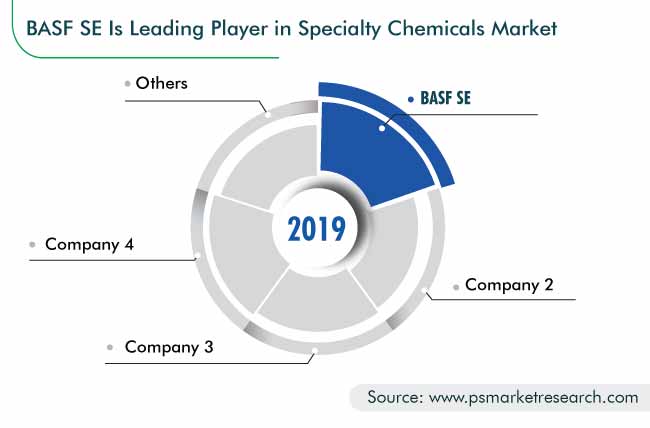

Facility Expansion Is Key Market Strategy

The global specialty chemicals market is fragmented in nature, with the presence of players such as BASF SE, Dow Inc., China Petroleum and Chemical Corporation, Saudi Basic Industries Corporation, Henkel AG & Co. KGaA, and Evonik Industries AG.

In recent years, players in the industry have expanded many of their manufacturing facilities in order to stay ahead of their competitors. For instance:

- In September 2020, Henkel AG & Co. KGaA announced plans to invest $23 million in the expansion of its liquid hand soap and hand sanitizer manufacturing facilities in Geneva (Switzerland) and New York and Pennsylvania (U.S.), to meet the growing demand for cleaning chemicals amid the COVID-19 pandemic.

- In December 2019, BASF SE announced plans to invest in its coating business in Asia and expand its facility in Jiangmen, Guangdong Province, South China, which produces automotive coatings. The new facility will double the production capacity, to cater to the growing demand for automotive refinish coatings.

Some of Key Players in Global Specialty Chemicals Market Are:

-

Ashland Global Holdings Inc.

-

Dow Inc.

-

Evonik Industries AG

-

Akzo Nobel N.V.

-

Eastman Chemical Company

-

Mitsui Chemicals Inc.

-

Mitsubishi Chemical Corporation

-

BASF SE

-

Clariant International Limited

-

Huntsman Corporation

Specialty Chemicals Market Size Breakdown by Segment

The global specialty chemicals market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Type

- Agrochemicals

- Construction Chemicals

- Specialty Coatings

- Surfactants

- Food Additives

- Polymer Additives

- Electronic Chemicals

- Cleaning Chemicals

- Plastic Additives

- Paper & Textile Chemicals

- Adhesives & Sealants

- Lubricant & Oilfield Chemicals

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Italy

- U.K.

- Spain

- Asia-Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- Saudi Arabia

- South Africa

The specialty chemicals market will witness 5.5% growth during 2020–2030.

Agrochemicals are the largest, while lubricant & oilfield chemicals are the fastest-growing category in the specialty chemicals industry, based on type.

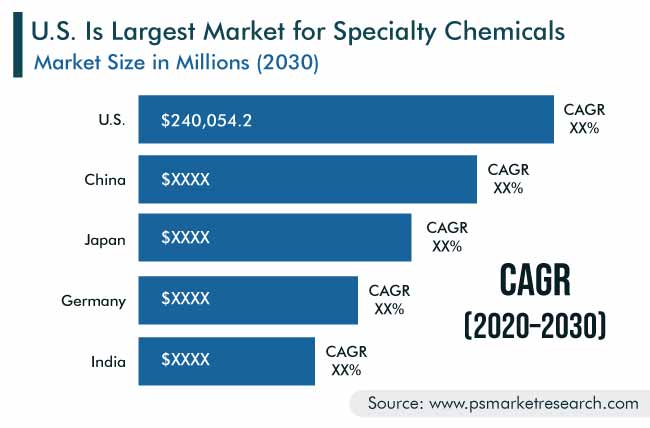

Investors in the specialty chemicals market should target APAC, as it will remain the largest region in the market till 2030.

The major specialty chemicals industry growth drivers are the wide-ranging applications of these chemicals and the rising demand for them in developing countries.

The key specialty chemicals market strategic development is facility expansion.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws