Report Code: 12483 | Available Format: PDF | Pages: 212

Southeast Asia E-Commerce in Automotive Aftermarket Outlook by Component (Engine Parts, Drive Transmission and Steering Parts, Suspension and Braking Parts, Equipment, Electrical Parts, Miscellaneous), Channel (Third Party Retailer, D2C), Consumer (Garage Owners, Mechanics, Spare Part Retailers, B2C) - Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12483

- Available Format: PDF

- Pages: 212

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

The Southeast Asian e-commerce in automotive aftermarket is estimated to generate $3,819.8 million in 2022. This is further expected to advance with a CAGR of 11.4% during the forecast period, to reach $9,184.6 million by 2030.

The usage of these platforms is expanding as a result of rising levels of digitalization and internet usage throughout Southeast Asia, as well as the increasing customer awareness of product details and other benefits of online shopping. Additionally, the market expansion is aided by the changes in the automotive aftermarket as a whole, owing to an increase in the number of vehicles in operation (VIO) and their aging, as well as the rise in the frequency of road accidents.

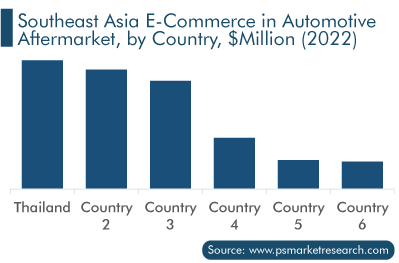

Thailand Contributes Majority of Revenue

Thailand had the greatest e-commerce in the automotive aftermarket in Southeast Asia during the historical period, and it would continue to develop significantly over the forecast period, with a CAGR of almost 11%. This will be due to its sizable population, growing disposable income, rapid urbanization, and expansive vehicle industry with plenty of OEMs. The industry is also set to benefit from technology improvements, fleet owners' growing awareness and use of quality replacement parts, and the government initiatives related to passenger and vehicle safety.

In addition, Malaysia is projected to grow with the highest rate in the Southeast Asian e-commerce in automotive aftermarket. The country witnessed a sale of 508,761 vehicles in 2021, and the advancement of the market for automotive components is directly impacted by the rising car sales. Additionally, as the nation's population grows more accustomed to using digital media, there will be a larger growth potential for e-commerce in the aftermarket. Further, the industry has witnessed significant development in the recent past due to the increasing manufacturing of commercial vehicles.

Moreover, Vietnam has a significant market size due to the presence of numerous well-known automobile brands, including Toyota, Ford, Honda, and Mitsubishi, as well as local companies such as Thaco and VinFast. There is now also a growing demand for the servicing and maintenance of these vehicles.

Increasing Number of DIY Customers Acting as a Key Driver

The automotive aftermarket is seeing the rise of a DIY culture as a result of the expanding trend of vehicle customization, with car owners and auto enthusiasts modifying their own automobiles. While maintenance & service facilities and technicians have historically been the primary customers for car parts manufacturers, DIY enthusiasts now account for a sizable portion of the sales of components through e-commerce platforms. This expanding customer base would be advantageous for the automotive aftermarket.

Additionally, the online mode makes it simpler for DIY and DIFM customers to compare products from various manufacturers, which is not always possible at brick-and-mortar stores. Comparisons can be made for prices, features, compatibility, specifications, delivery times, offers, and other aspects.

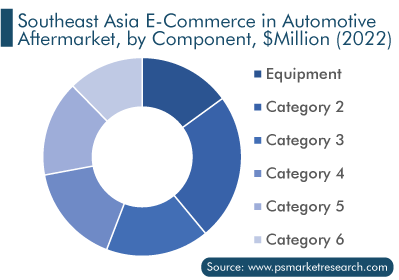

Equipment Sales To Witness Fastest Growth

The equipment category will register the fastest market growth, at a CAGR of around 12%. This can be ascribed to the trend of upgrading the various pieces of equipment of vehicles over time and the availability of a wide range of products on online platforms. A large number of e-retailers, such as Alibaba Group Holding Ltd., Amazon.com Inc., and Wal-Mart Stores Inc., offer automotive equipment on their portals, thus making the access easy for consumers.

Moreover, the electrical parts category held the major share in 2022. As the number of key manufacturers engaging in collaborations with prominent sales platforms increases in the region, the online sale of automotive electrical parts is projected to witness significant progress in the coming years.

Increasing Need for Quality Products Boosts Consumer Base

The demand for quality products has increased in recent years. Users are significantly focusing on quality products, rather than brand value. With millions of cars expected on the roads in the coming years, aftermarket companies are investing heavily in the upgradation of their products and focusing on offering in-vehicle connected devices, which is expected to benefit the market during the forecast period.

Moreover, due to the increasing investment in research and development (R&D) by product manufacturers, such solutions have gained significant interest among users of e-commerce platforms.

Growing Rate of Digitization Presents Endless Opportunities

The rapid digitization across the world is essentially expected to create opportunities for the advancement of online services. E-commerce has enabled customers to purchase products from anywhere and compare the prices of different products with just a swipe on a smartphone screen. The fact that customers are increasingly preferring online shopping has had a great impact on the courier industry. As customers are becoming more dependent on digital services, which include online shopping, they are demanding a better service quality, which, in turn, is generating lucrative growth opportunities for the industry players.

| Report Attribute | Details |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Market Size in 2022 |

$3,819.8Million |

Revenue Forecast in 2030 |

$9,184.6 Million |

Growth Rate |

14.4% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Company Profiling |

Segments Covered |

By Component; By Country |

Explore more about this report - Request free sample

Mergers and Acquisitions Are Key Trends

The players in the Southeast Asian e-commerce in automotive aftermarket are engaging in mergers and acquisitions, business expansions, and partnerships, to gain a competitive edge. They are also improving their existing aftermarket products and working in collaboration with other leaders. For instance, in August 2022, Cummins Inc. announced that it has acquired Meritor Inc., for serving the commercial vehicle and industrial sectors.

Key Players in the Southeast Asia E-Commerce Automotive Aftermarket Are:

- Robert Bosch GmbH

- BU Autoparts

- Ubuy Co.

- HELLA GmbH & Co. KGaA

- Meritor Inc.

- Amazon.com Inc.

- eBay Inc.

- Alibaba Group Holding Ltd.

- Bellipart

Market Size Breakdown by Segment

This report offers deep insights into the market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Component

- Engine Parts

- Piston and Piston Rings

- Engine Valves and Parts

- Fuel Injection Systems and Carburetors

- Powertrain Components and Others

- Drive Transmission and Steering Parts

- Gearboxes

- Wheels

- Steering Systems

- Axles

- Clutch Assembly System and Others

- Suspension and Braking Parts

- Brake Calipers

- Brake Pads

- Suspension Systems

- Other Parts

- Equipment

- Headlights and Lighting Components

- Wiper and Washer Systems

- Dashboard Instruments

- Other Equipment

- Electrical Parts

- Starter Motors

- Spark Plugs

- Electric Ignition Systems

- Battery and Others

- Miscellaneous

Based on Channel

- Third Party Retailer

- Direct to Consumer

Based on Consumer

- Garage Owners

- Mechanics

- Spare Part Retailers

- B2C

Geographical Analysis

- Indonesia

- Thailand

- Vietnam

- Malaysia

- Philippines

The value of the e-commerce in automotive aftermarket in Southeast Asia was $3,819.8 million in 2022.

The e-commerce in automotive aftermarket of Southeast Asia is dominated by electrical parts.

Thailand generates the highest Southeast Asia e-commerce in automotive aftermarket revenue.

The e-commerce in automotive aftermarket of Southeast Asia is witnessing a growing FIFM and DIY culture.

The e-commerce in automotive aftermarket of Southeast Asia is driven by the rising rate of digitization.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws